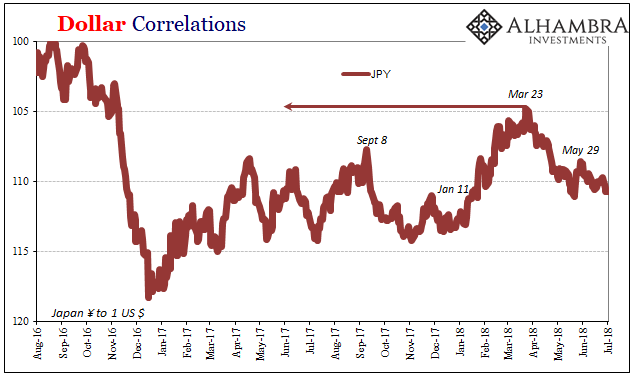

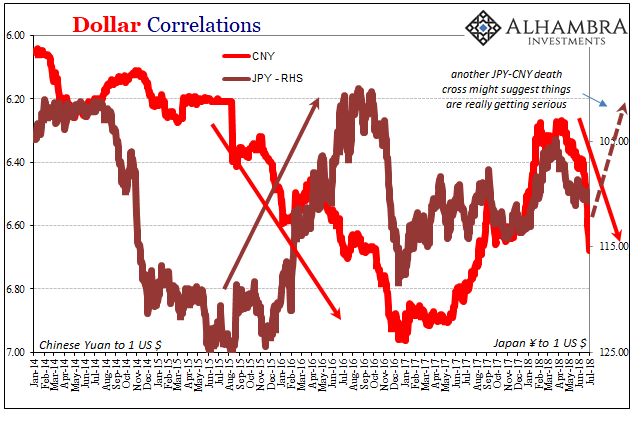

There are several factors missing from the latest eurodollar rout. Well, not really missing so much as sitting this one out to this point in time. We knew things were really getting serious in 2015 when the Japanese yen joined the currency parade. Only it didn’t fall as others had, JPY rather rose very much against the Bank of Japan.

Over the subsequent years, the pattern has largely filled out in that manner; JPY UP = BAD, as it was. That held true even as late as March this year, where a high in yen against the dollar marked some of the more visible shakeups.

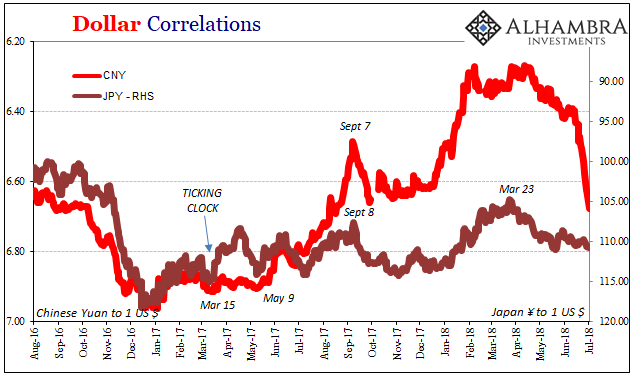

But as EM currencies are behaving like they did two and a half years ago, JPY isn’t. Right now, it is largely trading on the periphery. CNY is taking up all the space for obvious reasons. The yen being in the background to it isn’t by chance, either. I have to believe it is by design.

Not that there are government and central bank officials huddled in Tokyo hammering out the daily trading direction of JPY, cajoling it over time toward “devaluation.” For one, the Bank of Japan is run by clowns. Even if they wanted to intervene directly it would have been far more likely to have had the opposite effect (such as NIRP in January 2016).

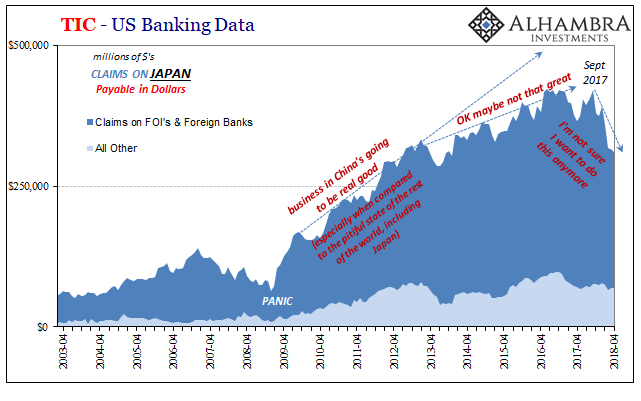

No, this is about Japanese banks. They wanted in on the eurodollar business as it moved toward Asia in the immediate aftermath of 2008. You know the old saying, be careful what you wish for.

That’s the upshot of waking up to global “dollar” reality, even if a little late to the realization. When the next one comes, or is coming, you aren’t situated right at the front of the downside.

It doesn’t mean, however, Japan is out altogether. Far from it. Japanese banks are still in the eurodollar business and tied to China. Like some mafia family organization, once you are in there is no getting out, at least not all the way. They can cut back and turn off some of their activities but not all of them. There is still very much a “dollar” redistribution business running through Tokyo.

That would be, for me, one indication of moving deeper into the red at least as I sketched out these reflation/deflation cycles last week. If JPY were to suddenly and sharply move inversely to CNY, it might propose those kinds of self-reinforcing behaviors that are down at the worst of things.

Does Japan’s retreat from the Asian “dollar” make it more likely or less likely to happen? I don’t know for sure, but I suspect that if it does develop by this setup a JPY/CNY cross would propose nothing good.

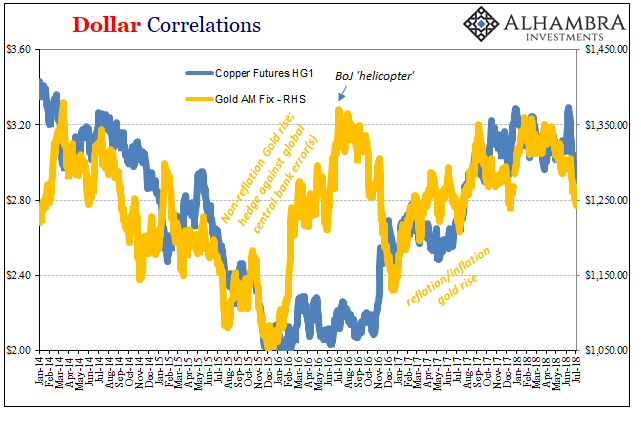

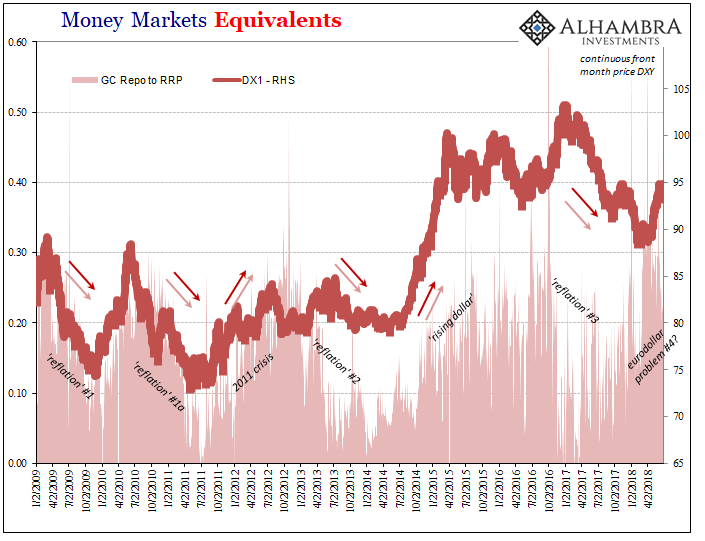

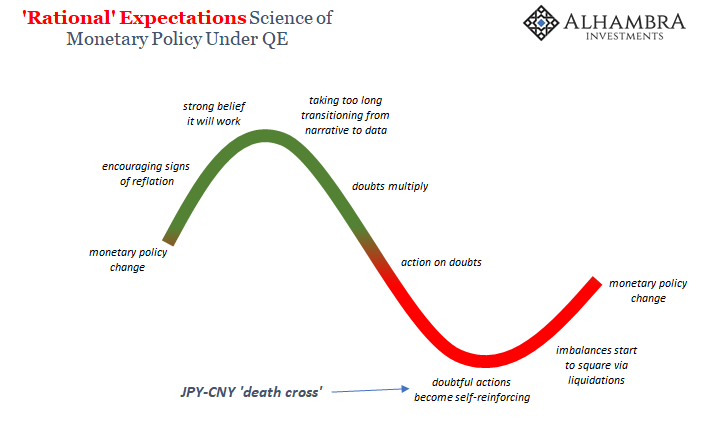

That said, there is plenty to suggest what’s already turned some shade of red. Hints of deflation abound already, the descent from reflation green back toward the wrong direction.

