It's often like this prior to market-moving events. Prices keep trading in a narrow consolidation, dropping subtle clues here and there. The context remains though, and coupled with the preceding price action, it allows to us to see the market tipping its hand. So, how have we prepared for what's to come?

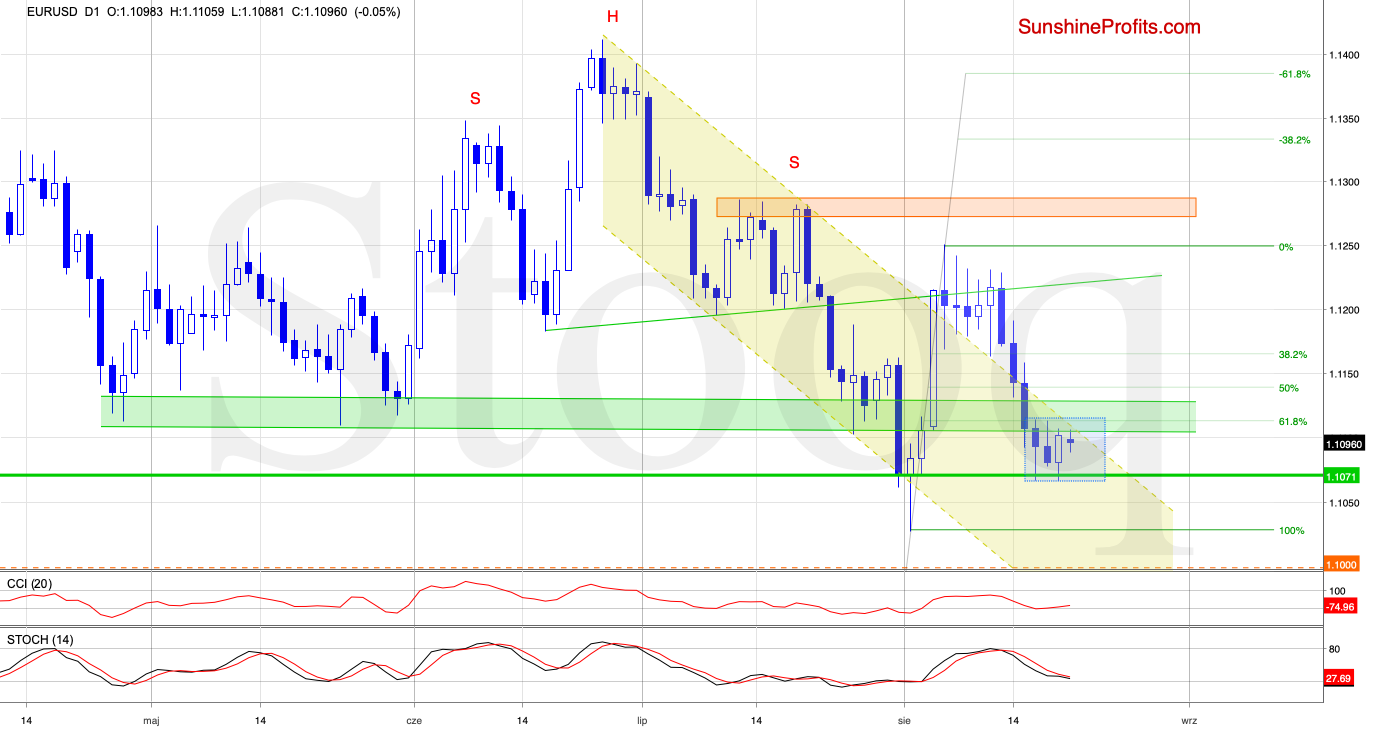

EUR/USD - Consolidation About to End Soon?

Although EUR/USD moved a bit higher yesterday, the overall short term situation hasn't changed much. The exchange rate is still trading sideways inside the blue consolidation between the green horizontal support line and the green zone based on the April and May lows, which together serve as the nearest resistance.

Meanwhile, the CCI generated its buy signal, while the Stochastic Oscillator is very close to doing the same. These suggest that an upside move may be just around the corner. Nevertheless, as long as there is no breakout above the upper border of the consolidation, or a breakdown below its lower border, higher, or respectively lower values of EUR/USD are not likely to be seen. Short-lived moves in either direction should not surprise us.

