The S&P 500 is above 1500. CBOE S&P 500 Volatility (VIX) is sitting near 15-year lows. And 88% of iShares S&P 100 (OEF) component stocks are above respective 200-day moving averages.

Normally, you might hear more discussion about complacency and/or an imminent sell-off. Instead, you’re hearing more about the “Great Rotation” out of bonds and into stocks. In fact, if Laszlo Birinyi or Jeremy Siegel have your ear, we’ve just barely begun an exuberant stage for equities.

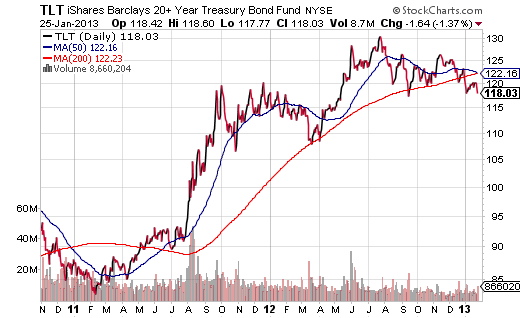

Bullish prognosticators certainly do have a mound of evidence to fall back on. Consider the iShares 20-Year Treasury Bond Fund (TLT). Its current price is well below short and long-term trendlines. And the 50-day recently crossed below the 200-day… a price movement pattern that goes by the name, “Death Cross.” (Note: The last “death cross” for TLT occurred over 2-years ago.)

It may be reasonable to agree that long-term Treasuries are facing hardship. Or perhaps… the potential rewards of owning TLT over the next year (e.g., yield, capital appreciation, perceived safety, etc.) are not commensurate with the possible risks (e.g., loss of principal, excessive volatility, etc.).

On the other hand, it may be a bit near-sighted to dismiss the entire community of debt instruments. For example, over the past 3 months, the S&P 500 SPDR Trust (SPY) has put together 5.5%. The fiscal cliff impasse kept the market range-bound for a period of time, but the market has since gone on to hit a 5-year peak; similarly, TLT has logged a dismal -3.1%.

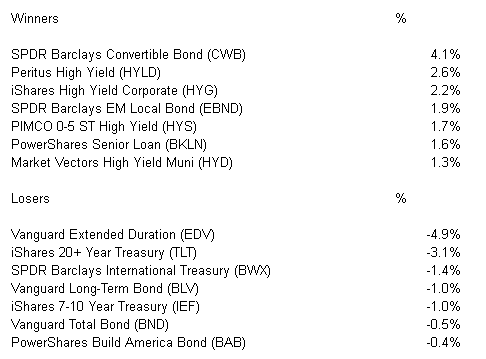

Nevertheless, a wide range of bonds have provided admirable risk-adjusted returns over the period. SPDR Convertible Bonds (CWB) garnered 4.1%, iShares High Yield Corporate (HYG) registered 2.2%, SPDR Barclay Emerging Market Local Bond (EBND) amassed 1.9% and Market Vectors High Yield Muni (HYD) served up a tax-free 1.3%.

3-Month Total Returns For A Wide Range Of Bond ETFs

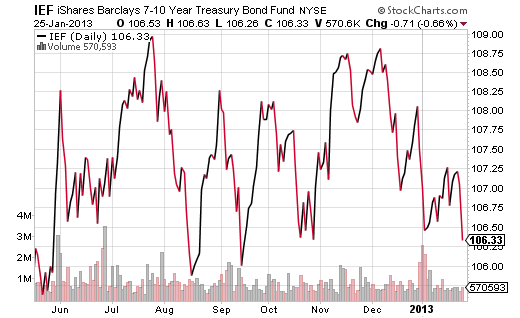

Granted, if a steady stream of outflows from intermediate- and long-term Treasuries turns into a stampede, higher Treasury yields may put pressure on other fixed income vehicles. Indeed, if we witness a full-fledged exodus at a pace that the Federal Reserve isn’t able to offset through its quantitative easing policies, stock investors might also find themselves struggling with a sharp uptick in the 10-year. After all, most of the country’s mortgage and car loan euphoria is dependent on subdued 5, 7 and 10-year notes.

As of this moment, however, iShares 7-10 Year Treasury (IEF) has not entirely thrown in the towel. For the better part of 9 months, it has traded in a fairly stable range.

It follows that a slow rotation out of lower-yielding Treasuries might be manageable and moderately bullish. Conversely, a rapid-fire rotation would likely bring bears back to the dance floor.

Regardless of how it ultimately plays out, it’s important to recognize that not all Bond ETFs are cut from the same cloth. I maintain a healthy allocation to emerging market bonds, short-term high yield bonds as well as munis in taxable accounts.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Death Of Bond ETFs? Change Your Fixed Income Lenses

Published 01/27/2013, 05:27 AM

Updated 03/09/2019, 08:30 AM

The Death Of Bond ETFs? Change Your Fixed Income Lenses

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.