Summer is the time of year when people like to really kick off their shoes and relax. It's a time when families pile into the car, take to the highways and head to that much anticipated summer vacation. A time when people like to fire up the BBQ and grill up their personal favorites. This is the season when people want to get out and really enjoy different activities. However, these days, getting out and enjoying what life has to offer comes with a price.

As many of you may or may not know, the US consumer makes up about 70% of the economy. That's a pretty hefty dependence on people going out and spending money. And spending is what many retailers SPDR S&P Retail (ETF) (NYSE:XRT) are hoping for this summer, as they went through one of the coldest winter's on record. So with the Polar Vortex squarely in the rear view mirror, the pent-up consumer should be ready for that long awaited spending spree, right? Well not so fast, just as one nemesis in old man winter was put in hibernation, another foe in high Crude Oil (United States Oil Fund LP (ETF) (NYSE:USO) has emerged.

So far, not too many people are talking about high oil prices, as this is seen as a temporary surge because of the new uncertainty in Iraq. However, we all know that it's a matter of when, not if, the pain will be felt at the pumps. Once the consumer starts to feel the pinch from high gas prices, it will inevitably hurt retailers SPDR S&P Retail (ETF) as it always does.

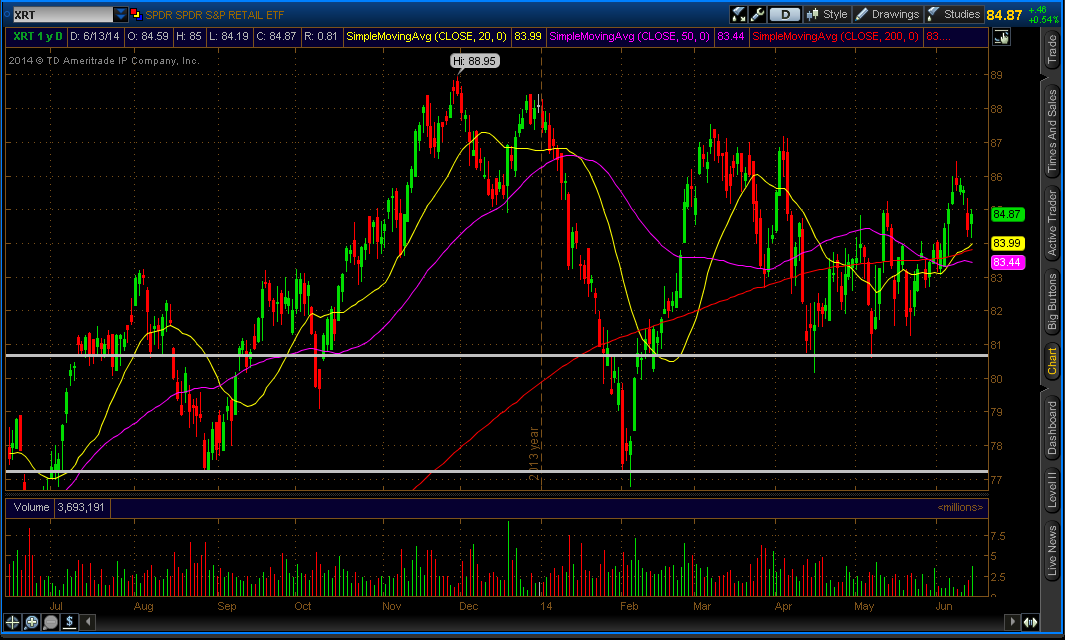

Below is a chart of the SPDR S&P Retail (ETF) showing not only the under-performance of the retail sector, but some areas of support and potentially good opportunities to put on a long trade. So with the official start of summer and sun just days away, the retail sector might just be left out in the cold yet again.

BY Parm Mann