- Oil and natural gas prices remain under pressure

- Other commodities, even orange juice, are weak

- Some commodity trends look deflationary, and that's how bond markets see it

- Brazilian real at record lows

- Palladium up, platinum down on Volkswagen (XETRA:VOWG) crisis

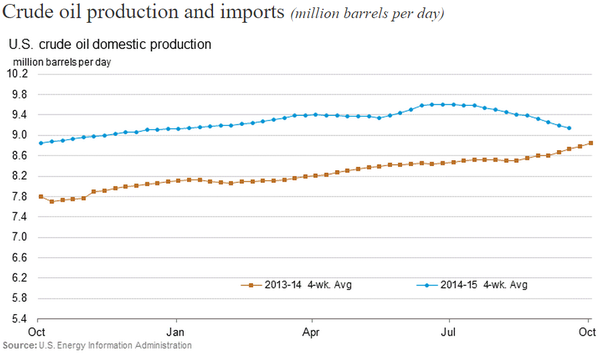

The latest data from the US shows crude inventories lower than expected and production continues to fall.

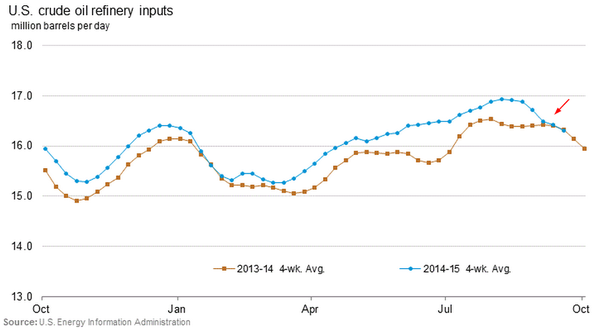

While the above is a bullish sign, US refinery inputs are falling as seasonal maintenance picks up and is expected to take more refinery capacity offline than usual.

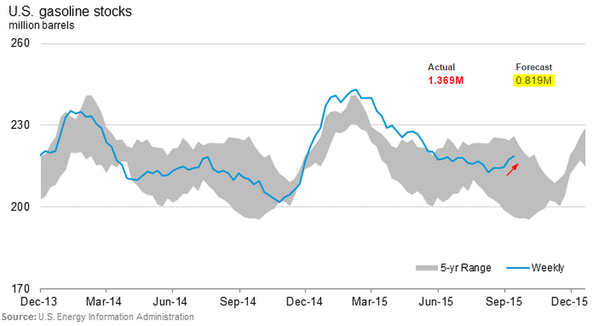

Moreover, the government report showed higher than expected levels of gasoline in storage.

The combination of weaker refinery inputs and higher gasoline inventories sent crude prices lower.

Source: barchart

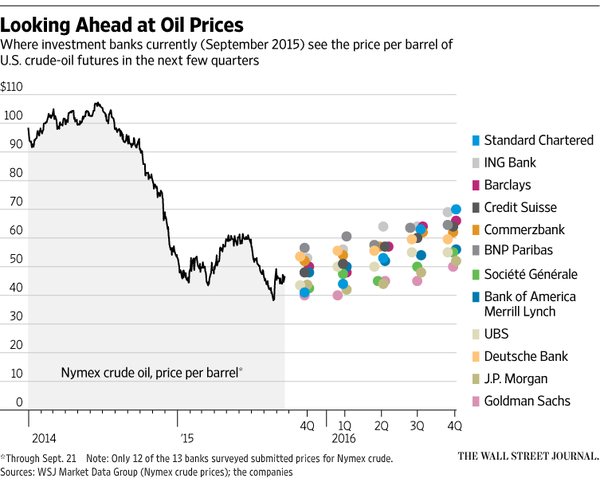

Over the intermediate term, crude oil prices are projected on average to stay below $60/bbl by sell-side analysts.

Source: @georgikantchev, WSJ

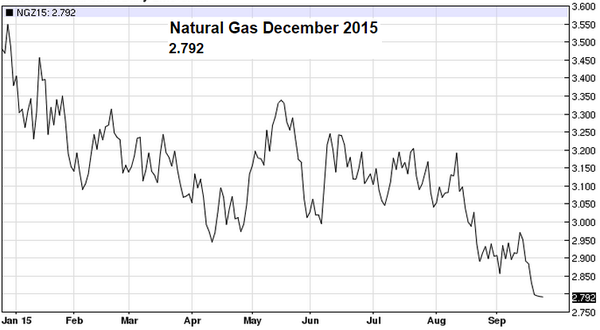

Weakness in energy prices is not limited to crude oil. US natural gas futures are pricing in warmer temperatures this winter (and plenty of supply).

