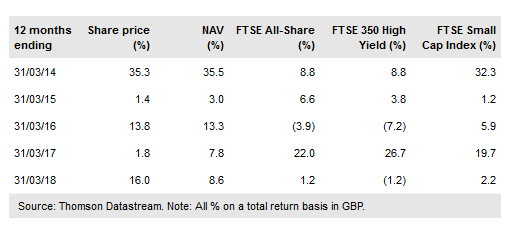

Diverse Income Trust PLC (LON:DIVI) seeks to provide shareholders with an attractive level of dividends and capital growth over the long term. It achieves this through investing primarily in UK-listed companies that are able to improve productivity, where strong cash flow can underpin sustained dividend growth. The managers Gervais Williams and Martin Turner believe a multi-cap approach has the advantage of investing over a wider opportunity set relative to those limited to large mainstream stocks, and around two-thirds of DIVI’s holdings are outside the FTSE 350. The strategy also seeks to manage the scale of potential capital loss, in the event of a major market setback, through the use of a FTSE 100 put option. DIVI has a solid track record of performance; from inception in April 2011 to end February 2018, it has generated an annualised total return of 13.8%.

Investment strategy: Fundamental, unconstrained

DIVI is focused on finding companies with durable long-term dividend growth. These firms typically have strong balance sheets, conservative managements and are attractively valued. Unconstrained by a benchmark, the managers are free to invest across the whole market-capitalisation spectrum, and currently tend to find many of the better investment opportunities among small-cap income stocks. The investment approach is bottom up and the managers meet around 70-80 companies each month. DIVI’s portfolio is well diversified, consisting of around 150 holdings across 11 sectors. Were there a significant market correction, the trust has an undrawn gearing facility so it can fund extra investments prior to any future market recovery.

To read the entire report Please click on the pdf File Below: