Pre-market update:

- Asian markets traded 0.7% higher.

- European markets are trading 0.6% higher.

- US futures are trading 0.1% higher ahead of the market open.

Economic reports due out (all times are eastern): MBA Purchase Applications (7), Housing Starts (8:30), EIA Petroleum Status Report (10:30), FOMC Meeting Announcement (2), FOMC Forcecasts (2), Chairman Press Conference (2:30)

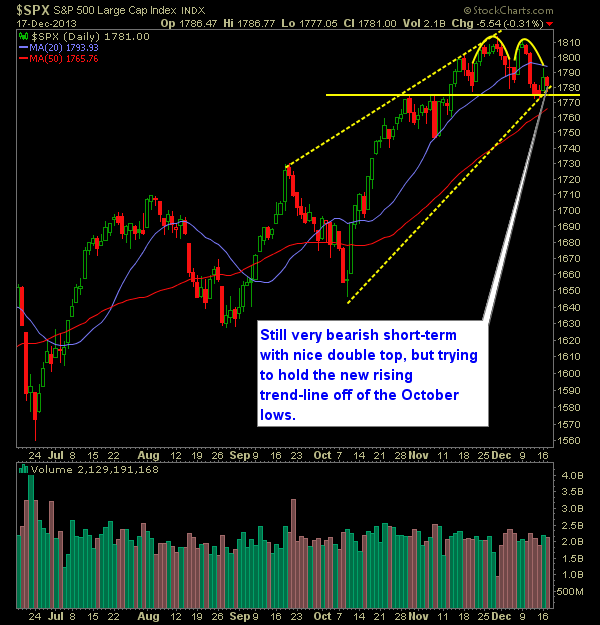

Technical Outlook (SPX):

- SPX managed to sell-off yesterday at double top neckline/confirmation level.

- Today is FOMC day which means, come 2pm, volatility will rapidly increase.

- 10 & 20 day moving averages continuing to create resistance for price action.

- The difficulty with bearish price patterns in today's market is that they are often negated by an extremely favorable (translated bullish) Fed that can trump price patterns at will.

- The key price level to watch heading into the FOMC today is 1772. If it breaks, there is legitimate reason to become much more bearish.

- Remember that once the FOMC Statement is released you will likely see a series of reverses in price action. Never fall for the first price move. Instead it is usually the third move in price action that defines the real move in reaction to the FOMC Statement.

- VIX has risen unrelentingly for six straight days - currently at 16.21.

- Watch 1767 which is the 50-day moving average. Price hasn't dipped below it since October lows.

- Some resistance overhead for the bulls between 1800 and 1808.

- We remain in oversold territory.

- Markets don't care about the economy nor earnings. That is not what is driving them. The markets only care about what the Fed is doing to keep equities propped up.

My Opinions & Trades:

- Added two new positions yesterday, including FCS at $12.89.

- Closed out two struggling positions: BIDU at $168.44 for a 1.4% loss and AGCO at $57.58 for a 2.8% loss

- Will likely remain on the sidelines and avoid any new positions until the FOMC announcements are finished.

- Long 70% / Cash 30%

Chart for SPX: