We begin with Greece where the markets are now pricing in a substantial probability of sovereign default (and potentially Grexit). The Greek banking system is losing deposits while the fiscal situation is deteriorating rapidly. Yet a compromise with the Eurogroup remains elusive. Both parties are prepared to take this crisis to the brink.

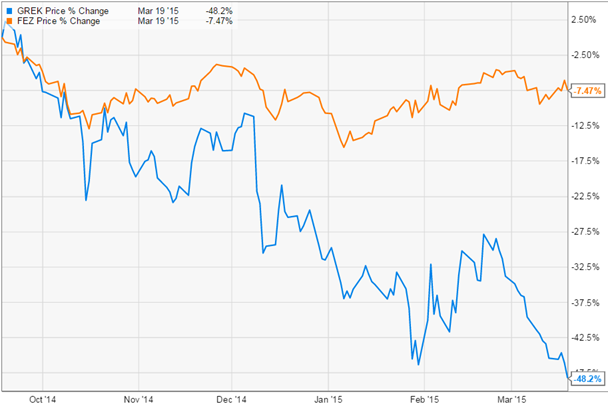

The Greek equity markets are under pressure -- particularly the banks. Here is the relative performance of Greece market ETF (NYSE:GREK) vs. Western Europe ETF SPDR DJ Euro STOXX 50 (NYSE:FEZ) :

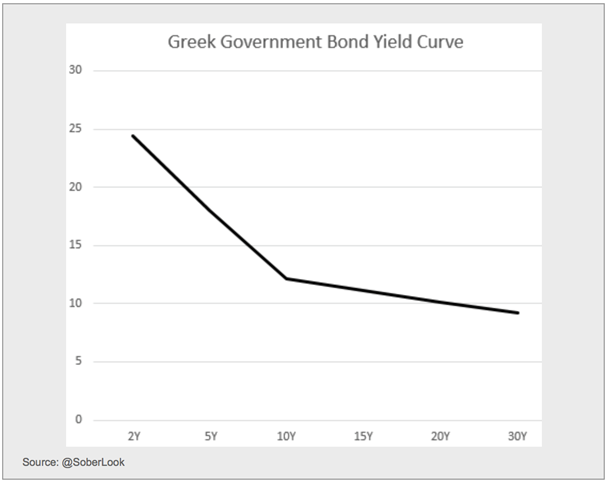

But it's the bond markets that are flashing red. The Greece 10-Year yield broke through 12%.

And the 2-Year yield is approaching 25%.

The yield curve has inverted further and now resembles what we often see in distressed corporate credits.

A similar story is developing in the credit default swap market, where the 1-year CDS spread has gone vertical.

As discussed yesterday, while the Eurozone has been able to find some last-minute solution for each crisis, I don't have a good feeling about this one. And neither do the markets. I'll have further discussion on the potential consequences of Grexit on the Eurozone's economy at a later date.

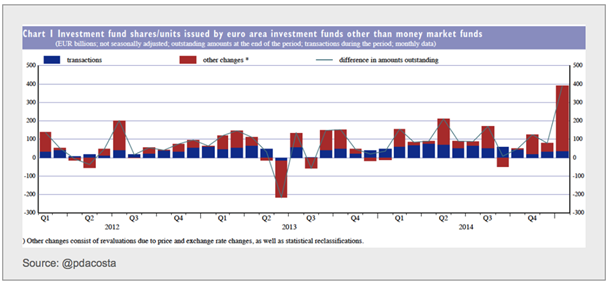

Investors however continue to ignore the warning signs from Greece, as the euro area investment funds share/unit count spikes.

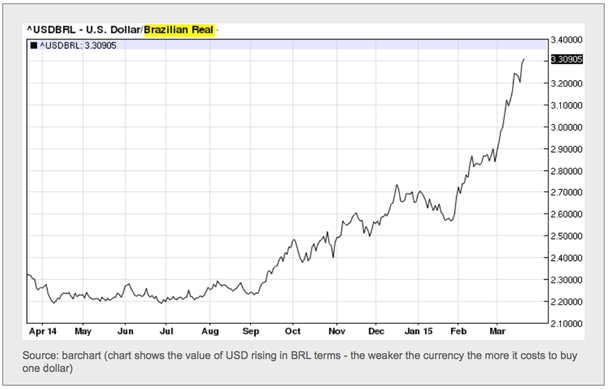

In spite of a more dovish stance from the Fed and a pause in the US dollar rally, the Brazilian real continues to deteriorate.

The nation's investment has been declining and consumption growth has stalled.

As I discussed before, this weakness in the real is spilling over into commodities markets.

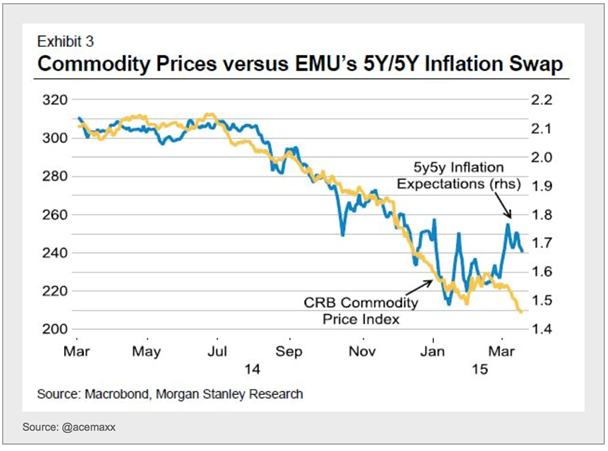

Since we are on the topic of commodities, Morgan Stanley (NYSE:MS) is pointing out that commodities have decoupled from inflation expectations.

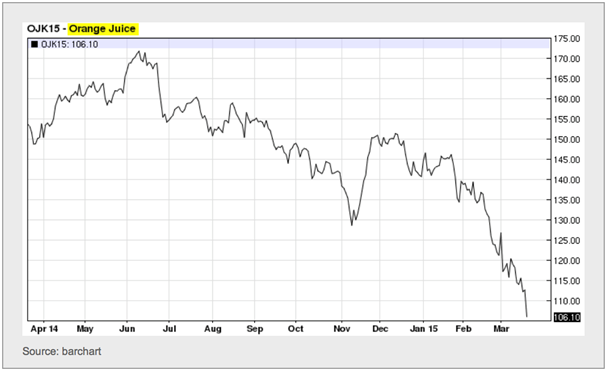

Even with less pressure from the Fed, commodities remain depressed - often for different reasons. We saw the impact Brazil is having on some products. We also have US pork prices collapsing as the West Coast port shutdown limits exports to Asia, oversupplying domestic markets. Combine this "bacon deflation" with lower sugar, coffee and orange juice prices and your breakfast is getting cheaper by the day.

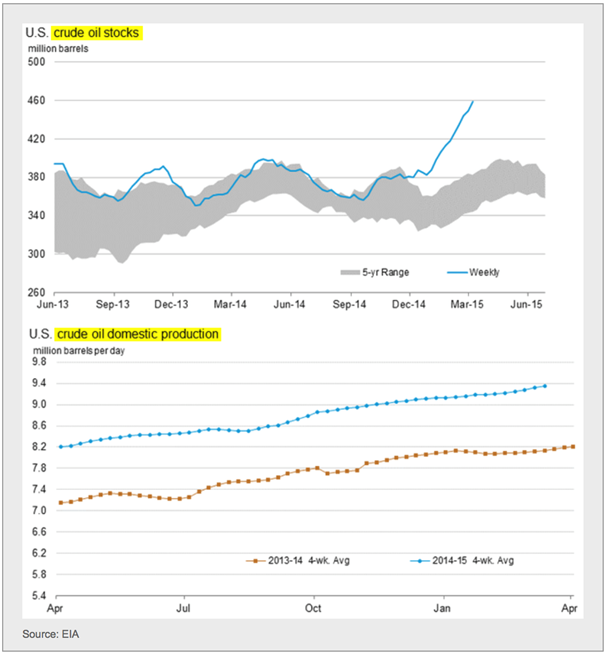

Shifting to energy, both US crude oil in storage and domestic crude production continue to rise. Something's got to give -- either production slows or we run out of storage (projected to happen this summer).

