Earlier this week, we issued our Economic Forecast August 2013: Economy Slowing To a Crawl.

Our forecast was based on data from several sectors not expanding or in slight contraction. Then the Advance Estimate of 2Q2013 GDP was released last Wednesday estimated growth at 1.7% – but the BEA revised GDP back to 1929 including revising 1Q2013 growth from 1.8% to 1.1%. So would one conclude that GDP growth is improving?

Advance GDP estimates are nothing more the wild guesses unless the economy is stable between quarters. However, the economy has not settled down since the Great Recession and continues to oscillate. The real changes between 1Q2013 and 2Q2013 are:

- lower personal consumption (GDP negative)

- higher non-residential investment (GDP positive)

- higher exports (GDP positive)

- higher imports (GDP negative)

- imports are are economic tattle-tails;

- most of the non-oil imports are goods, and as we all know goods production is not a big employer;

- imports are a worry for those who have balance-of-payment concerns;

- consumption of imports IS economic activity.

There is a lag between the government’s reporting of import data (red line Figure A – which is preliminary through May 2013) and a multitude of import data points which have shown good correlation to the final government reported import data. Without fear of being contradicted with final data – both imports and exports are collapsing in the USA and globally.

Warren Mosler recently tossed up a graphic (Fig 1 below) from Nomura showing there has been a broad-based weakening in Asian exports through June 2013:

Growth at West Coast ports is decelerating and showing contraction most months since 3Q/2012. . The latest data is from June 2013.

Unadjusted Year-over-Year Change in Container Counts – Ports of Los Angeles and Long Beach Combined – Imports (red line) and Exports (blue bars)

Econintersect is not optimistic that the economy is improving as many of our forward looking data points are decelerating and some are in contraction. Many will point to improving employment dynamics as signs of economic growth, and I too will argue the more jobs the economy can grow acts as a multiplier for future growth. However, there are dynamics which create jobs growth and we are projecting these will begin to decelerate in a month or two.

I am far from suggesting there is a recession coming based on the data to date. I am suggesting the economic dynamics are not strengthening.

Other Economic News this Week:

The Econintersect economic forecast for August 2013 again declined, and sees the economy barely expanding. The concern is that consumers are spending a historically high amount of their income, and several non-financial indicators are struggling or flat.

The ECRI WLI growth index value has been weakly in positive territory for over four months – but in a noticeable improvement trend. The index is indicating the economy six month from today will be slightly better than it is today.

Current ECRI WLI Growth Index

Initial unemployment claims improved from 343,000 (reported last week) to 326,000 this week. Historically, claims exceeding 400,000 per week usually occur when employment gains are less than the workforce growth, resulting in an increasing unemployment rate.

The real gauge – the 4 week moving average – improved from 345,250 (reported last week) to 341,250. Because of the noise (week-to-week movements from abnormal events AND the backward revisions to previous weeks releases), the 4-week average remains the reliable gauge.

Weekly Initial Unemployment Claims – 4 Week Average – Seasonally Adjusted – 2011 (red line), 2012 (green line), 2013 (blue line)

Bankruptcies this Week: Gryphon Gold

Data released this week which contained economically intuitive components(forward looking) were:

- Rail movements growth trend is currently accelerating.

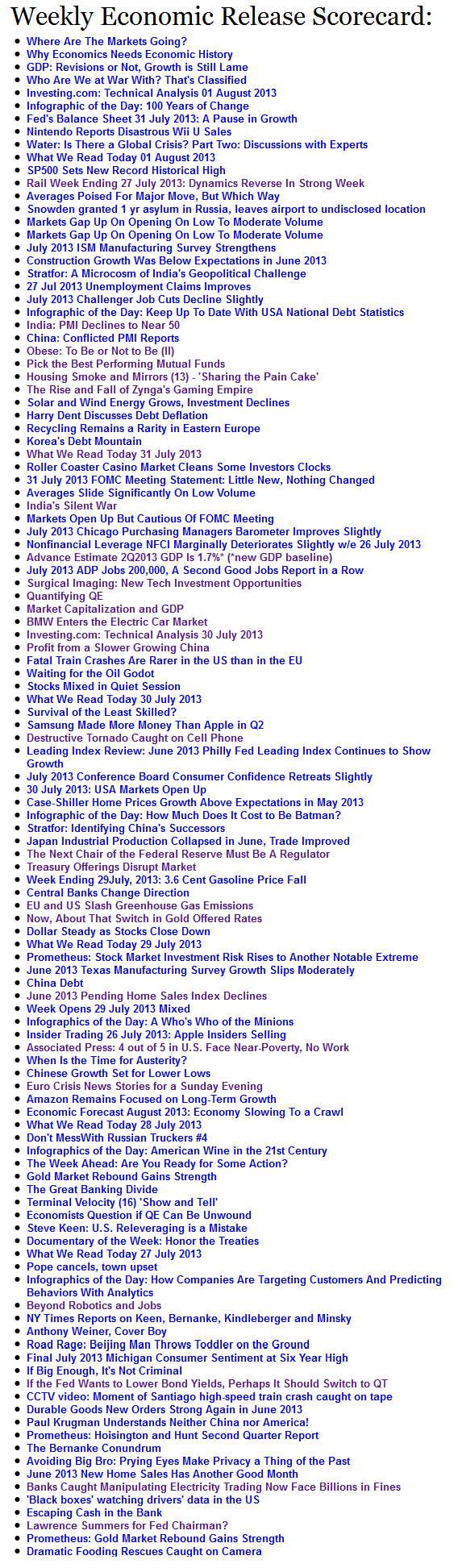

Weekly Economic Release Scorecard:

Click here to view the scorecard table below with active hyperlinks