Last week we were treated to some encouraging news: on Tuesday we learned that Canada’s Gross Domestic Product had grown 1.7% (YoY), which was 0.4% more than expected. This allowed the loonie to continue gaining strength and rise 2% in two weeks. We also learned that Mark Carney’s successor at the Bank of Canada will be Stephen Poloz. The new Governor, who will officially assume his new duties on June 3, has a PhD in Economics from the University of Western Ontario and was the President and CEO of Export Development Canada. In the U.S., the Federal Reserve reiterated its commitment to continue purchasing bonds at a rate of $85 billion per month. In addition, on Friday the markets were pleasantly surprised to hear that the unemployment rate had fallen from 7.6% to 7.5% and that 176,000 new jobs were created in April. Lastly, on Wednesday the European Central Bank lopped 0.25% off its key interest rate, bringing it to 0.5%. Have a great week!

The Loonie

I never had a policy; I have just tried to do my very best each and every day. – Abraham Lincoln

Last week we were treated to a raft of information from the central banks, so we will provide you with a brief review of the week’s events and their impacts on financial markets. First, in the least surprising of the three major news items, the U.S. Federal Reserve decided to leave its key interest rate unchanged. However, there were some notable changes in the wording of the press release. The Fed clearly identified fiscal policy (i.e., the actions taken in Washington) as restraining economic growth, but it did not go so far as to say what should be done to alleviate the situation. Another important change: the Fed mentioned the possibility that monetary easing measures could be increased or decreased in order to attain the institution’s inflation rate and unemployment rate objectives. Since it is easy to read what you want into this, the markets seem to have greeted the news with only a hint of enthusiasm.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

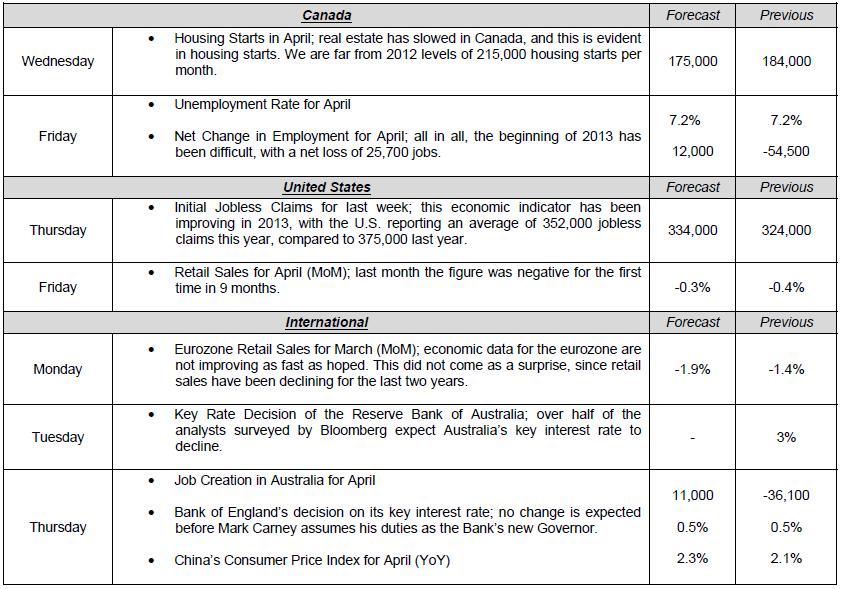

The Data Week Ahead

Published 05/07/2013, 07:08 AM

Updated 05/14/2017, 06:45 AM

The Data Week Ahead

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.