Imagine you bought a vending machine for $2,000. This vending machine made you profits of $100 a year, after all expenses. It would take 20 years to recoup your initial investment.

The amount of time an investment requires to pay back your initial investment amount is called the payback period.

Analyzing investments through the lens of the payback period is very practical. It tells you how quickly an investment will pay back the amount you put into it. This makes comparing different investment options very easy.

Keep in mind that the payback period does not take into consideration the gains from the sale of a stock. It only considers the income produced from your investment, not the return of your initial invested amount.

Valuing a stock perfectly is an impossible task. Instead of looking for ‘undervalued securities’ everywhere, what would happen if we focused on how long it takes for our investments to pay as back?

What would happen if we applied the payback period principle to dividend stocks?

When to Use the Payback Period

Not all stocks have a policy of paying steady or increasing dividends every year. The payback period is useless for these stocks.

But that doesn’t mean it is useless for all stocks. Some stocks do pay steady or increasing dividends every year, and are very likely to continue to do so.

The payback period can be applied to high quality dividend growth stocks to compare their relative investment merits.

What Is Needed To Calculate the Payback Period?

To calculate the payback period for a dividend stock, you only need 3 pieces of information:

- Stock price

- Expected growth rate

- Annual dividend payment

Have you heard the expression garbage in, garbage out? If your formula uses many uncertain-at-best estimates, the output of the formula is garbage. You can’t get anything of value from valueless inputs.

Of these 3 metrics, 2 of them are exact. The stock price and the annual dividend payment are not up for debate. They are what they are.

Only the expected growth rate is estimated in calculating the dividend payback period.

For some stocks, the expected growth rate is virtually impossible to calculate. For others, it is far easier. High quality, highly predictable business tend to grow at fairly stable rates. Perhaps the best example of this is Coca-Cola Company (NYSE:KO)

The company has averaged earnings-per-share growth of about 9% a year over the last decade. It is highly likely they average around 9% a year again over the coming decade. It could be 8% or 10%, but 9% is a fairly good estimate for future growth.

When looking at stable businesses with durable competitive advantages, the future can look an awful lot like the past.

Merits of the Payback Period

The payback period has certain hidden benefits.

The expected growth rate is the least accurate piece of information the formula uses. Expected growth also has less of an effect on the payback period than it does on most other valuation metrics. As an example, imagine a stock with a share price of $100 and an annual dividend of $3 (for a 3% yield).

- At a 10% growth rate, the payback period is 16 years

- At a 5% growth rate, the payback period is 21 years

If you estimate 10% growth, but you are wrong by 100% (a huge error), your payback period is only off by about 24%.

The price and dividend are more important than growth in the payback period calculation. In discounted cash flow analysis, the growth rate has a greater impact on the analysis because it forecasts growth indefinitely. The payback period only forecasts growth out to the amount of time it takes to pay back your initial investment.

The Dividend Payback Period Applied

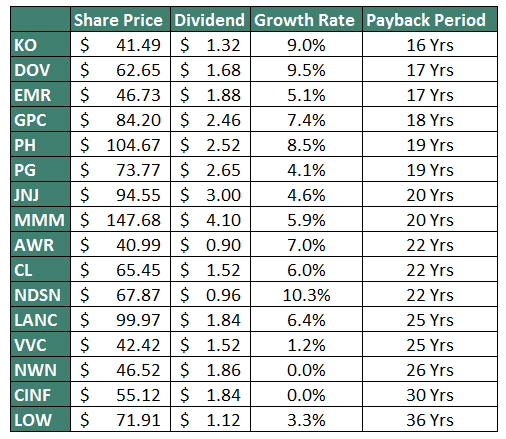

The table below shows the dividend payback period and all relevant data for the 16 Dividend Kings – stocks with 50+ years of consecutive dividend increases.

Notes to table: Growth rate in the above is the lower of 10 year historical dividend growth and earnings-per-share growth. Stocks with negative growth rates were given a 0% growth rate instead.

As you can see, there is significant variability in the payback periods of the Dividend King. Coca-Cola has a payback period of 16 years, while Lowes (LOW) has a payback period of 36 years. For Lowes to grow have a payback period of 16 years (the same as Coca-Cola), it would have to grow its dividend payments at 17% a year for 16 years in a row.

The payback period can be applied to potential dividend growth stock candidates to quickly ascertain the stocks that are worthy of further analysis.

A Word of Caution

The dividend payback period is a very useful metric. It frames investment decisions around the income they generate – and how quickly you will get your money back from your investment.

What the payback period does not tell you is the relative safety of each investment. I specifically picked the Dividend Kings stocks in the example above because they all have such a long history of dividend growth and stability.

The dividend payback period will be of little value for a highly risky stock with a 15% dividend yield that might or might not cancel its dividend in the next few years.

It only applies to businesses you think will be around (and thriving) for at least as long as the payback period. Even for a ‘fast’ payback company like Coca-Cola, you would have to wait a full 16 years to receive your investment back in the form of cumulative dividend payments.

I certainly think Coca-Cola will continue to grow for the next 16 years. I am much less certain of stocks in fast changing industries – Qualcomm (NASDAQ:QCOM) would be a good example, or of stocks that generate much of their revenue from a patent that will expire fairly soon – like AbbVie Inc (NYSE:ABBV).

The Link Between Payout Ratio and Growth

The dividend payback period captures the relationship between the payout ratio and growth. As an income seeking investor, the preferred payout rate is 100% if the company cannot grow through reinvesting earnings. When a company decides to retain earnings, management had better be using those earnings to grow the dividend payment in the future.

Some companies still manage rapid growth despite having a high payout ratio. Take Altria Group (NYSE:MO) as an example. The company maintains a payout ratio of around 80%, Take Altria Group (MO) as an example. The company maintains a payout ratio of around 80%, yet still manages to grow earnings-per-share around 8% to 9% a year. The company’s management is very efficient with the earnings it does retain and uses them very effectively. Altria’s payback period is 14 years using an 8.3% growth rate.

Put another way, a company that is retaining 30% of its earnings should be growing much faster than a company that is retaining 80% of its earnings. If it isn’t, management is likely wasting capital on very slow growth projects.

Final Thoughts & Dividend Payback Period Calculator

The dividend payback period focuses an investors’ thinking on what matters: actual cash flows back to the investor.

It lends one to invest in high quality businesses that use capital efficiently and can therefore pay a high dividend and grow reasonably quickly.

Click the link below to download an Excel spreadsheet that quickly calculates the dividend payback period.