This is a repost of the recent Palisade Weekly Letter –

Earlier this week – news went by relatively unnoticed by the ‘mainstream’ financial media (CNCB and such) that Beijing’s started selling their U.S. debt holdings.

Putting it another way – they’re dumping U.S. bonds. . .

“China’s ownership of U.S. bonds, bills and notes slipped to $1.17 trillion, the lowest level since January and down from $1.18 trillion in June.”

Remember – dumping U.S. debt is China’s nuclear option (which I wrote about back in April – click here to read if you missed it).

And although they’re starting to sell U.S. bonds – expect it to be at a slow and steady pace. They don’t want to risk hurting themselves over this.

I believe China may be selling just enough to get the attention of Trump and the Treasury. A soft warning for them not to take things too far with tariffs and trade.

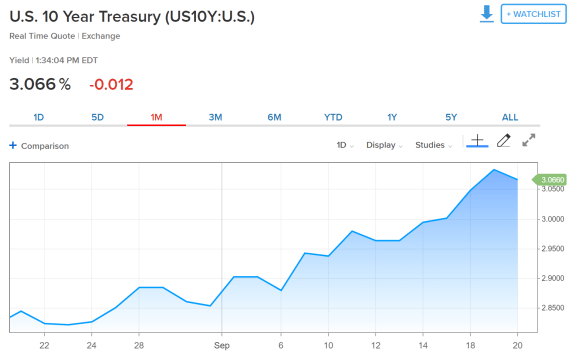

Yet already just as news hit the wire that China was selling bonds a few days ago – U.S. yields spiked above 3%. . .

Don’t forget that China’s the U.S.’s largest foreign creditor. And this is an asset for them.

And although them selling is worrisome – the real problems started months ago. . .

Over the last few months, my macro research and articles are all finally coming together. This thesis we had is finally taking shape in the real world.

I wrote in a detailed piece a few months back that foreigners just aren’t lending to the U.S. as much anymore (you can read that here).

I called this the ‘silent problem’. . .

Long story short: the U.S. is running huge deficits. They haven’t been this big since the Great Financial Recession of 08.

And it shouldn’t come as a surprise to many.

Because of Trump’s tax cuts, there’s less government revenue coming in. And that means the increased military spending and other Federal spending has to be paid for on someone else’s tab.

The U.S. does ‘bond auctions’ all the time where banks and foreigners buy U.S. debt – giving the Treasury cash to spend now.

But like I highlighted in the ‘silent problem’ article (seriously, read it if you haven’t) – foreigners are buying less U.S. debt recently. . .

This is a serious problem because if the Treasury wants to spend more while collecting less taxes, they need to borrow heavily.

This trend’s continued since 2016 and it’s getting worse. And with the mounting liabilities (like pensions and social security and medicare), they’ll need to borrow trillions more in the coming years.

So, in summary – the U.S. has less interested foreign creditors at a time when they need them more than ever.

But wait, it gets worse. . .

The Federal Reserve’s currently tightening – they’re raising rates and selling bonds via Quantitative Tightening (QT – fancy word for sucking money out of system).

This is the second big problem – and I wrote about in ‘Anatomy of a Crisis’ (read here). And even earlier than that here.

So, while the Fed does this tightening, they’re creating a global dollar shortage. . .

As I wrote. . . “This is going to cause an evaporation of dollar liquidity – making the markets extremely fragile. Putting it simply – the soaring U.S. deficit requires an even greater amount dollars from foreigners to fund the U.S. Treasury. But if the Fed is shrinking their balance sheet, that means the bonds they’re selling to banks are sucking dollars out of the economy (the reverse of Quantitative Easing which was injecting dollars into the economy). This is creating a shortage of U.S. dollars – the world’s reserve currency – therefore affecting every global economy.”

The Fed’s tightening is sucking money – the U.S. dollar – out of the global economy and banks.

And they’re doing this at a time when Foreigners need even more liquidity so that they can buy U.S. debt.

How is the Treasury supposed to get funding if there’s less dollars out there available? And how can they entice investors if Foreigners don’t have enough liquidity to fund U.S. debt?

These Emerging Markets must use their dollar reserves to prop up their own currencies and economies today. They can’t be worrying about funding U.S. pensions and other bloated spending when their economies are crumbling.

These two themes I’ve written about extensively – the decline of foreign investors and the Fed’s tightening – have gotten us to this point today.

And the U.S. is extremely fragile because of both problems. . .

Here’s the worst part – China probably knows this. That’s why they’re selling just enough U.S. bonds to spook markets.

But if the trade war and soon-to-be a currency war continues, no doubt China will sell more of their debt – sending yields soaring.

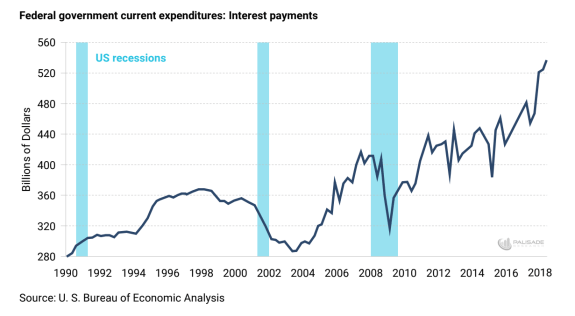

I just got done last week detailing how U.S. debt servicing costs (interest payments) are already becoming very unsustainable (click here if you missed it).

At this point they’re literally borrowing money just to pay back old debts – that’s known as a ‘ponzi scheme’.

This is why I believe the Fed will eventually cut rates back to 0% – and then into negative territory. And instead of sucking money out of the economy via QT, they’re going to start printing trillions more.

How else will the Treasury be able to get the funding they need?

I’ll continue to keep you up to date with what’s going on and how it all fits together.

But I think the two big problems I wrote about above are now converging into a new massive problem. And I don’t see any way out of it unless the Fed monetizes the U.S. Treasury and outstanding debts. And that will cause massive moves in the markets.

I’m sure Trump will eventually tweet, “Oh Yeah? Foreigners don’t want to buy the U.S. debt? Blasphemy! Who needs you all when we have a printing press!”

Or something like that. . .