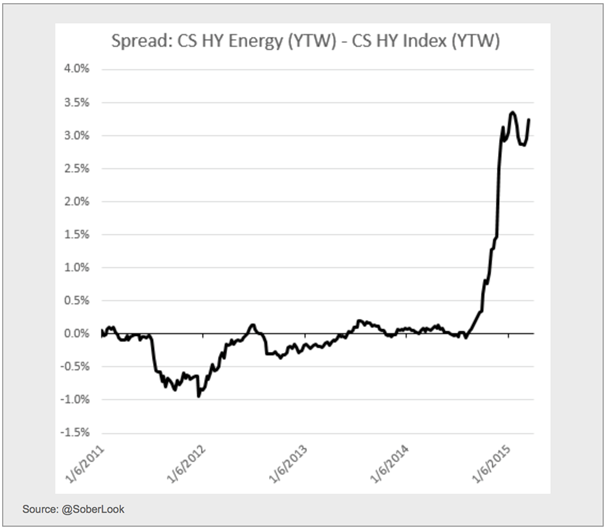

This oversupply (and the resulting price weakness) is the reason for energy credit remaining under pressure. US high yield energy names continue to trade at multi-decade wides to the rest of the Credit Suisse (SIX:CSGN) HY index.

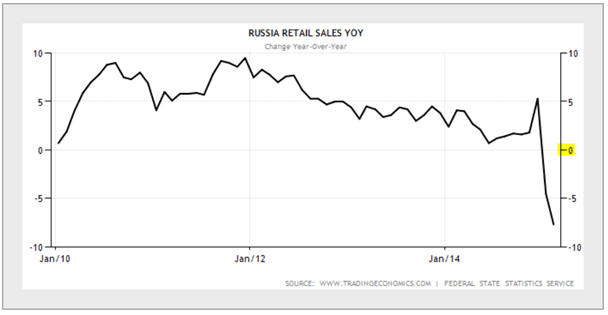

This situation in the oil markets puts more pressure on the Russian economy. With inflation on the rise, retail sales have deteriorated sharply.

Now a couple of notes on the US corporate sector:

