UST 10yr yield retreated further to be now near 2.82%, after the risk aversion sentiment contained the market during the US session lingering to the Asian session.

The weaker than expected retail sales figures of March could boost the risk-off sentiment increasing the demand for safer assets lower the outlook of the interest rate in US.

US retail sales in March declined by 0.1% monthly, while most of the markets pundits were waiting for rebounding of the consuming spending can raise retail sales by 0.4% m/m, after retreating in February by 0.3% has been revised yesterday to declining by only 0.1%.

The data added more worries about the US expansion rate in the beginning of this year, after Jan US Durable goods have previously shocked the markets by falling by 3.7% showing lower business spending.

Despite the continued improving of the US labor market which has shown recently higher scale of hiring can fuel the demand for consuming and the inflation upside risks.

It is not any longer foredoomed to see interest rate hiking next week by 0.25%, after the meeting of the FOMC members who can appreciate taking that action which has been highly previously expected just to restore trust in US economic activity by showing their confidence in it, despite the volatility in the Equities markets.

The committee can shock the markets by any reference to weakness or slowdown in the US economy, after the optimism which has been highlighted it is released economic assessment following the meeting of January.

When the committee members were confident in the US economy and its ability to reach the Fed's 2% inflation goal specially after considering adopting $1.5 trillion in tax cuts to take effect starting from this year.

EUR/USD is now trading near 1.2380, after ECB president Mario Draghi's try to talk down the single currency yesterday ended to retreating to 1.2346.

Draghi has warned about the EUR appreciation negative impact on the inflation in EU. Draghi said it clearly that the single currency recent gains were more due to external factors than the EU economic growth

Draghi assured on the monetary policy adjustment which will remain predictable, while the policy makers look for further evidence that inflation is moving in the right direction.

After the ECB governing council members meeting showed that they are no longer "standing ready to increase the asset purchase program in terms of size and/or duration".

As they removed this phrase from their economic analysis replacing its by saying that "the ECB current €30 billion monthly pace of buying is intended to run until the end of September 2018, or beyond, if necessary".

So, the current available option is only extending the time of the program not the size of it too. The markets have seen in this language change unexpected hawkishness.

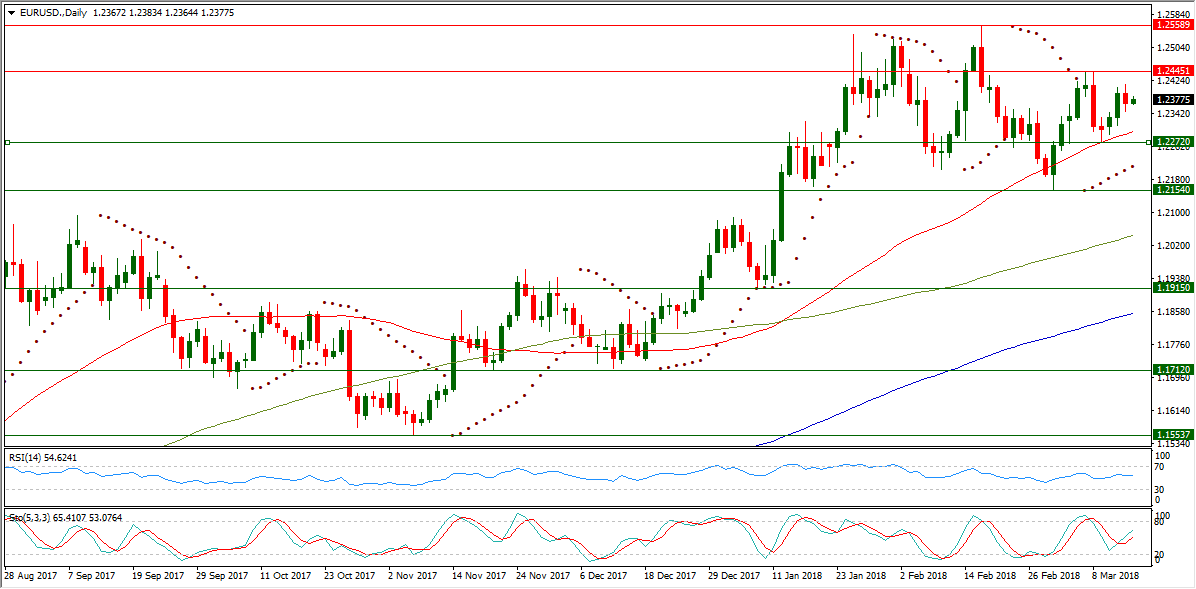

EUR/USD gains were limited to reaching 1.2445, before easing back for meeting its daily SMA50 at 1.2272 whereas it formed its higher low for bouncing up for trading currently near 1.2380.

The pair is still boosted over longer range by continued being above its daily SMA100 and also above its daily SMA200.

After forming a lower high below 1.2555 at 1.2445, EUR/USD is now trading in its seventh consecutive day above its daily Parabolic SAR (step 0.02, maximum 0.2) which is reading today 1.2212.

Forming a lower high at 1.2445 came as a result of forming a lower low at 1.2154 on Mar. 1 below 1.2205 bottom of last Feb. 9.

The pair is still negatively impacted over the short term by forming this lower low at 1.2154 which gave the pair longer leeway for trading below last Feb. 16 peak which has been at 1.2555.

EUR/USD daily RSI-14 is referring now to existence inside the neutral region reading 54.624.

EUR/USD daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line in its neutral area at 65.410 leading to the upside its signal line which is lower in this same area at 53.076.

Important levels: Daily SMA50 at 1.2298, Daily SMA100 at 1.2044 and Daily SMA200 at 1.1853

S&R:

S1: 1.2272

S2: 1.2154

S3: 1.1915

R1: 1.2445

R2: 1.2555

R3: 1.2599