Gold rebounded to a new high for the week in overseas trading, buoyed by expectations that the Fed won’t be raising rates any time soon and interest from Asian buyers who are returning from the long Lunar New Year holiday. While the yellow metal softened after a round of mixed U.S. economic data, the short-term bias remains to the upside.

Fed chair Yellen reassured investors in testimony before Congress earlier in the week that the central bank would remain patient with regard to any potential tightening of monetary policy. Nonetheless, the dollar remains firm, with the dollar index setting new 4-week highs today. While this may be limiting the upside for gold somewhat, dollar strength has not really been pushing gold lower lately.

Part of this has to do with foreign demand for U.S. Treasuries, where you can still get a positive yield, albeit a small one. Let’s use the recent U.S. 5-Year note auction to illustrate the point: The U.S. 5-year yield is presently 1.51%. By comparison, the Japanese 5-year JGB yield is 0.09% and the German 5-year Bund yield is -0.1%.

Indirect bidders (a proxy for investments made by foreign investors) took up 60.1% of yesterday’s $35 bln 5-year auction. That’s the 4th highest indirect bid on record. It is reflective of the reality, that while 1.51% on 5-year money is pretty lame, it’s a far-sight better than 0.09% or -0.1%. These foreign investors need dollars to buy these relatively high yielding U.S. securities.

The Fed hasn’t raised rates in nearly a decade, but the mere hint that they might at some point this year has caused the dollar to rally more than 20% since May of last year. Certainly, the fact that other major central banks continue to cut rates and launch additional extraordinary accommodations have played a significant role in the dollar’s rise as well.

Earlier this week, Jim Grant of Grant’s Interest Rate Observer warned that the “virus of radical monetary policy is now coursing through the political bloodstream. There’s no going back, at least not for the medium term.”

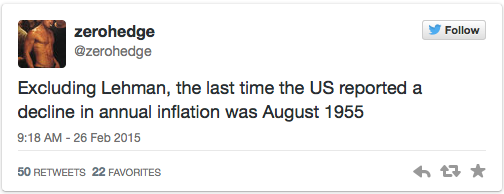

U.S. CPI fell 0.7% in January, pushing the annualized rate into negative territory for the first time since 2009.

That’s pretty remarkable when you think about it. Nearly 10 years of falling and near-zero interest rates, not to mention trillions of dollars worth of bailouts, QE and other extraordinary measures and deflation is the biggest threat right now. One might view this as a rather ominous harbinger.

The BLS blames the deflation on plummeting gas prices, and the Fed maintains the effects will be “transitory.” However, if negative price risks persist, the Fed is going to find it very difficult to justify hiking rates.

The policy trend elsewhere in the world, which is being driven largely by concerns over deflationary pressures, is going to be a hard one to buck. I continue to think that the most hawkish stance we can expect from the Fed this year is that they hold steady.