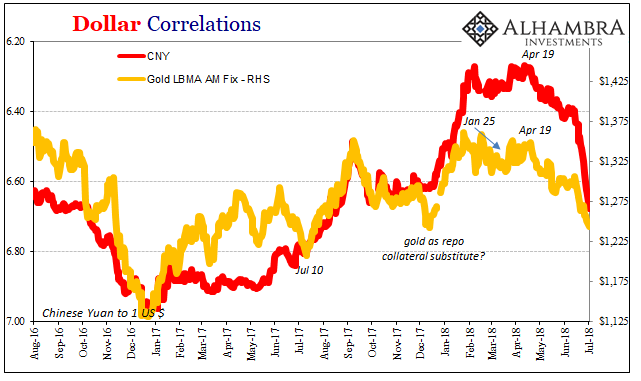

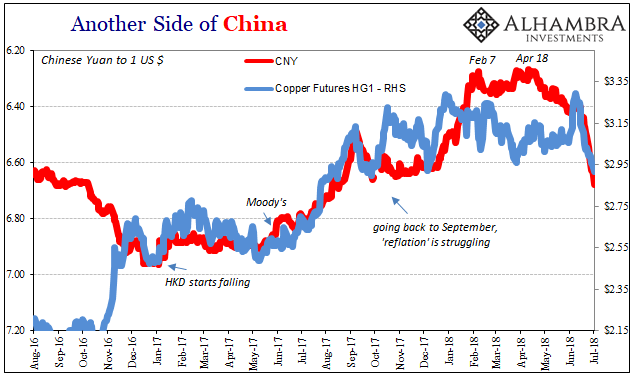

A lot, obviously, is trading off CNY which is what you would expect. Because of it, the money metals are suffering new lows. Gold is back down less than $1,250 on global rather than repo collateral (though a small rise in fails the week of June 20, if from a low level the prior week), which if it keeps going a little more in the same direction will be less than the mid-December low. It would mark a serious departure from reflation.

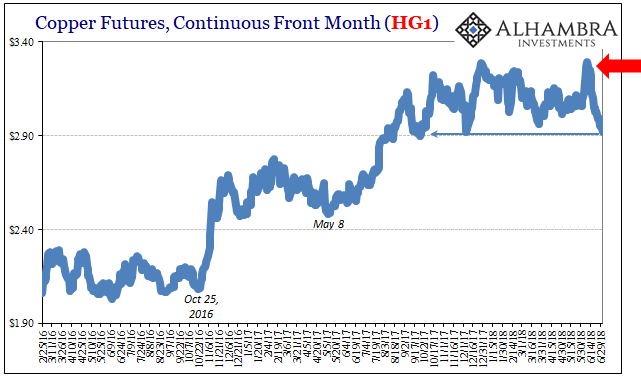

Copper is already at a nine-month low and still falling. After jumping at the start of last month, it has been crushed by CNY’s sudden, intense fall.

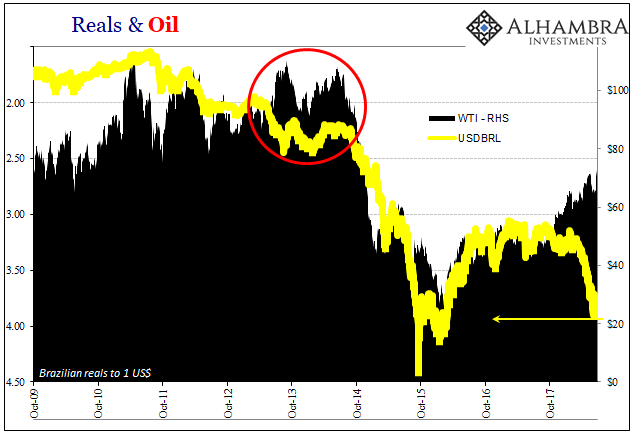

One notorious commodity remaining conspicuously on the sidelines well outside of deflation is crude oil. WTI and other benchmarks are supported by geopolitics and really uncertainty about the small “e” economics of the former “supply glut.” A lot of American oil has been exported which has helped alleviate the physical imbalance, but ultimately what does that really mean?

Is it an indication of actual growth, or, like 2013 and early 2014, the final false hopes of dwindling reflation sentiment as the global economy slowly turns over yet again? Reflation doesn’t die all at once uniformly. Like everything, it’s a lengthy process.

If WTI and JPY were to crack in the weeks and months ahead, that would really mean something. Not that we shouldn’t be concerned now; we don’t need to look at things in binary fashion. The possible or even likely end of Reflation #3 doesn’t necessarily mean the beginning of Eurodollar Event #4. There is some space in between them.

Still, the more of deflationary hints that might appear the less likely the self-reinforcing stuff remains at bay.