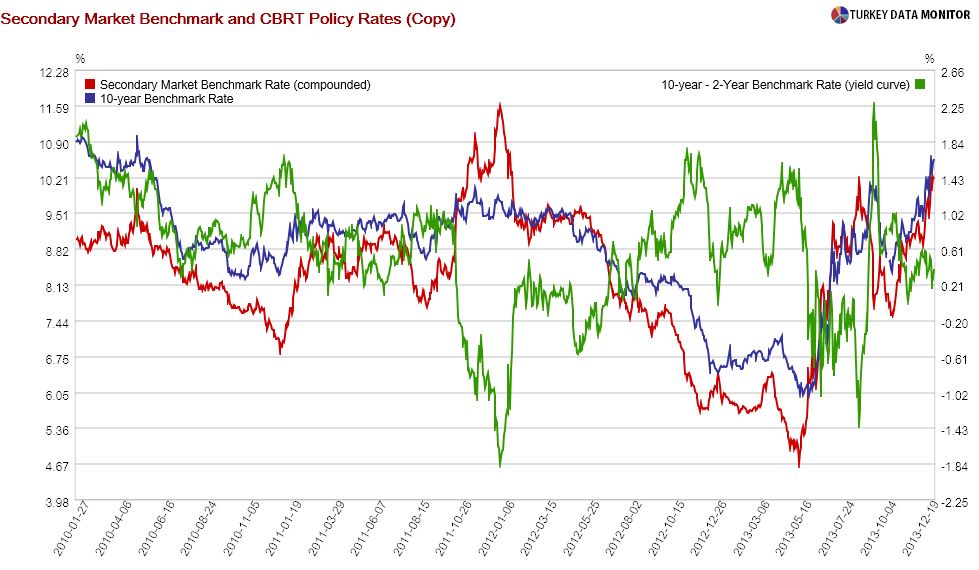

The Turkish yield curve inverted yesterday (January 6), with the yield on the 10-year government bond falling below the benchmark two-yield. What did this mean? And more importantly, what does it imply?

The most general explanation for yield curve inversion is that there are short-term risks to the economy, whereas economic fundamentals are sound in the long-run. But nothing particular that would change long versus short-term perceptions happened yesterday in Turkey.

Another explanation is monetary policy. In the U.S. (and other developed countries), the yield curve inverts when bond investors expect short-term interest rates to fall. The mechanics are similar in Turkey, but it’s the two-year benchmark that responds most to monetary policy. So if markets are expecting a rate hike, the benchmark yield could rise, causing the yield curve to invert.

Before going further, let’s do some simple math: The yield curve could invert if short-term rates are rising more than long-term rates, or if long-term rates falling more than short-term rates. Let’s have a look at two earlier episodes of yield inversion in detail:

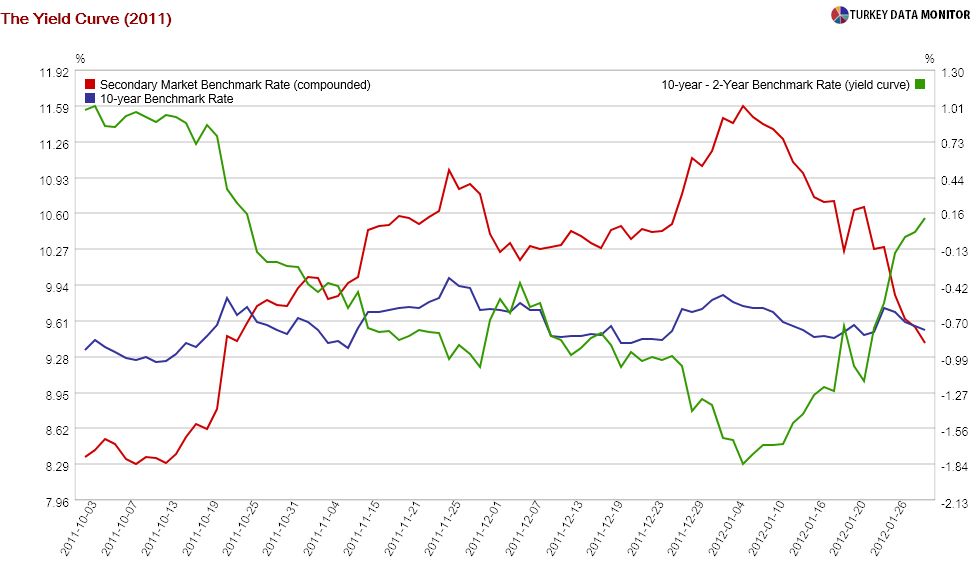

The first episode started in October 2011, when the Central Bank had to do substantial rate hike, and continued until early-2012, during which time the lira was under pressure. The benchmark rose substantially, whereas the 10-year was quite well-behaved.

