- President Draghi’s very accommodative speech

- High yield spreads between Germany and the US

- Falling euro

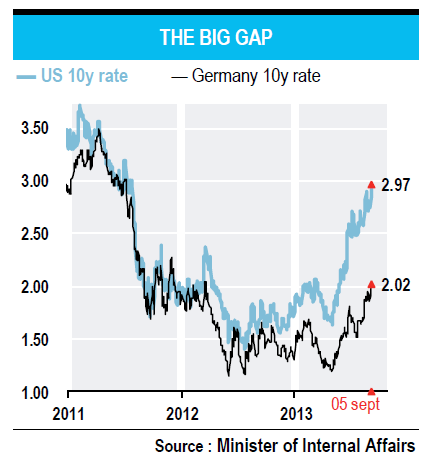

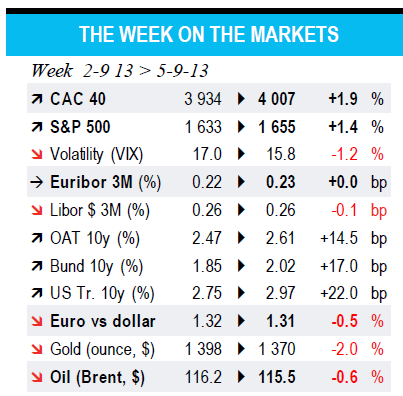

Since May, and the Federal Reserve’s hints about a possible change in monetary policy, interest rates have gone up around the world, with the USA leading the way. In barely four months, the 10-year Treasury yield has risen from 1.6% to nearly 3% (2.97% on 5 September). German interest rates have followed suit, albeit on a smaller scale. Given the integration of markets, it is not the scale of the rise that stands out (10- year Bund yields are 80 basis points above their latest low) so much as the gap that has opened up with the USA (see chart). In the euro zone, the shock created by the ending of the US quantitative easing programme has been significantly attenuated.

With high borrowing ratios and an economy that is barely in recovery (see our Overview), a bond crash is the last thing the seventeen euro zone nations need. This threat is being kept at bay by the European Central Bank, which made an about turn in its position two months ago, indicating that policy rates would “remain low for an extended period”. This has drawn a clear distinction between monetary policy stances either side of the Atlantic.

BY Jean-Luc PROUTAT