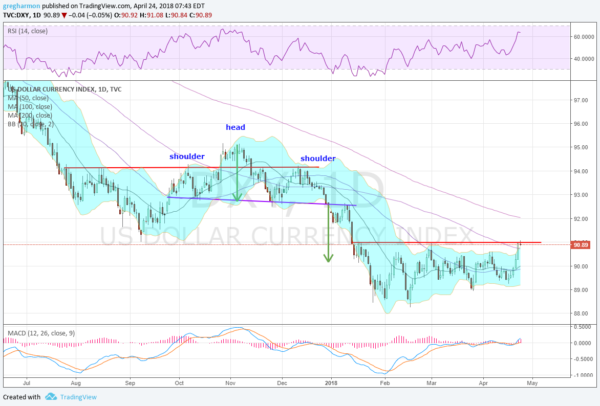

First let’s get something straight. The US dollar has been in a downtrend for nearly 18 months. It has at times shown short term relative strength, but the downtrend persists, even now. The chart below does give some hope to the dollar bulls though. There is a potential bottom forming and since everyone wants to pick a bottom lets take a look.

Let’s also note that the dollar has been in this situation before in this same downtrend. You only need to look back to the end of last year to see it. The brief bounce over consolidation that fell back and then failed on a retest. A Head and Shoulders Top in a downtrend. The break of the neckline eventually led to the move lower to the current consolidation.

So why may this time be different? There is no magic to a breakout. All the conditions will look the same and some will reverse while others will fizzle. In this instance the dollar has just moved over its 100 day SMA. The last time it did that was the failed breakout mentioned above.

It is also testing resistance of the last three months. The RSI is making a higher high and the MACD is crossed up and positive. Even the Bollinger Bands® are opening to allow a move higher. All the makings of a reversal are here again. A move over the 200 day SMA would certainly give it more strength. And then a higher high, over the Head of that Head and Shoulders. But by then many will have already taken profits.

All you can do is follow the price in the short term and manage risk if you are looking to play a reversal in the dollar. It my continue or it may not.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.