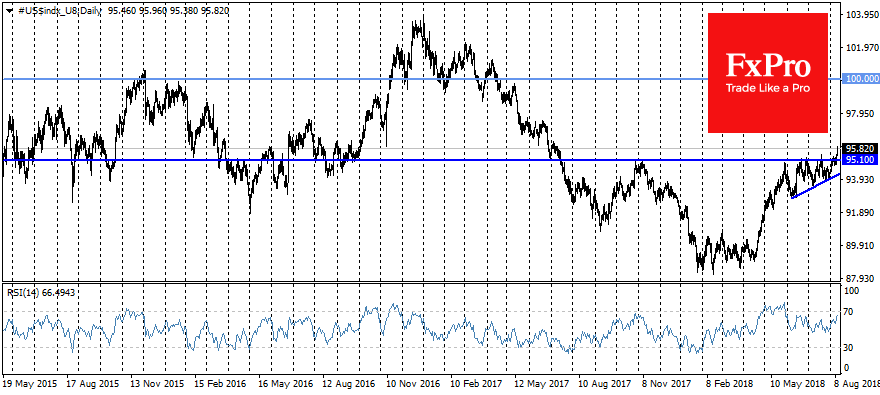

The dollar rewrote 13-months highs on Friday, adding 0.25% after gaining 0.5% on Thursday. The further growth of the US currency from the current levels would mean the end of the consolidation period, which has lasted since May, when the index has fluctuated in a relatively narrow range. The way out of this range can start a new stage of the USD strengthening, as it was in April-May. The repetition of the spring rally is able to send the dollar index to 100, the psychologically important level, where it had a significant resistance in 2015-2017, being only briefly receding above.

The growth of the dollar this week is mostly due to other currencies’ problems and is not caused by the strong output of American economy. However, the most dramatic decline can be seen for the currencies of the countries with which the United States has some kind of disputes. While the weakening of currencies to the dollar is due to the outflow of investors, there is a higher risk that Trump will once again be dissatisfied with the strengthening of the dollar as it was last month when the symptom rally of the dollar was stopped by Trump’s call for a softer Fed policy.

However, the dollar is strengthened for quite objective reasons, so it is unlikely that Trump’s comments would fundamentally roll the course of the American currency.

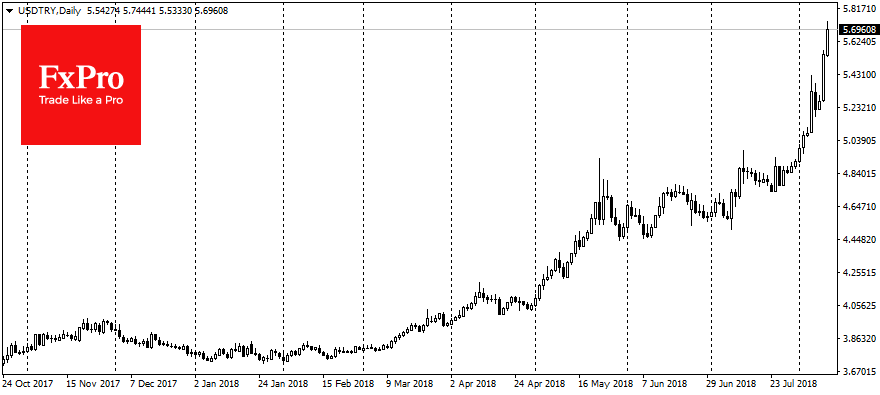

Once again, the Turkish lira was among the main victims. It collapsed over the last 24 hours by 7.5% to a new historical low of 5.72 per dollar due to the diplomatic conflict between Ankara and Washington. Since the beginning of the year, USD/TRY pair has skyrocketed by 51%.

The Russian ruble lost to the dollar 1.7% on Thursday up to 66.65 per dollar, increasing the pace of the decline since the beginning of the month to 6.7% on the outflow of investors from Russian assets under the threat of new U.S. sanctions.

This morning, sterling has fell to 1.2815, the lowest rate since August 2017 on investors’ fears that Britain would leave the EU without an agreement with Brussels, which would exacerbate economic uncertainty for the country.

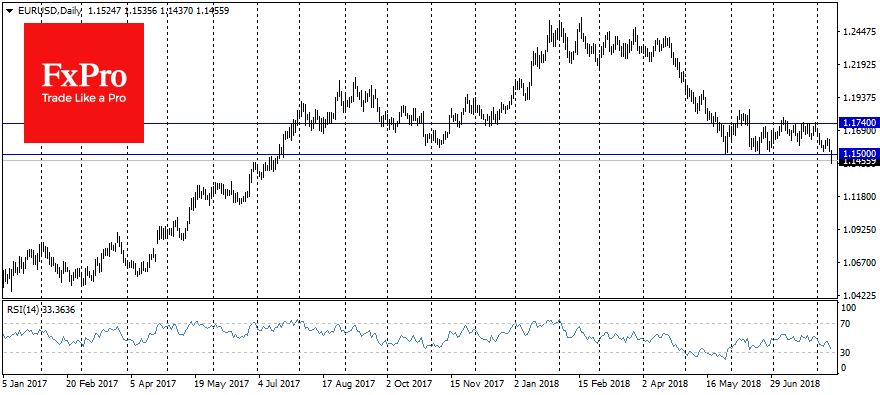

The EUR/USD pair has fallen on Friday morning below 1.1500, the lowest rate since July 2017 and below trading range for the last 3 months that increased a sale-off by massive stop-orders flow. A single currency is under pressure due to uncertainty around Britain and worries about the Turkish exposure to some European banks.

In addition, the ECB commented on the euro that the increasing protectionism raises risks for the global growth. This was perceived as a signal that the regulator might be willing to soften its rhetoric in the event of a trade conflicts proliferation.

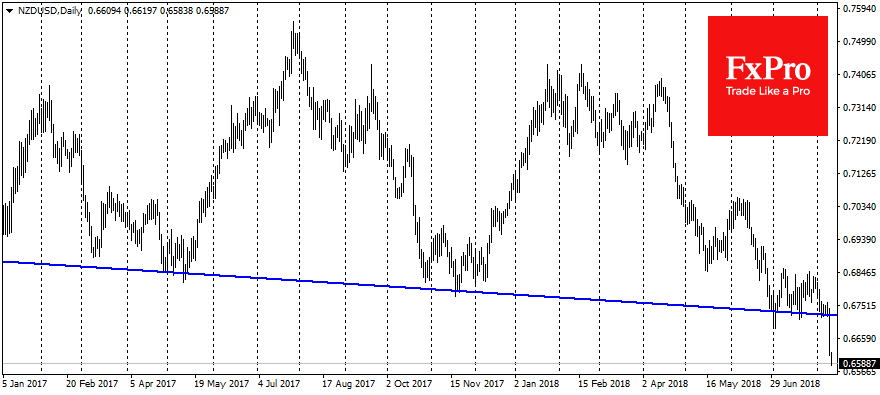

The New Zealand dollar lost 2% to lows of 2.5 years after RBNZ had predicted that it would not raise the rates until 2020.

In the context of reduced trading volumes due to the vacation period, the dollar’s output beyond the established trading range can turn into a rather sharp rally in the coming days.

Alexander Kuptsikevich, the FxPro analyst