Source: barchart

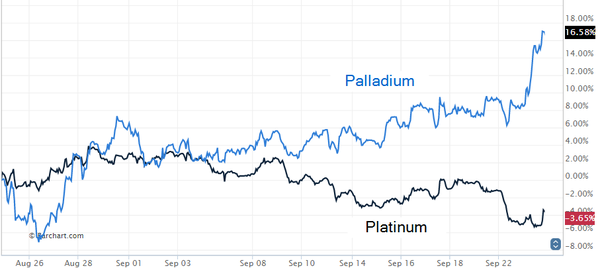

Now let's look at key developments in a number of other commodity markets. First, we have the Volkswagen (XETRA:VOWG_p) contagion into the commodities markets. Platinum is used for diesel engines while palladium for gasoline engines. Since the Volkswagen fiasco will diminish diesel auto production (which is likely to be replaced by competitors' gasoline autos), we have the following divergence.

Source: @SoberLook

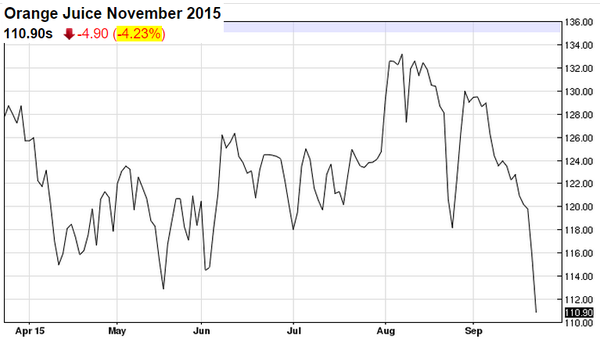

Orange juice futures fell more than 4% on strong Florida crops and a falling Brazilian real. The Dukes are not happy.

Source: barchart

The Duke brothers Randolph (Ralph Bellamy) and Mortimer (Don Ameche), commodity traders in the 1983 American comedy film Trading Places., who commit all their holdings to buying frozen concentrated orange-juice futures.Source: Business Insider

Clearly some of the commodity trends look deflationary. At least that's how the bond markets interpret the situation. US 5-year forward breakeven inflation expectations are at the lowest level since 2010. Will the Fed ignore this in December?

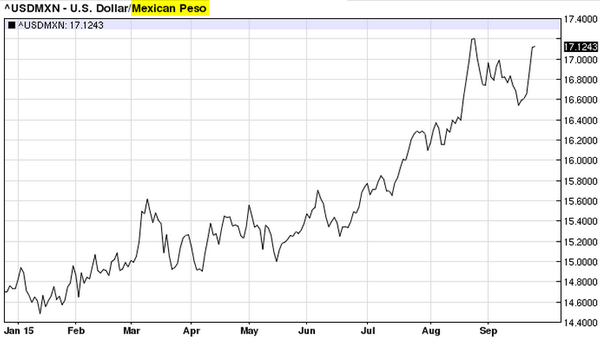

Now let's turn to emerging markets (EM) currencies where in spite of some central-bank interventions, the selloff continues. Mexico's central bank sold dollars to try stabilizing the peso. The intervention was not successful, as the peso again approaches a record low vs. the dollar.

Source: barchart

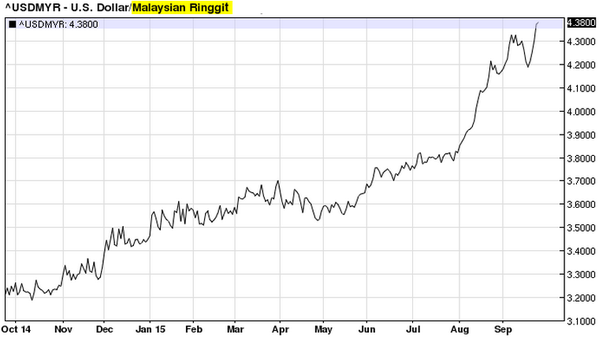

The Malaysian ringgit hit another low as US authorities investigate allegations of corruption involving Prime Minister Najib Razak. Apparently some shell companies were used to buy US properties to move the prime minister's "family money" out of Malaysia.

Source: barchart

Brazil's central bank also intervened in the FX market to prop up the real. Once again there was little success as the currency continued to fall to record lows.

Source: barchart

The overall JPMorgan (NYSE:JPM) EM Currency Index hit fresh lows.

Source: @MetricAdvisors

Related to the above, there were more losses for Brazilian government bonds. Here is the 10-year yield.

Source: @MxSba

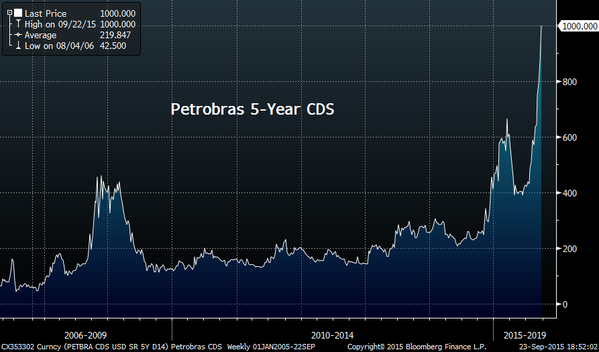

Petrobras 5-year CDS spread hit 1,000 bps as the company's credit trades at distressed levels.

Source: @MktOutperform

China's slowdown is the key cause of the situation in Brazil. It also continues to pressure a number of Asian economies.

Disclosure: Originally published at Saxo Bank TradingFloor.com