The Euro Zone debt crisis has certainly kept the credit rating agencies busy in the news headline. On Friday, 16 Dec. Moody's downgraded Belgium's credit rating by two notches to Aa3 with a negative outlook, citing concerns over soaring borrowing costs, economic growth as well as the health of Belgium's banking sector after the demise of Dexia.

Fitch Ratings also lowered France’s credit outlook and put Spain and Italy, alongside Ireland, Belgium, Slovenia and Cyprus, on downgrade review, citing Europe’s failure to find a “comprehensive solution” to the debt crisis. S&P already on 5 Dec. placed the ratings of 15 euro nations on review for possible downgrade, including six AAA rated countries Moody’s also noted on 12 Dec. that it will review the ratings of all euro countries in the first quarter of 2012.

All these downgrades and rating warnings are not only putting further pressure on the debt crisis now going on for 2+ year, but is also sharpening the picture of a possible breakup of the Euro Zone.

MarketWatch reported that the latest monthly survey of about 200 major institutional investors with about $600 billion under management.by Merrill Lynch/Bank of America Securities revealed that nearly half of all institutional money managers now fear a partial break-up of the euro zone. Investment houses like Merrill Lynch and Barclays Capital have in recent weeks issued various reports discussing that very scenario as “The euro zone financial crisis has entered a far more dangerous phase,” lamented analysts at Nomura.

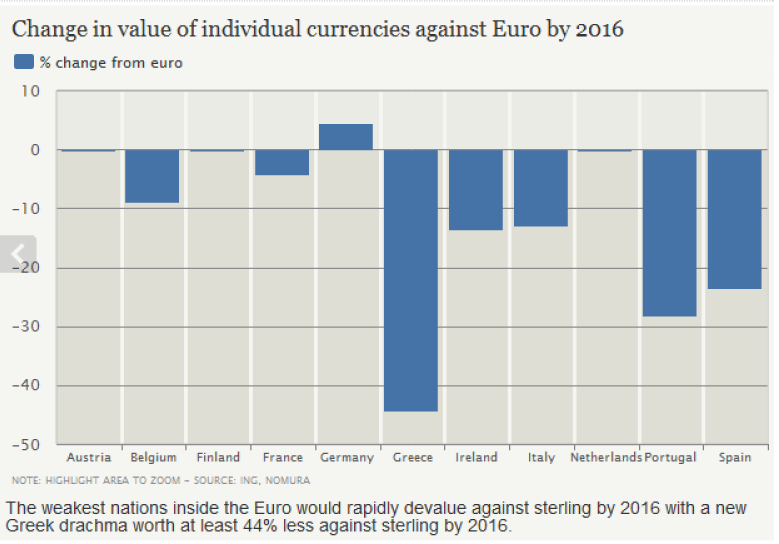

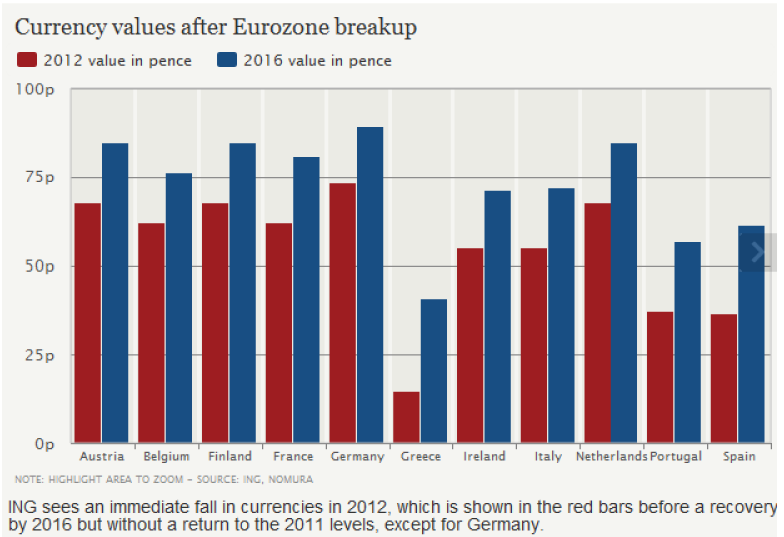

The Telegraph published a graphic depiction of the effects on European exchange rates of a Euro break-up forecast by ING that sees an immediate fall in individual currencies in 2012. (See Charts Below).

From the Telegraph:

"ING predicts that most of the new currencies will not reach Euro

exchange rates, except for Germany which would see its currency

appreciate by four per cent.

The weakest nations inside the Eurozone would rapidly devalue

against sterling by 2016, with a new Greek drachma worth at least

44 per cent less against sterling by 2016, the Portugese escudo

worth 28 per cent less and the Spanish peseta worth nearly 24 per

cent less.

.... In the Eurozone ING sees GDP output falls ranging from seven

per cent in Germany to 13 per cent in Greece."

Their studies collated the relative worth of potential new currencies five years after a theoretical collapse of the Euro in 2011. ING's forecast for 2012 based on their assumption of a dollar to sterling rate of 1.42. For 2016 the chart shows the average of their forecasts, converted to ING's guess of a dollar to sterling rate of 1.5.

The Telegraph also cited that both ING and Nomura there would be enormous uncertainty after a Euro collapse, with currencies liable to overshoot and be subject to high volatility.

Our thought is that the highly indebted peripherals including the GIIPS would most likely benefit the most from having their own currencies to devalue out of debt, while making their goods and services more attractive to help with GDP growth.

However, Germany would end up with a much stronger currency. That means a double whammy for the Germans--losing the export advantage of the weaker Euro, but also the purchasing power of its neighboring countries that would not otherwise be able to afford German goods without the stronger Euro. There's a reason Chancellor Angela Merkel of Germany has rebuked Euro breakup talk with this pointed remark - "It’s never going to happen."

On the other hand, since Germany is footing a lot of the bills of the Euro Zone bailouts, as well as suffering from the contagion effect on its bond yield and sovereign credit rating, there could be a balance point of cost vs. benefit where it is better off to cut all losses. But that is a very remote tipping moment that would not take place for at least another 18 months. We see the emerging and increasing likely scenario is that the Euro would survive, but one or more of the Euro weaker sisters could end up leaving the currency union to mend their own fiscal houses.

Amid the high uncertainty, right now according to MarketWatch, money managers are holding a lot of cash — an average balance of 4.9% of their assets. It goes without saying European and British stocks are the less popular investment options. Some brave contrarian investors might bet the other way as some European stocks and banks such as Citigroup and Bank of America are trading at less than half and a third of their respective book values. But most iinvestors are heavily underweight bank stocks, Japanese stocks and low-yielding bonds are also out of favor.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Currency Collapse After A Euro Breakup

ByEconmatters

AuthorEconMatters

Published 12/18/2011, 05:40 AM

Updated 05/14/2017, 06:45 AM

The Currency Collapse After A Euro Breakup

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.