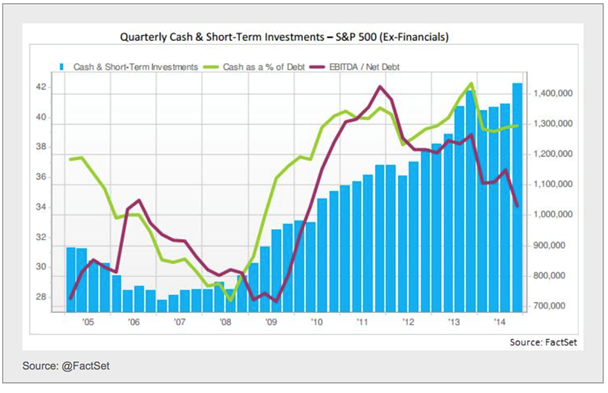

1. Cash balances at large firms hits a new record. Leverage has risen as well.

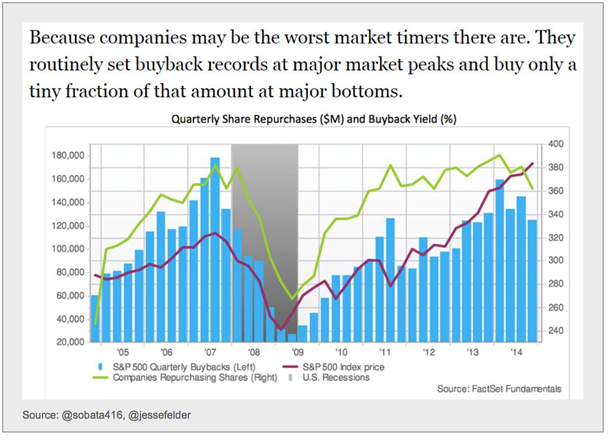

2. US companies are absolutely terrible at timing their stock purchases.

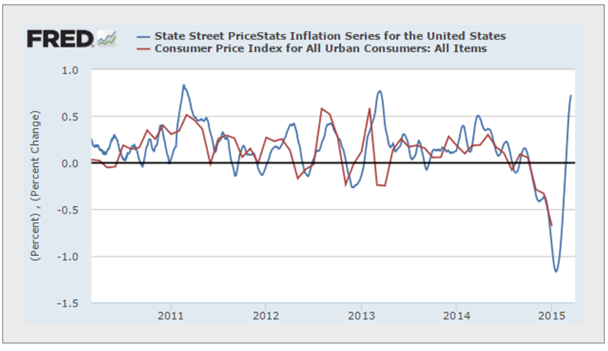

Finally, are online prices (PriceStats) forecasting a rebound in inflation? Prices posted by online merchants seem to show significant improvements.

Now some food for thought:

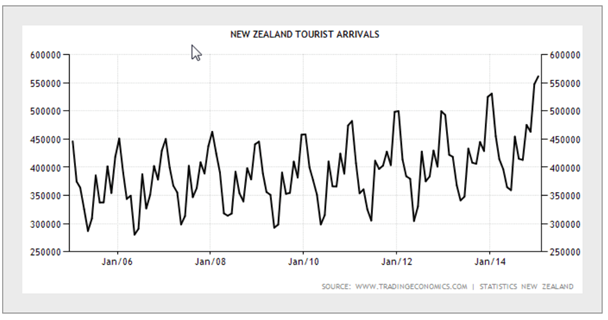

1. New Zealand Tourism hits new highs.

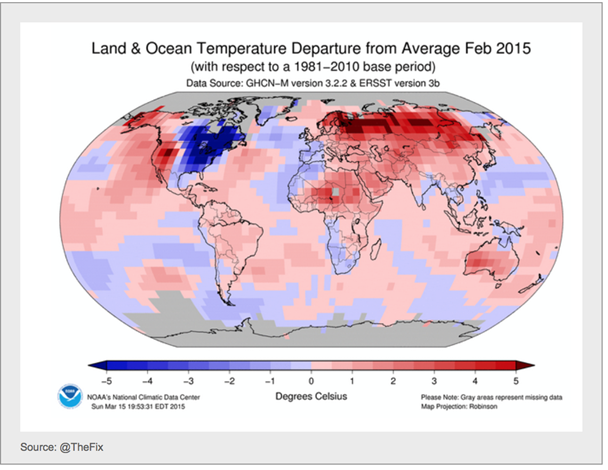

2. This has been the warmest winter ever, except...

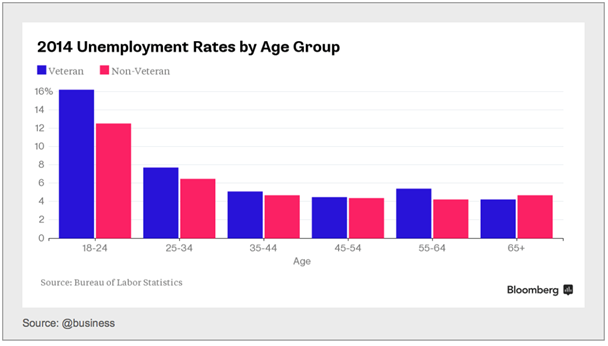

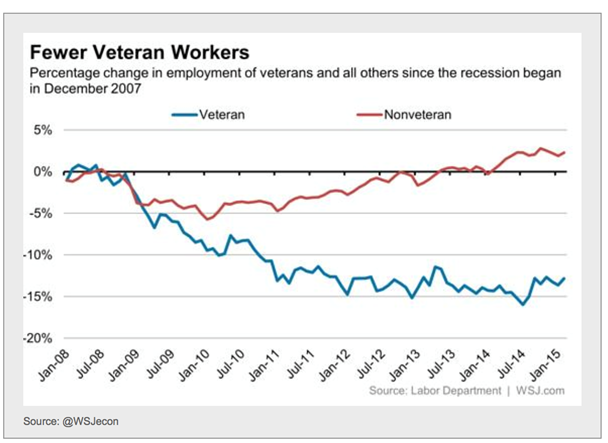

3. The employment situation for US veterans remains terrible.

And it seems to be the Millennial military veterans who are having the toughest time.