There’s evidence of much more collective dollar buying in FX markets in November rather than December so don't be caught out by the 'year-end' effect.

When it comes to year-end USD demand, November appears to be the onset of action.

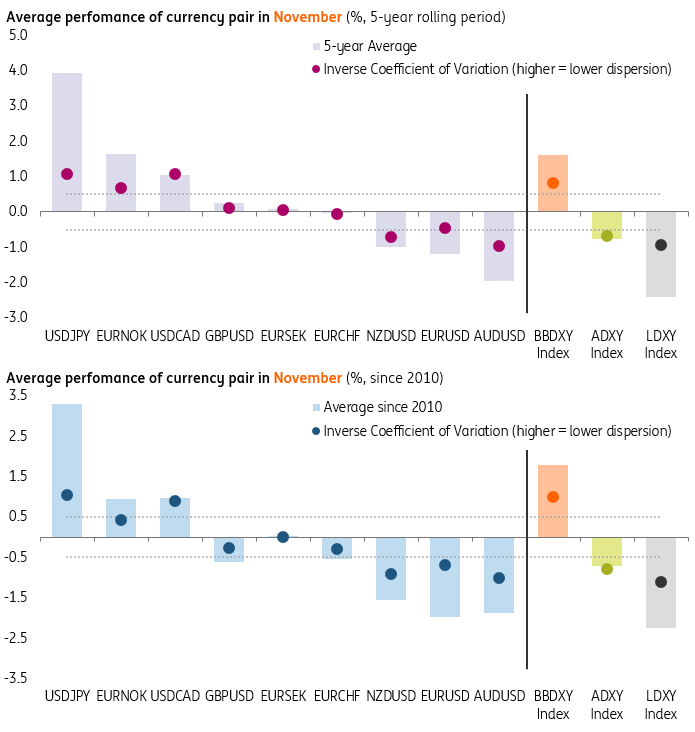

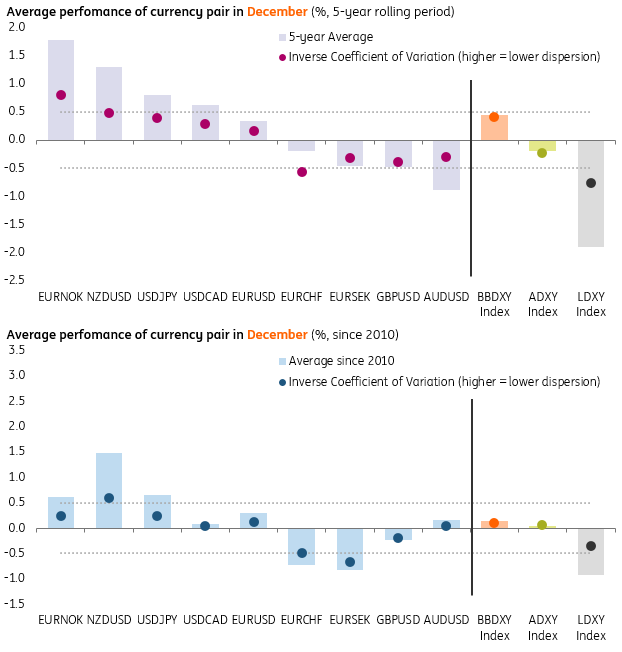

- Amid the noise around dollar funding difficulties, we take a quick look at year-end seasonality trends and find that November is typically a strong month in terms of both performance and positioning for the broad USD index. The Bloomberg Dollar Index (BBDXY) has posted average returns of +1.6% and 1.8% over the last 5 and 10 years respectively in the month of November (see first graphic below). In contrast, our calculations show inconsistent returns for the BBDXY index in the month of December (see the second graphic). However, we would caveat that 2017 was an anomaly - which saw the BBDXY index fall 1.46% in November (and -0.35% in December)

- Looking at individual currency pairs, we find USD/JPY to be most vulnerable to potential year-end USD demand effects; the pair has posted a normalised average return of +1.07% over the past five Novembers. G10 dollar-bloc FX (CAD, AUD and NZD) also appear to underperform against the USD in November. As for EUR/USD, we find some evidence of a downside bias in November - although the lower statistical significance over the past five years hints at possible waning effects.

- As for EM currency blocs, LATAM FX looks most vulnerable to year-end USD seasonality trends - with both November and December seeing heavy losses for the overall LATAM FX index. Asian currencies (ADXY index) broadly to move lower in November - but as with the G10 currencies, there is no consistent evidence for December being a bad month for the region.

- Scandi currencies to some extend buck the above pattern - with December being a relatively more difficult month for NOK and SEK (against the EUR). This is somewhat consistent with our bearish outlook for SEK into year-end as the resolution fund related decline in interbank rates should weigh on the currency. However, it's worth noting that we find EUR/NOK to have the more statistically significant year-end effects.

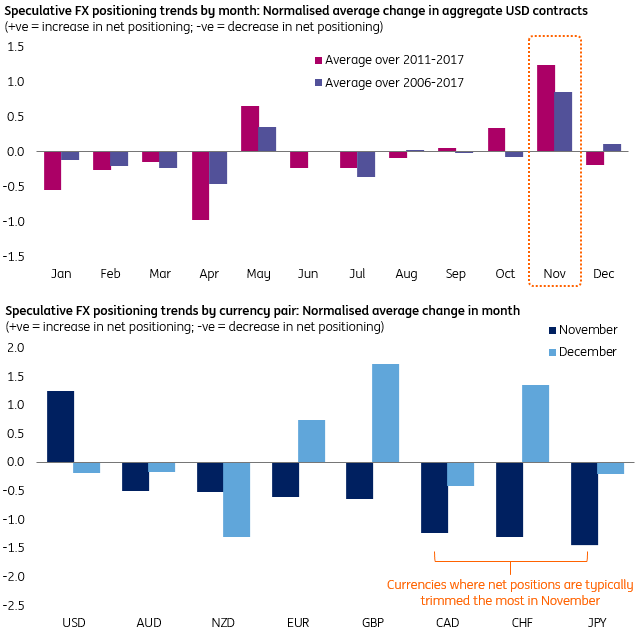

- All of this can be somewhat corroborated when we look at monthly positioning trends across G10 currencies (see third graphic below). Broadly speaking, we have seen strong USD buying by speculative investors in November - followed by a selling theme in December.

- Bottom line: For those investors concerned about year-end USD demand impact, we find greater evidence of 'USD buying' in spot FX price action and speculative positioning in the month of November - as opposed to December.

[Disclaimer: These observations are largely factual and we make no attempt to add a fundamental overlay to understanding these trends]

November FX Seasonality (Returns)

December FX Seasonality (Returns)

G10 FX Positioning Seasonality

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means.