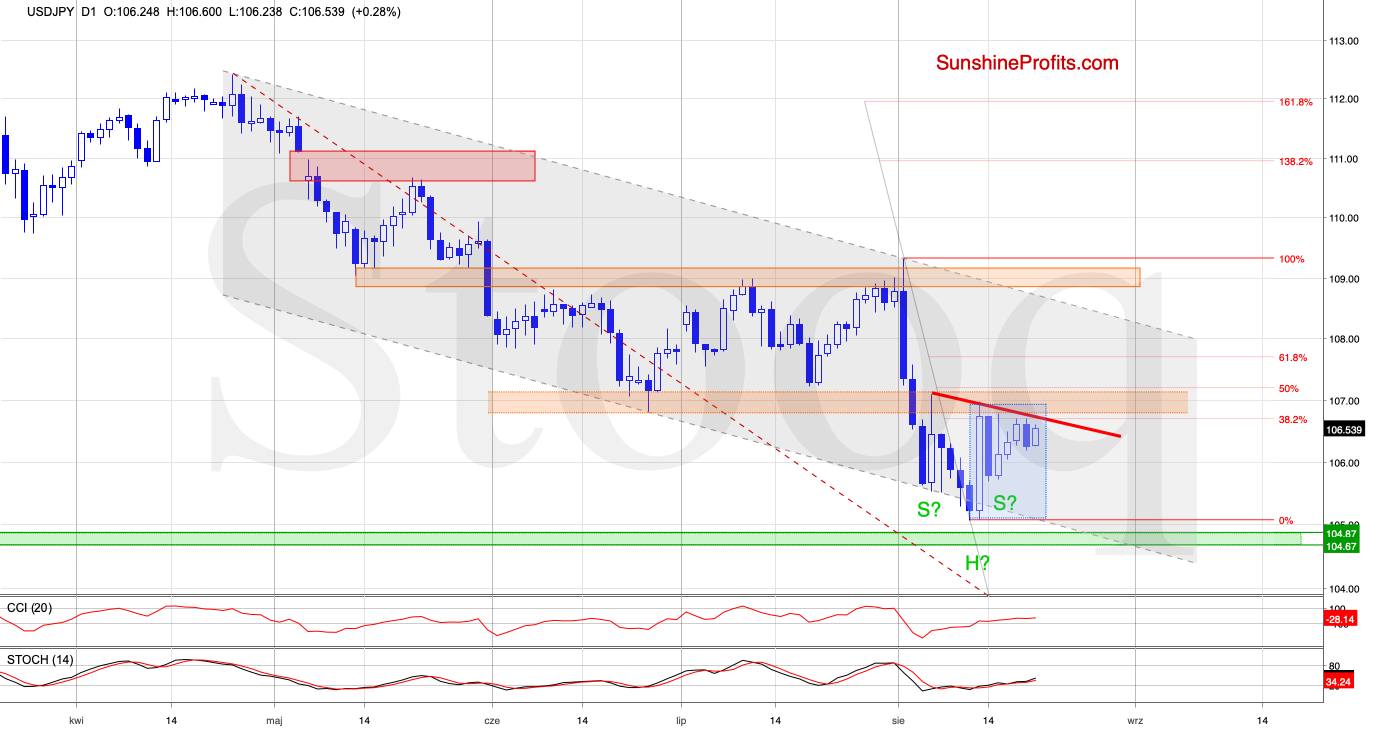

USD/JPY - Where Are the Bulls?

The overall situation in USD/JPY also remains almost unchanged as the exchange rate continues to trade inside the blue consolidation, slightly below the declining red resistance line and the orange resistance zone. Let's quote our Monday's words - they are up-to-date also today:

(...) Earlier today, we saw another upswing. It suggests that we'll see a test of the red declining resistance line based on the previous peaks soon. This resistance could be a neckline of a potential reverse head and shoulder formation - successful breakout both above the neckline and the above-mentioned orange resistance zone could open the way to the north.

Additionally, the current position of the daily indicators suggests that the bulls are likely to see them flash buy signals in the very near future. This increases the probability of an upward move in the coming days. Should we see USD/JPY breaking above these mentioned resistances, we'll consider opening long positions.

