For this week’s meeting, some ECB veterans might long for the good old days when the bank's summer meeting was held in the form of a teleconference. With little news, ECB President Mario Draghi will simply reiterate the main message of the June meeting.

The June ECB scenario analysis

Cementing the message from the June meeting

With little substantial change to the economy, the ECB could definitely take it easy at Thursday's meeting. The main focus, in our view, will be on cementing the message from June, giving market participants no reason to doubt the bank’s determination.

It was then the ECB announced it expects interest rates to remain unchanged “at least through the summer of 2019.” To some, this statement suggests that a first rate hike could come as early as July 2019. To others, it suggests a hike would not come before 21 September. In our view, however, EU aficionados know the official European summer break always ends in the last week of August, opening the window for a first hike in September 2019.

If the recovery is derailed on the back of increased trade tensions or there is no increase in underlying inflation, the bank's efforts to end QE will be compromised. Nevertheless, it's obvious that the broad majority of ECB members seems determined to end QE, though as quietly as possible, and would like to return to interest rates as the main policy tool.

FX: EUR/USD sailing through the non-event

We look for a very modest reaction in EUR/USD on Thursday with the cross staying around the 1.17 level. The ECB meeting is like to be a non-event with Draghi reiterating the message of the June meeting. Although the market seems to be pricing the ECB for a dovish perfection (only one full 10bp depo hike by the end of the next year vs our call for 40bp), we don’t expect Draghi to provide a catalyst for a more hawkish re-pricing.

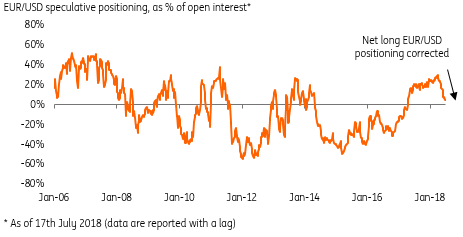

The recent material correction in EUR/USD speculative positioning from heavily long three months ago to close to neutral currently points to a more limited downside to the undervalued EUR/USD

EUR speculative positioning

Bond markets: Watch the curve when QE-twist hopes fade

Merely affirming last month’s message would, on the face of it, have little impact on rates. However, the long-end of the yield curve received an additional push lower over the past few weeks from speculation about the ECB discussing “QE-twist”, (i.e. skewing reinvestments into longer maturity bonds). We think these hopes are likely to be disappointed this time around. This should steepen the curve as the short-end remains protected by the rates forward guidance. Amid ongoing trade tensions and lingering political risks in Europe, any increase in yields is likely to be limited as investors favor the safety of core bonds.

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. “For more from ING Think go here.”