I would like to discuss some of the economic data out of the US yesterday. American economic activity has definitely moderated over the last few months and yesterday’s retail sales report, which was worse than the consensus, really spooked market participants – particularly fixed income investors. The world is falling apart …

Jittery investors went on a shopping spree, buying government bonds globally – and setting new records for low yields.

1. The long bond at 2.4%:

2. Canadian 110-Year at 1.52%:

3. Swiss 10-Year below 16bp – the lowest 10 year yield globally:

4. A new low for the 30-Year Gilts:

5. 10-Year Bund yield fell below 43bp – another low:

6. And finally the 10-Year JGB yield fell below 25bp:

Source: Investing.com

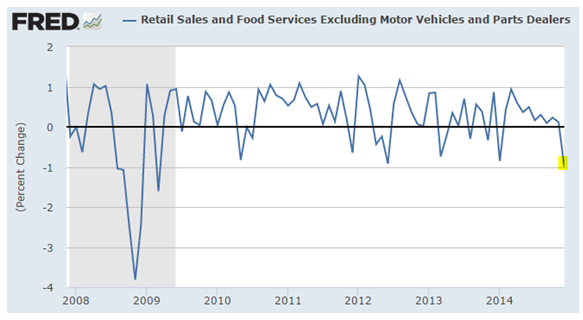

This feels overdone. Let’s take another look at that US retail sales number. We have a couple of factors at play here telling us that retail sales were not nearly as bad as the report suggests.

1. A number of retail outfits started promotions and discounts right after Halloween. The 2014 holiday season was therefore longer, with a portion of sales showing up in November rather than December. The seasonal adjustment applied to December made holiday sales appear worse than they were.

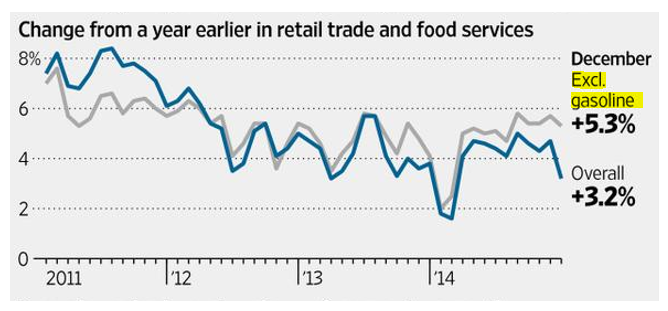

2. With fuel prices collapsing, the proceeds from gasoline sales were considerably lower. Adjusting for gasoline, December retail sales were OK – up 5% from last year.

Source: @NickTimiraos , WSJ

I expect US retail sales to remain decent in the next few months. Americans have more cash from cheaper fuel (and in some cases cheaper food) - and they do not like to sit on cash. China will be a major beneficiary of this by the way.

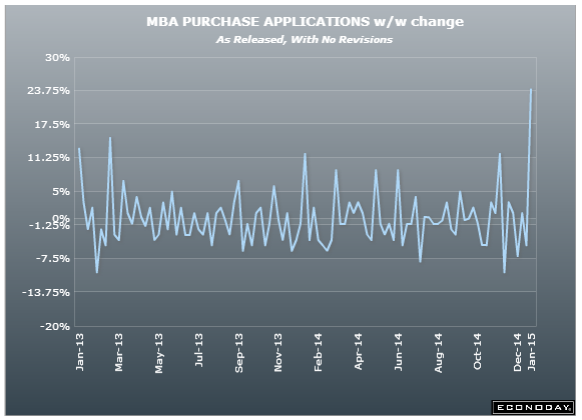

Speaking of strange seasonal adjustments, US mortgage applications for home purchase unexpectedly spiked (as reported by the Mortgage Bankers Association). It’s hard to imagine a sudden fundamental shift taking place in the housing market. My guess is this is another December seasonal adjustment aberration.

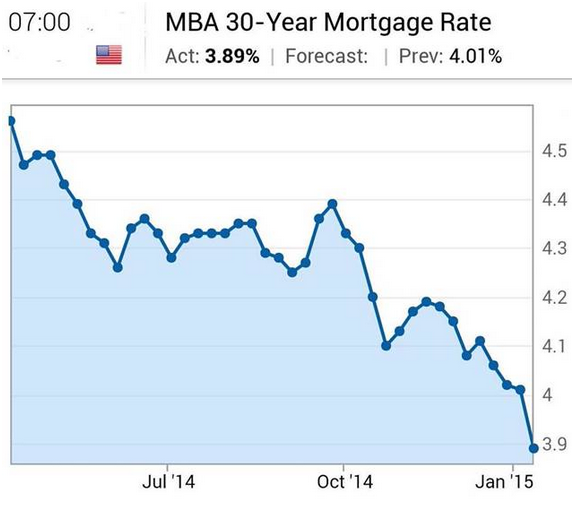

One helpful trend for the US mortgage market is the decline in mortgage rates. It’s not clear how much (if at all) this will help the housing market, but refinancing may pick up again. And that will put extra cash in US households’ pockets (taking us back to better retail sales).

Oil prices stabilized. WTI futures bounced off the lows, as $45/bbl become an entry point for some. This was the biggest one-day jump for WTI since 2012.

Source: barchart

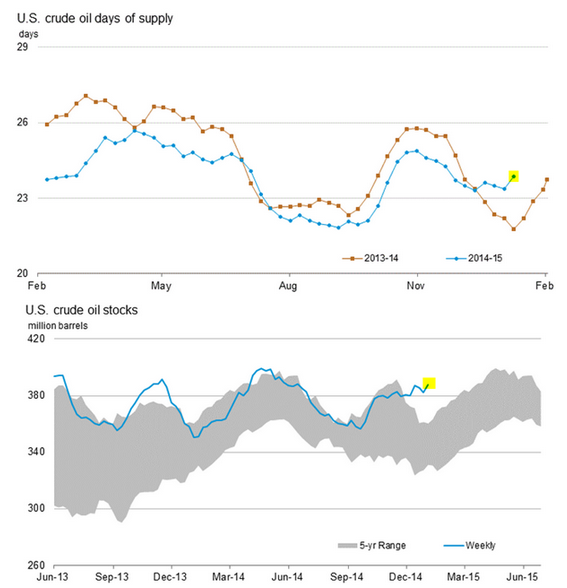

It was a technical rally and crude may come under pressure yet again. US markets are well supplied as US crude oil inventories remain elevated relative to recent years.

Source: EIA

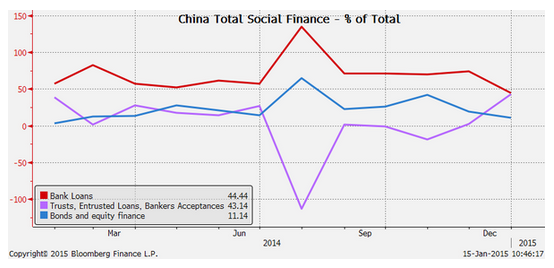

Now we go to China, where the latest lending statistics report shows “shadow banking” on the way to become the dominant source of credit. In general there is nothing wrong with non-bank sources of capital. The issue is increasing corporate leverage - with Beijing having limited capacity to control it.

Source: @TomOrlik

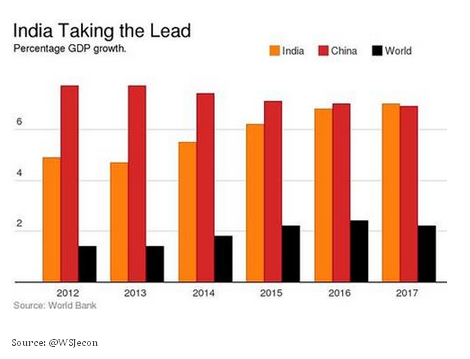

India’s GDP growth is expected to overshoot China’s within a couple of years. Among other reasons, India does not have the labor shortages that China increasingly faces. China’s correcting property markets, tighter government budgets (as land sales slow), and the overleveraged corporate sector will cap growth rates.