But as long as there is no breakout above the orange resistance zone, a bigger move to the upside is not likely to be seen.

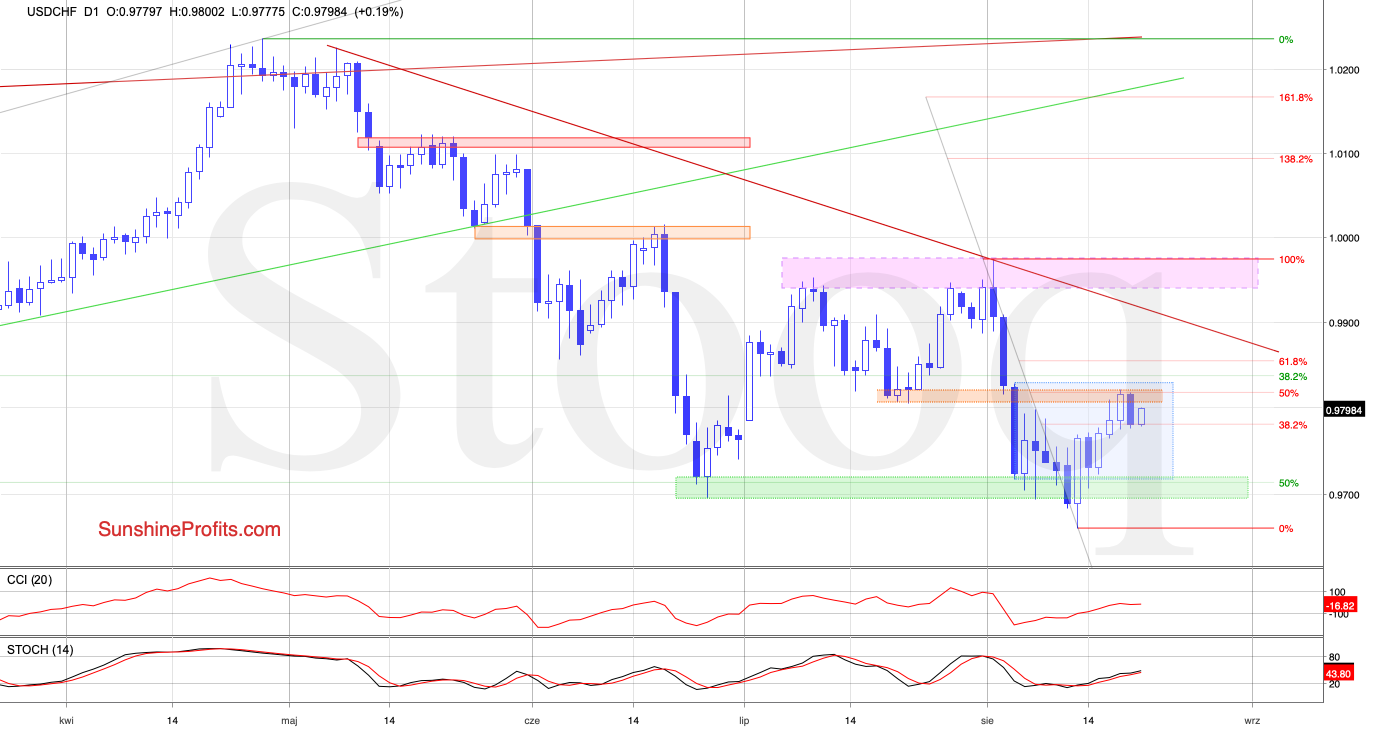

USD/CHF - Bulls, Please Step Forward

Neither in the case of USD/CHF have we seen any important development that would change its short-term picture. Let's turn to our Monday's observations once again:

(...) The exchange rate is still trading inside the blue consolidation between the green support zone and the orange resistance area reinforced by the 50% Fibonacci retracement.

As long as there is no breakout above these nearest resistances, another bigger move is questionable - but should we see bulls' strength and such a breakout, we'll consider going long.

Summing up the Alert, no euro upswing has materialized so far, and the common currency is trading inside its recent consolidation. There have been no signs of the USD/JPY and USD/CHF bulls' strength and a break above their respective resistances that would justify possible long positions. GBP/USD hasn't made a decisive move either that would justify opening new positions. Apart from these, there're no other opportunities worth acting upon in the currencies.