The Euro (EURUSD) depreciated on Tuesday due to the ECB vice president Vitor Constancio’s statement about considering the possibility of reducing the interest rates or monetary issue (QE), in case it is needed to keep the economy growing.

Yesterday the British economic data were neutral. However, the Pound fell. The Bank of England has stated that it will work with the commercial banks to prevent manipulating the exchange rates. The share of London in Forex market is 40% of daily round turn, estimated at $5.3 trn.

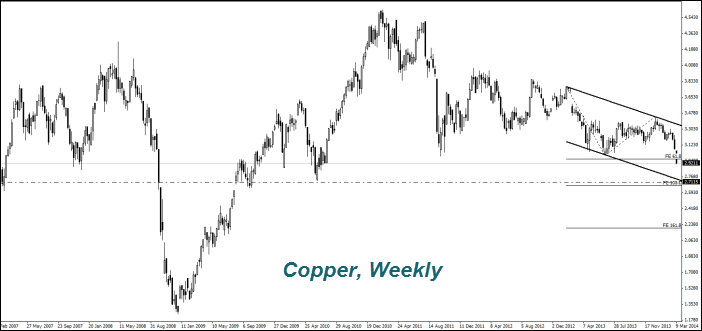

Now the second Chinese manufacturer of solar energy (Baoding Tianwei Baobian Electric) is close to defaulting on its debt. Investors began to doubt the further acceleration of Chinese economy and that fact caused continued fall in the Copper prices. The significant increase in metal imports in January-February led to the growth in reserves on the Shanghai Futures Exchange to 200 thousand tons. This is 65% higher than it was at the beginning of 2014. Another 745 tons of Copper are in the Chinese customs warehouses. Market participants do not understand what China needs so much copper for and fear that it can dramatically reduce its imports in the near future. As for other metals, we note a significant drop in the Steel and Iron Ore prices which occurred a few days earlier.

All of this has led to a weakening of the Australian Dollar (fall on the AUDUSD chart). The Copper and Iron Ore are Australian main export commodities. Note that tomorrow at 00-30 GMT, we will see the Australian labor market data. The preliminary forecasts are neutral, therefore, actual results could affect the exchange rate only if they do not coincide with expectations. USD/JPY" title="USD/JPY" width="702" height="331">

USD/JPY" title="USD/JPY" width="702" height="331">

Corporate defaults in China made the strengthening of the Japanese Yen (fall on the USDJPY chart). Investors see it as a safe heaven asset. An additional positive factor for the Yen was the good industrial production data. Today at 23-30 GMT, another block of economic statistics of Japan strikes out. In our opinion, the forecasts are positive for the Yen.

The Gold (XAUUSD) continued to rise in price as investors consider it as a safe heaven asset due to a possible slowdown in Chinese economy. An additional factor of political instability were the rumors of moving the Ukrainian army towards Crimea, which is controlled by pro-Russian forces for now. Probably, the new Ukrainian government wants to disrupt a national referendum in Crimea scheduled for March 16th. The Prime Minister of Ukraine flew to the U.S. for consultations. Note that rising tensions contributed to higher Wheat prices. Ukraine is one of the world's largest grain exporters.

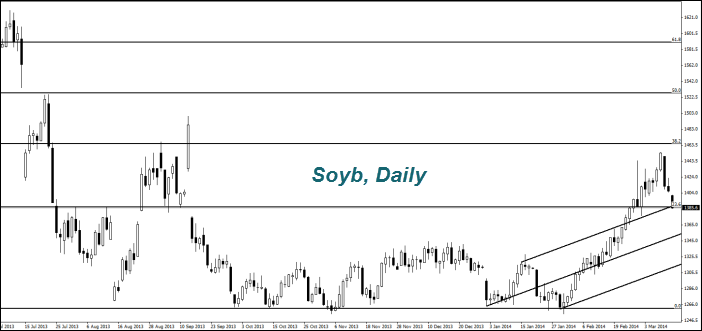

The Soybean and Corn continued to fall in price due to the information from the USDA we wrote about in yesterday's review. According to the USDA projects, this year Soybean exports from Brazil will increase by 7.4% compared to last year and by 3.3% from Argentina. In our opinion, the USDA report provoked a technical correction of agricultural futures. By its end, the regrowth in prices is possible.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The ECB still does not exclude rate cuts

Published 03/12/2014, 10:13 AM

Updated 12/18/2019, 06:45 AM

The ECB still does not exclude rate cuts

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.