David Einhorn just wrapped up a stellar September that continued to lift his assets, boosting returns to the 24% range.

It comes after a tough year for the stock picker - but in 2019, it has been an Einhorn kind of market.

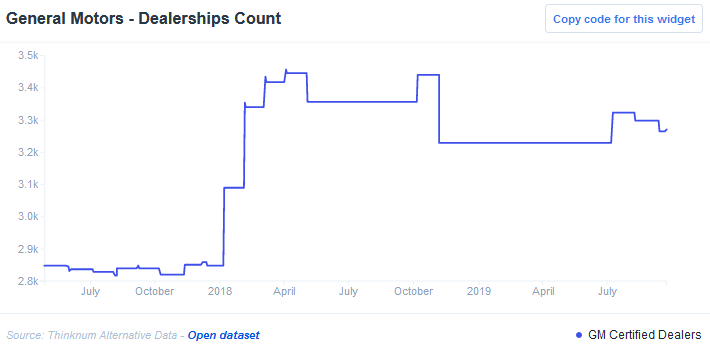

Part of Einhorn's strategy has been buying into value stocks - and General Motors (NYSE:GM), which is up year-to-date, is one such example. We can tell from our first chart that GM has boosted the number of dealerships it runs in the third quarter.

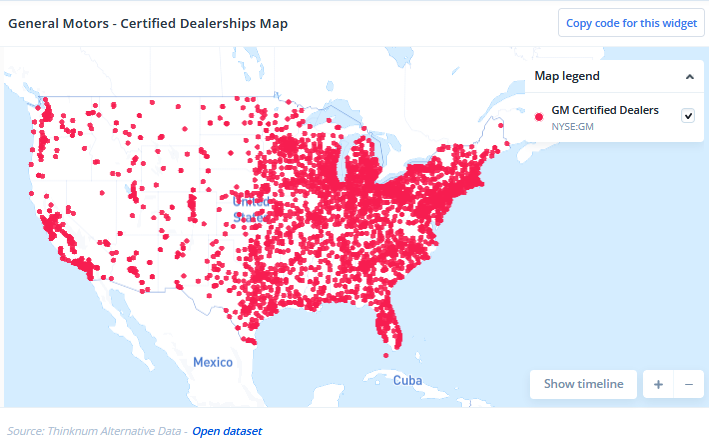

Next up is a map of GM's US presence mapped. You can zoom in on the map, and watch development pver to,e by clicking the 'Play' symbol in the lower-left-hand corner on the slidebar. A separate FT piece, which highlighted Einhorn's fund as a September winner, notes that he has also taken a position in aircraft leasing firm AerCap Holdings NV (NYSE:AER) when he spoke at the annual Sohn Investment event in midtown Manhattan.

Part of Einhorn's successful trading strategy in 2019 required he take on some gutsy calls against market darlings, according to the Bloomberg report - including Amazon.com (NASDAQ:AMZN) and Netflix (NASDAQ:NFLX). And, in September, Einhorn was right on both. His call of Amazon's top was foreshadowed in job posting data - below - and hiring began to dip, right before the stock did - which is in our next chart.

In fact - as October sets in - it seems that the only poor decision Einhorn has made, lately, is that he just can't hop off the New York Mets' bandwagon.

About the Data:

Thinknum tracks companies using information they post online - jobs, social and web traffic, product sales and app ratings - and creates data sets that measure factors like hiring, revenue and foot traffic. Data sets may not be fully comprehensive (they only account for what is available on the web), but they can be used to gauge performance factors like staffing and sales.