Brace yourself! This week promises to be a particularly busy one for economic reports.

By my tally, the market is set to digest 20 separate data points – ranging from construction and natural gas spending to the MBA Mortgage Index.

Understandably, some reports will be more important and impactful than others. With that in mind, here’s a rundown of the three data points investors should be watching the closest.

Stocks Love Jobs

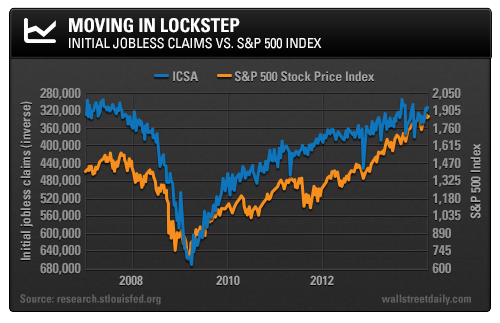

It’s been a long time since I’ve run this chart. And yet, it remains one of my favorites because the relationship between initial jobless claims and the S&P 500 is undeniable.

As claims go down, stocks go up (and vice versa).

The good news is that the passage of time, which often undermines the reliability of any indicator, has only cemented this one’s trustworthiness.

Take a look:

Come Thursday at 8:30 AM, we’ll get the latest reading on initial jobless claims. The consensus estimate is for an increase from 311,000 to 320,000.

But that doesn’t necessarily mean we should expect a pullback in the stock market. You see, the trend is more important than the individual data point. And for four weeks in a row, initial claims have come in lower than expected.

The four-week moving average continues to trend lower, too, recently hitting its lowest level in 26 weeks.

For the bulls in our midst (myself included), another initial claims number that’s below expectations points to higher stock prices ahead.

Too Impatient?

If we want to get an early read on the initial jobless claims figure, look no further than today’s auto sales report, due out at 2 PM.

After all, you can’t buy a new car without a J-O-B.

I’m not saying auto sales can predict the exact same outcome for initial jobless claims. However, a strong report would certainly increase the likelihood of it, as auto sales tend to be a reliable proxy for employment.

While we’re on the topic of autos, now is as good a time as any to reiterate my bullish stance on shares of Ford Motor Company (NYSE:F).

It’s cheap, trading at just eight times forward earnings compared to the S&P 500 Index at 16 times. And at 3.2%, Ford also sports a better yield than U.S. Treasuries, plus a history of increasing its dividend.

And based on the industry average price-to-earnings ratio, a mere reversion to the mean for shares implies a 26% upside to current prices. Like the analysts at Morningstar, though, I’m convinced that the stock is worth even more, closer to $25 per share. Don’t miss out!

The Big Kahuna of Economic Reports

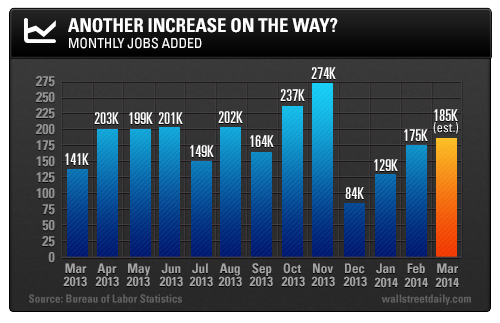

Last but not least, we need to pay careful attention to what Business Insider’s Joe Weisenthal calls “the big kahuna” – Friday’s jobs report.

Economists estimate that the economy added 185,000 jobs, up from 175,000 last month.

If they’re spot on with their predictions – or the jobs figure comes in even higher than expected – it’ll pretty much eliminate any fears that the cold winter weather put a permanent damper on the U.S. labor market. It would also represent the third consecutive report showing month-over-month gains.

We need to pay attention to the unemployment rate contained in the jobs report, too.

Granted, the Fed abandoned the Evans Rule, which stated that it will keep the federal funds rate low either until unemployment falls below 6.5% or inflation rises above 2.5%.

Nevertheless, the unemployment rate remains important for predicting the timing of the first interest rate increase. An unexpected drop could put an end to the rally in the bond market, as it would suggest that an increase is coming sooner rather than later.

It’s also worth noting that bonds are actually outperforming stocks so far this year, despite fears that they would dramatically underperform. The Barclays Global Aggregate Bond Index is up 2.5% year to date compared to the S&P 500′s 0.5% rise.

Bottom line: In case you haven’t figured it out yet, it’s all about the jobs data this week. The future direction of stocks, bonds and even auto sales hangs in the balance.