Source: @WSJecon

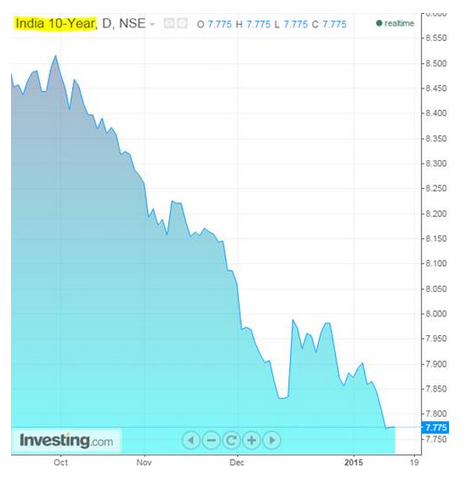

India on the other hand is helped by the relative stability of the rupee (in part due to Raghuram Rajan’s efforts), lower food and energy prices, and declining interest rates (something I discussed a few months back).

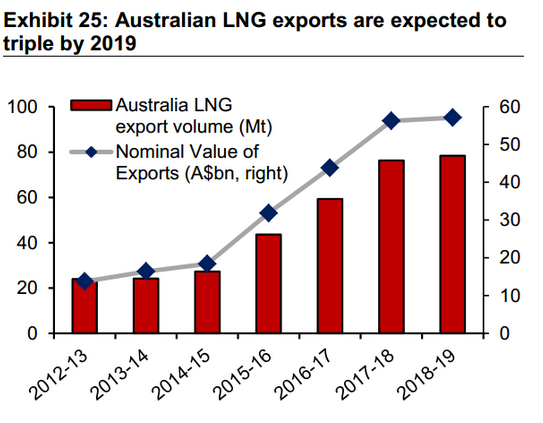

Japan and other Asian countries will soon be benefitting from cheap(er) natural gas, as LNG (liquefied natural gas) production in the region ramps up. Australia will be a particularly large supplier.

Source: @NickatFP

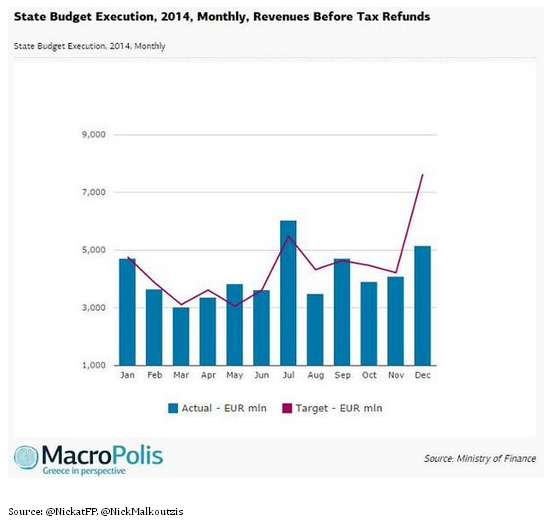

In Europe, troubles for Greece seem to have no end. The latest budget figures suggest that Greece missed its revenue target. This is something the new government will be dealing with shortly – and come into play in (re)negotiations with the troika.

Source: @NickatFP, @NickMalkoutzis

FT: - After weeks of negotiation Greece is still at odds with its creditors over key conditions for unlocking a €7bn aid payment and securing a precautionary EU loan arrangement that would ease the country’s return to borrowing on international capital markets.

Also in the Eurozone, the ECB is now one step closer to QE with the legal hurdles (almost) cleared.

Reuters: - The European Court of Justice is giving QE a helping hand. Its advocate general has blessed the principle of ECB government bond-buying, with few conditions attached. That provides cover for the central bank’s quantitative easing plans – and will do little to soothe German opposition to the ECB’s policies.

As I discussed a few days back, one way to address German concerns will be to leave some (or all) of the bond-buying risk within the national central banks (NCBs) – carving it out from the ECB. An ugly solution, but doable.

Now some food for thought – a quick look at US job creation. There is a general perception that jobs created in the United States are low-wage retail jobs. Indeed food services, retail, and temp jobs have been some of the largest growth areas since 2009.

Source: @FactTank

But we are not in the 2010-11 period anymore. The jobs created last year have been considerably better paying