All of us have opinions on the affects of automation. My university education stressed that there was nothing to fear from automation, as historically automation created at least as many jobs as destroyed.

Follow up:

The Mainstream View

From McKinsey Global Institute:

While much of the current debate about automation has focused on the potential for mass unemployment, people will need to continue working alongside machines to produce the growth in per capita GDP to which countries around the world aspire. Thus, our productivity estimates assume that people displaced by automation will find other employment. Many workers will have to change, and we expect business processes to be transformed.

However, the scale of shifts in the labor force over many decades that automation technologies can unleash is not without precedent. It is of a similar order of magnitude to the long-term technology-enabled shifts away from agriculture in developed countries’ workforces in the 20th century. Those shifts did not result in long-term mass unemployment, because they were accompanied by the creation of new types of work.

We cannot definitively say whether things will be different this time. But our analysis shows that humans will still be needed in the workforce: the total productivity gains we estimate will only come about if people work alongside machines. That in turn will fundamentally alter the workplace, requiring a new degree of cooperation between workers and technology.

History repeats until it no longer repeats. My issue is that the new normal and globalization added new dynamics to the economic mix - and in any event, what has been witnessed historically is likely no longer repeatable.

Anecdotal Opinion

But being out in the real world running REAL work for 45 years - seeds of doubt formed formed over time that this general theory on automation creating jobs was still true. The most recent significant job destructor was the internet and networks. We have become nearly paperless - needing significantly less administrative support - and now able to more effectively run work.

Any manager worth his salt does more with less - all while raising quality. I saw no economic sector in the USA or globally which was not doing more with less. Even if there is no productivity growth in the future, the there is a direct relationship between service / goods production employment growth and population growth.

President Obama's Final Thoughts

One statement stood out in President Obama's farewell address this past week:

I agree, our trade should be fair and not just free. But the next wave of economic dislocations won't come from overseas. It will come from the relentless pace of automation that makes a lot of good, middle-class jobs obsolete.

If a lot of good middle-class jobs become obsolete - what steps are being taken by government? What steps are parents taking for their children's future? Are workers educating themselves for alternate jobs? Seems like no one has a clue what to do. The USA (and most of the world) is frozen in the headlights of this oncoming freight train.

Existing Firms Are Driving the Economy

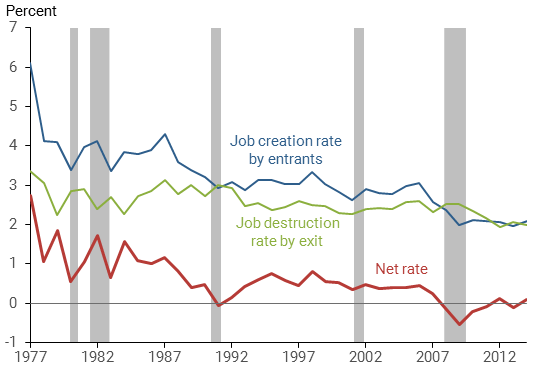

The following graph from the San Francisco Fed was produced to show the difference between the job creation rate by new firms and job destruction by firms exiting the market. Their conclusion:

Therefore the difference between the job creation rate by new firms and job destruction by exiting firms yields the change in employment share for surviving firms. This is a measure of surviving firms’ relative productivity growth.

Job creation and destruction relative to total employment

Source: Census Bureau Business Dynamics, San Francisco Fed, ecointersect. Gray bars indicate NBER recession dates.

I found one additional paragraph in the San Francisco Fed post interesting:

In short, declining business turnover is not strongly tied to overall productivity growth, as some theories would suggest, because that growth is largely driven by existing firms.

Thinking this through, if the economy is now driven by existing firms (which I believe the anecdotal evidence supports this with the number of new business starts declining for decades) - then logic dictates automation is generally shrinking the workforce size in existing firms per unit of output.

Concluding Thought

There are two separate types of automation occurring:

- labor saving - eliminating people

- new / different technologies - changing the horse and buggy for a car

It is the former which is now the larger automation - and it is accelerating. I see little logic in believing the net affect of this dynamic is neutral.

Some believe the solution to automation is paying people a living wage - whether they have a job or not. Some believe the solution is retraining decapitated workers. I say that every nation's economy is geared a certain way, and when you mess with the gearing - very unpredictable events occur. I believe the USA needs to look towards the states to experiment with potential solutions as I see no current single national remedy being effective.

Other Economic News this Week:

The Econintersect Economic Index for January 2017 again insignificantly improved with the economic outlook for weak growth. The index remains marginally above the lowest value since the end of the Great Recession. But there are indications of better dynamics in our index in the future. Six month employment growth forecast indicates little change in the rate of growth.

Bankruptcies this Week from bankruptcydata.com: Privately-held Limited Stores Company, Memorial Production Partners, Netherlands-based Metinvest, Avaya

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: