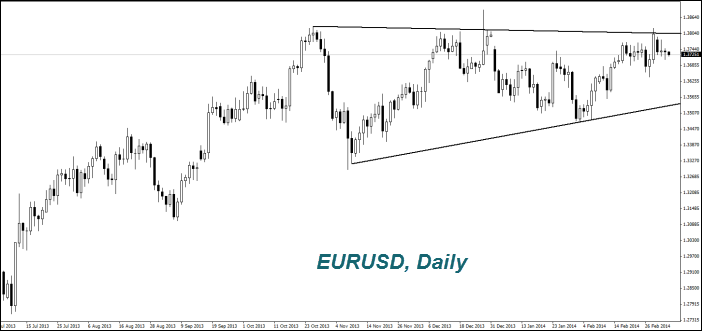

Yesterday's economic indicators from the U.S. were negative. The number of new jobs in February from the ADP was less than expected. This could threaten the positive outlook for the labor market official data, which will be released tomorrow. However, the decline in the Dollar Index (USDIDX) on Wednesday was insignificant since there was no reasonable demand for the Euro (EURUSD) observed before today's ECB meeting at 12-45 GMT. The market opinions were divided, but a small part of investors is still afraid of rate cuts. They believe that in this case the Euro may fall around 1.35. Recall that the role of the Euro in the Dollar Index is maximum and amounts to 57.6%. Economic growth in the U.S. is 2.4%, while it is 0.5% in the EU. The European Union wants to start conducting the same QE monetary policy as the Fed did previously

. EUR/USD" title="EUR/USD" width="702" height="331" />

EUR/USD" title="EUR/USD" width="702" height="331" />

The U.S. weekly unemployment data and productivity in the fourth quarter are to be released today at 13-30 GMT. The forecast is weak in our opinion. But later, at 15-00 GMT, we will see the industrial orders in January, and at 18-00 GMT and 23-00 GMT the regional Fed representatives' statements are expected. We believe that these three events may cause the strengthening of the U.S. currency in the evening if the day does not bring a strong movement after the ECB meeting.

The Australian Dollar (AUDUSD) appreciated strongly (rise on the chart). The retail sales in January rose by 1.2%. This is almost 1-year maximum and it is much better than the preliminary forecasts. Retail sales are 17% of the Australian GDP. The trade surplus in January was the highest in three years and also turned out far better than the forecasts. We do not exclude the continued growth of the Australian Dollar in the chart. It is part of the Russian forex/gold holdings, along with the U.S. Dollar and the Euro. Some economists believe that its share (2%) can be increased due to events around the Crimea and the negative reaction from the U.S. and EU. The next Australian economy significant indicators are coming out on March 11th.

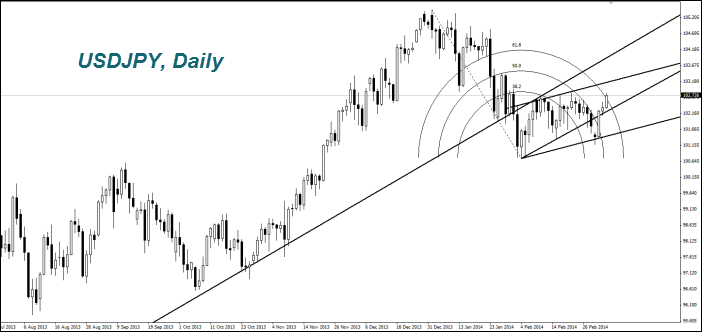

The British Pound (GBPUSD) slightly strengthened (rise on the chart). The PMI Services in February rose more than expected. Moreover, its value is still 58.2 points, lowest since July. Today, we expect the BOE meeting to be held at 12-00 GMT. Most of the market participants believe that the discount rate will remain at the current level of 0.5%. However, the information from the the Bank of England press conference may affect the Pound. Investors expect higher interest rates early next year. USD/JPY" title="USD/JPY" width="702" height="332" />

USD/JPY" title="USD/JPY" width="702" height="332" />

The Japanese Yen (USDJPY) showed a strong attenuation (up on the chart) after the government statements that the public pension investment fund should no longer invest in Japanese government bonds, since it does not keep its money from inflation. The Japanese pension fund earned only 1.7% last year. Its assets amount to 128.6 trn. Yen ($1.25 trn). Note that tomorrow night at 5-00 GMT, we will see the Japanese Consumer Confidence Index and the leading indicator striking out. The preliminary forecasts are positive and it may slow the weakening of the Yen down.

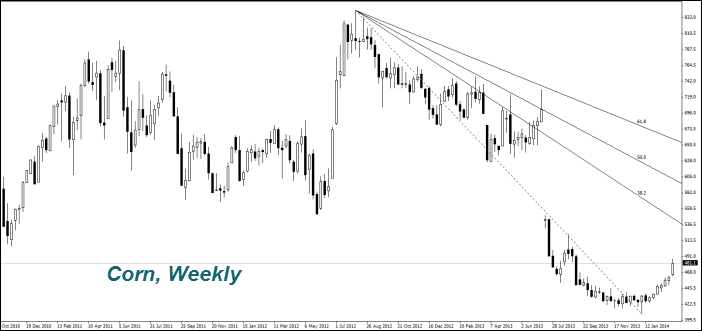

Rise in the world prices for grain crops may slow down due to the gradual normalization of the situation in Ukraine. Another factor may be the forecast of Chinese Ministry of Agriculture saying that during this season the grain import is unlikely to increase markedly. Last year, China bought 13 million tons of grain in the world market, it is only 2.4% of its domestic consumption.

The Lanworth, an analytical company, expects the maize (Corn) world cultivation areas to be reduced by 3.1% in the period of 2014/15. Other indicators of the crop forecast, in our opinion, also contribute to further increase in world corn prices.

Yesterday the Coffee prices rose strongly after the Somar Meteorologia reports that rains in Brazil may cease due to the cold front winds. According to the forecasts from the Brazilian National Institute of Meteorology, this summer Brazil may be the driest since 1972. Recall that this country produces 37% of the coffee in the world.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The ECB meeting will be held today

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.