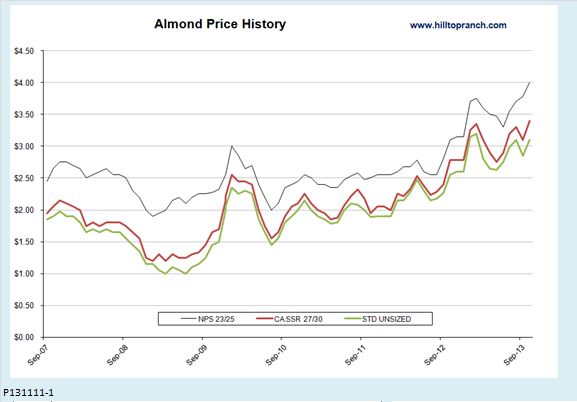

Almond prices are soaring. As the following chart shows, some varieties are selling for double the price of five years ago, others for three times more. What is driving the upward price trend? Supply and demand is the easy answer. Behind the supply and demand curves lies a more complex story of nuts, cows, and bees.

Cows are out, nuts are in

One of the factors behind the increase in almond prices is a shift in tastes toward foods that consumers perceive as healthier. Milk from cows is out. U.S. consumption of cow’s milk, which consumers associate with artery-clogging cholesterol, has fallen more than third since the 1970s. It is a generational thing. According to an analysis of government data by FoodNavigator-USA.com, each population cohort drinks less milk than the one before. In the late 1970s, Americans of all ages drank, on average, about one glass of milk a day. Thirty years later that was down to about two-thirds of a glass. And it is not just adults who are giving up on cow’s milk. Over the same period, children aged 2 to 12 years cut their daily milk intake from 1.7 glasses to 1.2.

At first, consumers turned to soy milk as their preferred dairy replacement. Recently, though, almond milk has been catching up. In another report, FoodNavigator-USA.com noted that soy milk sales fell in 2012 while almond milk sales grew 79%. The three-to-one advantage in market share that soy milk enjoyed as recently as 2011 is shrinking fast. Rice milk and coconut milk, the other main nondairy contenders, have market shares in the single digits.

Soy milk has more protein than almond milk but almond milk has fewer calories. By the time they are processed, most brands of both products compete with cow’s milk in calcium and vitamin content. Some people are allergic to soy products, and some are worried about products made from genetically modified soybeans. For many consumers, though, nutritional technicalities are beside the point. Taste tips the balance in favor of almond milk.

Domestic dairy replacements are not the only source of growing demand for almonds. Almonds are a big export crop. A couple of recent articles in the Financial Times [1] [2] have highlighted the increased appetite for nuts of all kinds, including almonds, among Chinese consumers. China is already the biggest foreign buyer of almonds, and its demand has been growing by as much as 30 percent per year.

Bees are in trouble

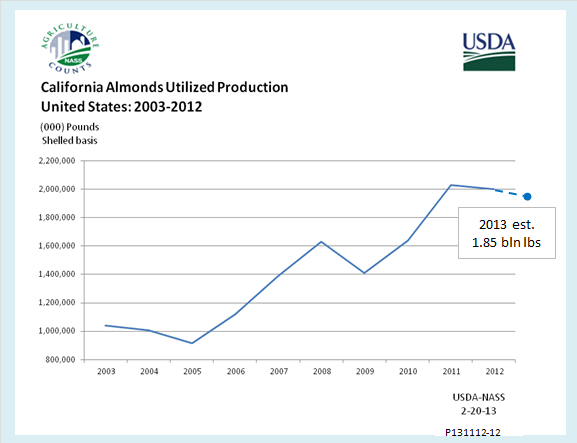

Most of the world’s almonds—up to 80 percent, by some estimates—come from California. Today, the acreage planted in almonds there is eight times greater than in the 1950s, and nearly double that of 1990. As growers planted more trees, the state’s crop grew steadily, reaching a peak of over 2 billion pounds in 2011. In 2012, however, the harvest decreased slightly and analysts expect final figures to confirm another decrease for 2013.

Unfavorable weather has played a role, but weather comes and goes. A decreased availability of honeybees, essential for pollinating the almond crop, is a more worrisome threat. For several years now, bees have suffered from a mysterious colony collapse disorder (CCD). Scientists have tracked several possible causes, including mites, microbes, pesticides, modern beekeeping practices, and even electromagnetic radiation. Relatively new pesticides called neonicotinoids are the latest suspects.

The EU has recently banned neonicotinoids because of their suspected link to CCD, but farmers in California continue to use them. Unfortunately, many scientists think CCD stems from several factors in combination, so taking neonicotinoids out of the picture might be only a partial solution. While the debate over causes and remedies goes on, CCD continues to kill bees by the billion. Beekeepers are losing some 30 percent of their hives each year. In response, they have doubled their usual fees.

The bottom line

Almonds don’t often make the headlines, but they are big business. The total value of California almond production is over $4 billion. They are the state’s largest farm export, ahead of wine and dairy products. A collapse of the California almond industry would be a huge blow to the state’s economy and would put a noticeable dent in the trade balance of the United States as a whole. More funding for CCD research would seem like a good idea, and a ban on neonicotinoids may be worth trying, even before all the research data are in, especially if the EU’s move in that direction gives any early signs of helping.

Meanwhile, just in case you are thinking that you can turn to pistachios if your supply of smoked almonds dries up, be forewarned: Pistachio prices are rising, too, and for many of the same reasons. In fact, there is just one big difference between the two crops: Iran produces half the world’s pistachios, with the United States only in second place. If diplomats in Geneva reach an agreement on Iran’s nuclear program, if Congress goes along with lifting sanctions, and if CCD doesn’t spread to Iranian bees—that’s only three ifs—your pistachios should be safe.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Economics Of The Billion Dollar Almond Market

Published 11/14/2013, 02:14 AM

Updated 07/09/2023, 06:31 AM

The Economics Of The Billion Dollar Almond Market

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.