We have discussed the potentially negative investment consequences resulting from investors projecting recent outcomes into the future, recency bias. One key for investors to keep in mind is to determine if a recent result is the beginning of a longer term trend either up or down. What is difficult in this type of assessment is trends are not of equal duration. The first chart below shows small cap stocks have outperformed large cap stocks since the end of the bursting of the technology bubble in 2002 (nearly 12 years). The second chart compares the biotechnology ETF, iShares Nasdaq Biotech (NASDAQ:IBB), to the S&P 500 Index. Biotechs have been outperforming the broader market since mid 2011 (almost 3 years). As we noted in yesterday's post, biotech performance has been much weaker over the course of the past several months than the broader market. Is this the end of the biotech outperformance trend?

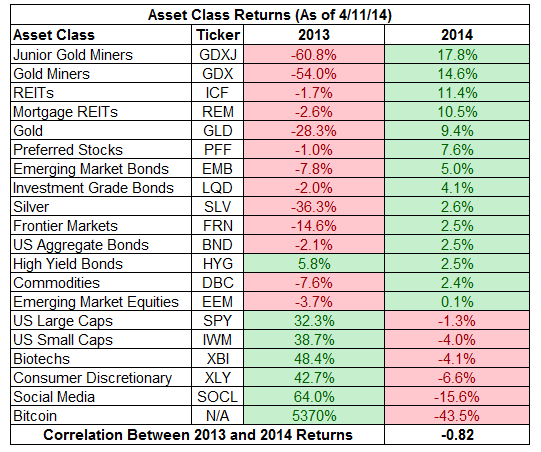

In addition to the above market segments, small cap and biotechs, trend reversals from 2013 are also evident. In a recent comment by Charlie Bilello, CMT of Pension Partners, he compares the returns of certain market segments in 2013 versus 2014. A number of the better performing market segments in 2013 have now turned out to be the weaker ones in 2014 and vice versa.

Simply chasing last years winners or jumping into a trend trade too late or even too early, can have negative consequences for the return of one's investment portfolio.