Last week’s action brought some welcome relief to the bulls as the major indices broke a two-week losing streak. The good news is that both the Dow and S&P 500 posted gains for the week. But the bad news is that more growth oriented indices like the IBD 50 actually declined on the week.

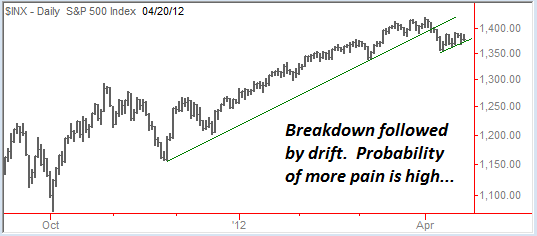

Even after a positive week, the primary US equity benchmark looks pretty ominous. After four straight months of low vol – advancing action (six months of positive movement off the October low), the S&P has clearly broken its trend line and is now consolidating recent losses…

This week promises to be a busy one with plenty of catalysts that could set the next wave of price action in motion.

On Tuesday, macro traders will be watching bond offerings from both Italy and Spain, and after the close we have an earnings report from mighty Apple Inc. (AAPL). The bellwether has broken its three-month bullish trend and has been pulling the broad technology sector down as it corrects.

Wednesday, we have the completion of the Federal Open Market Committee meeting – including both the standard press release as well as a press conference with Ben Bernanke. With the most recent economic reports offering a more negative picture for the domestic economic recovery, this will be an important event.

Heading into the week, our current exposure is about 2-1 bearish to bullish – with just a handful of profitable bullish scenarios and a growing roster of areas that are trading lower. More importantly, our pending setups are nearly all bearish as the technical picture looks ominous and the reward-to-risk metrics favors setups that will profit as markets fall.

Below are a few of the areas that we’re tracking for the week…

Building Materials & Engineering

As expectations for the domestic recovery fade – and the emerging market picture becomes notably weaker as well – companies that are tied to global construction and engineering are feeling the pain.

More importantly for us as traders, the investment perception for these names is undergoing a massive shift. Sentiment for construction and related businesses is directly tied to global economic expansion and contraction. So as the US employment picture softens, and China continues to report decelerating economic growth, value investors are beginning to cut back on their allocations to this group.

The change in capital commitments can be seen in the charts, as these names begin rolling over and violating key technical barriers.

Last week, we added two materials companies which had broken multi-month bullish trend lines, and then drifted slightly higher to set up attractive entry points.

When determining how to enter bearish themes like this, we typically want to see a thrust lower – followed by a drift or consolidation. Shorting a continuation move lower gives us both an attractive entry point (above the recent low), and also gives us an important resistance area so that we can set our risk point on the other side of this technical barrier.

The result is a high-probability short position with a relatively tight risk envelope. The amount of capital we are risking (between the entry point and the risk point) is very modest compared to the potential profit we will be able to lock in if the stock trades meaningfully lower.

Trinity Industries (TRN) is one of our two existing trades in the area, and heading into the week, we’ve got our finger on the pulse of several additional construction / engineering stocks that are poised to fall quickly.

Semiconductors Fall on Strong Volume

Chip stocks are in focus this week as Wall Street digests a number of important earnings announcements…

Advanced Micro Devices Inc. (AMD) released their Q1 report after the close last Thursday, beating estimates and actually issued guidance that was above the average analyst estimate for the coming quarter.

However, on Friday the stock reversed early gains, closing at the low of the day and posting a reversal bar on strong volume. The bearish action fell short of a true “breakdown,” but was certainly a disappointment. More importantly, the action in other semiconductor names has become quite bearish – setting up some great potential shorts for later in the week.

The tone of the semiconductor sector ties in with the notable weakness in networking stocks. Fears of declining corporate spending, coupled with decelerating growth and premium PE ratios has put the group in a vulnerable position. The overall “tech industry” has been trading higher – primarily due to AAPL’s influence – but is now shifting to much more bearish action.

Texas Instruments (TXN) will announce earnings after the close today, and should give traders a much better feel for the near-term action. The stock is sitting just above a key support area – which, if broken, could be a major catalyst for capital to exit the sector, and drive a number of semiconductor stocks lower.

Emerging Markets Under Pressure

While much of the focus this week is on US domestic data points, the action in emerging markets is still notable.

China is obviously the most well known “growth engine” of this group, and has reported a number of consecutive quarters of decelerating growth. But if Europe continues to struggle with heavy debt, and the US recovery comes under pressure, many other emerging regions will be in trouble.

As part of the Global Trend Capture weekly update, Nathan O pointed out a bearish pattern evolving for the iShares MSCI Brazil Index (EWZ). The ETF peaked in March and has established a bearish trend – now sitting well below the key moving averages.

A short position in EWZ is probably the cleanest way to trade this pattern, but Nathan also offers an alternative for retirement accounts that cannot directly short stocks. The alternative is Ultrashort MSCI Brazil ETF (BZQ) which trades at twice the inverse of EWZ.

For inverse ETFs, be careful to size your position correctly, and of course you should be aware of the volatility decay issues associated with leveraged and inverse ETFs. Still, this is a good way to profit from falling prices – even in the context of a tax-deferred or tax-free account.

As the overall environment becomes more volatile, short-term swing traders have a distinct advantage. The ability to capture gains in 3 to 5 trading days and choose from a number of new setups each trading day can be a key factor in building a smooth equity curve with predictable profits.

Shortly before the open, equity futures are indicating a bearish open – which is great for our positioning and our potential trades for this week. Buckle up and tie down any loose risk points because it’s going to be an important next few sessions…

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Drift Before The Storm: What We're Tracking This Week

Published 04/23/2012, 10:23 AM

Updated 07/09/2023, 06:31 AM

The Drift Before The Storm: What We're Tracking This Week

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.