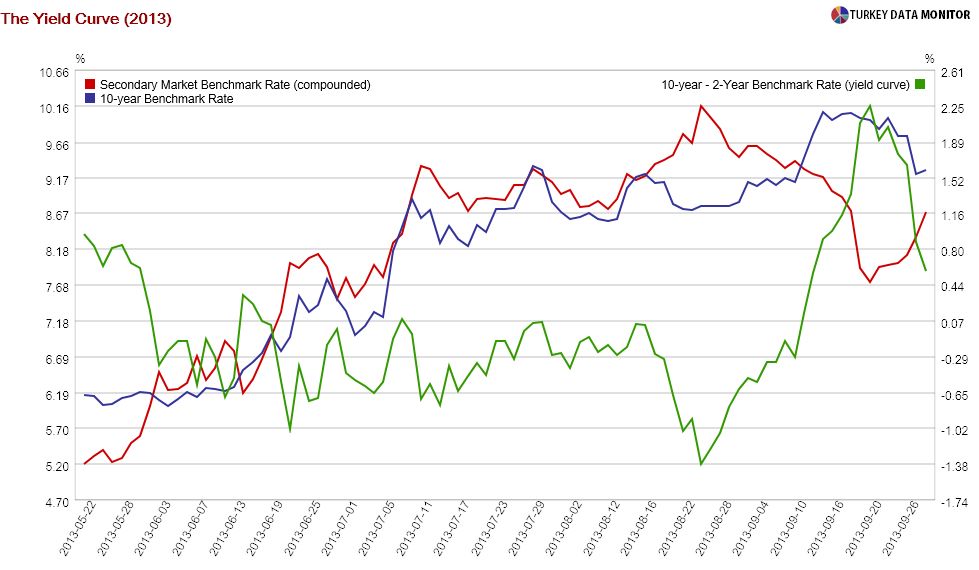

The second episode started with Bernanke’s famous tapering remarks and the Gezi protests and pretty much continued throughout the summer. In contrast to end-2011, both the 2 and 10-year surged, obviously the former much more.

Yesterday was different from both in the sense that while the benchmark surged to 10.46%, the 10-year retreated to 10.36% (before things got back to normal), which suggests two things: 1. There was indeed some interest rate expectations play going on. 2. Money was moving out of 2-year into 10-year instead of out of Turkish bonds altogether.

So the billion dollar question is whether they will hike rates at their meeting on January 21. They should, for the inflation if not lira outlook (although the two are related), as I argue in my latest Hurriyet Daily News column, which I posted here at the blog as well. But that doesn’t mean they will.

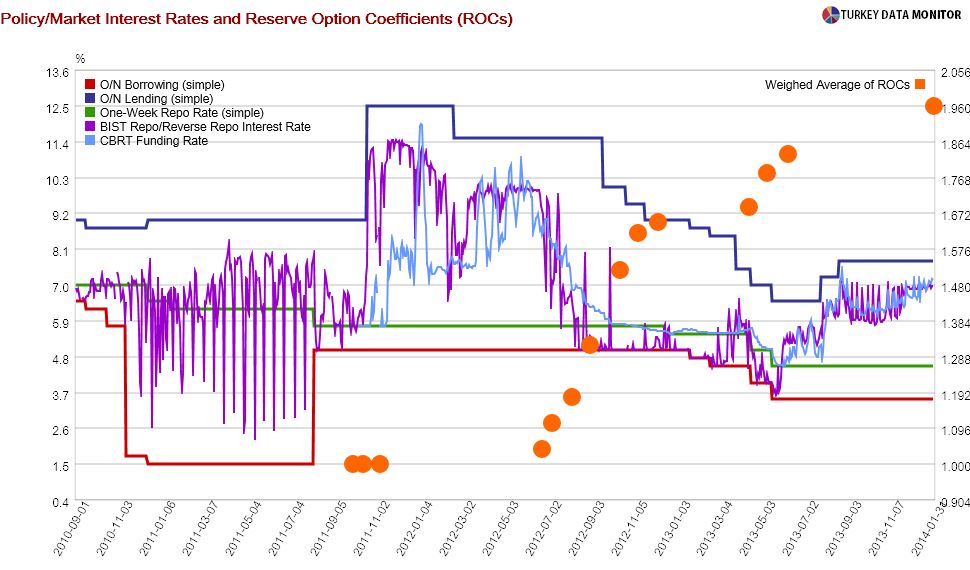

The Central Bank has clearly signaled it will try other methods before hiking rates: For example, it has already committed to selling $100 million of FX every month, $3 billion total, but it could increase that amount if need be even though at less than $40 billion the Bank’s reserves are dangerously low.

FX supply will also rise (hopefully, but banks have not released their FX reserves until not, which was the whole point of the mechanism- that’s why the Central Bank decided to raise the coefficients, to make it more expensive to use FX reserves instead of regular reserves and force them to release some FX) in the second half of the month, as the new reserve option coefficients come into effect. Finally, the Bank could bring market rates closet to its lending rate of 7.75 percent before attempting to increase the lending rate further.

Perhaps most importantly, speaking at penguin news channel CNNTurk today, Finance Minister Mehmet “Nominal” Simsek said that “recent meaures were taken to alleviate the need for rate hikes”. I know it is not normal for a government official to be discussing monetary policy in a country where the Central Bank is independent, but this is Turkey. In any case, he left no doubt that unless Turkish markets fall into turmoil in the next two weeks, there won’t be any rate hikes.

Note that, in their note on the latest inflation figures (Turkish version released on January 6, English version 7), the Bank painted a favorable inflation picture. It doesn’t matter if this picture is right or wrong (it is wrong!); the Bank is paving way for the no-rate-hike in the January meeting.

How about the rest of the year? Let’s first look at what markets think: As Deutsche economists note, “the spread between the 1Y cross currency swap (at 9.15% at the time of writing) and the average funding rate (at 7.17% at the time of writing) implies that around 200bps of CBT hikes are priced into the front end of the curve.”

Incidentally, that’s what I am expecting as well. I expect 100bp or so hikes right after the local elections at the end of March (so much for the independent central bank). I foresee a further 100bp in the last quarter, as the Fed starts hinting rate hikes and 10-year Treasury yields hit 4 percent. But I am not the best US economy expert out there:), so this latter hike expectation could not be realized if I am wrong on the US economy/dash monetary policy.

Of course, this is the base scenario. There is always the risk that domestic political or global environment forces the Central Bank to a substantial emergency hike as in 2006 and 2011

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Curious Case Of The Inverted Turkish Yield Curve

Published 01/08/2014, 01:55 AM

Updated 07/09/2023, 06:31 AM

The Curious Case Of The Inverted Turkish Yield Curve

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.