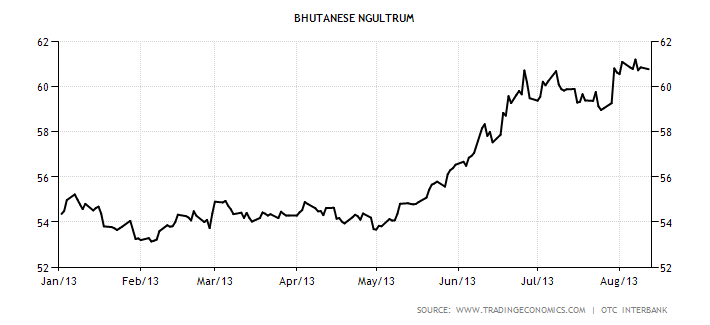

In recent times Indian economic newspapers and websites have been buzzing with articles and pieces about how Indian Rupee has set a new record by falling more than 12% since the beginning of this year and yet after numerous attempts of the Indian finance ministry and RBI it has not shown any signs of stability. This in turn has affected the industry tremendously and has spread chaos throughout the nation.

The major cause for the Rupee’s steep fall is the increase in Current Account Deficit (CAD) which happened due to the falling Gold prices and triggered record purchasing of Gold by Indians also the other factor which has increased CAD is the rise in oil prices which went from $90/barrel to $105/barrel in a space of 6 months which in turn further increased the CAD taking the situation from bad to worse.

The future for rupee looks bleak at the moment considering the Improving economic conditions in US and Europe and recent data indicating stabilization in China’s market, oil prices are expected to remain at the same level for the foreseeable future. Similarly, for Gold the prices are expected to plunge further as many economists believe that the fear of tapering by US Federal Reserve has not shown its full impact on the market yet. Apart from these global factors, the coming Diwali season will further increase the gold consumption in the Indian market and adversely impact the CAD which in turn would put pressure on the already crumbling currency.

The Indian Finance ministry seems confused at this time as it is talking about raising money through sovereign bonds which a few months ago was intent on starting a sovereign wealth management fund. With foreign reserves at $280 billion the idea that comes to mind is that they are not looking to maintain the volatility instead it is trying to strengthen the rupee by using unethical means which may have bad long term implications. This change in strategy by FM to has further tarnished economic sentiments about India which many investors already believe are unpredictable.

Government and the RBI have announced many measures to stabilize the Rupee including by promoting FDI in various sectors and also easing rules for FDI in multi brand retail which has not seen a single firm entering the Indian market after the much hyped law was passed. Also strict measures have been taken to curb the Gold imports. Apart from this, RBI has tried tightening the liquidity which resulted in increasing the loan prices. But so far all these measures have only supported rupee for a day or two but have been ineffective in producing any lasting stabilizing effects.

When an emerging markets currency does not respond positively to policy liquidity tightening then past evidences have indicated that the market is in deep trouble. With IMF lowering India's growth forecast for this fiscal to with every revison by citing significant capital outflows and rupee depreciation it will be interesting to see how the incoming RBI Governor and much hyped Raghuram Rajan is going to play his cards .

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Curious Case Of The Indian Rupee

Published 08/12/2013, 12:12 PM

Updated 07/09/2023, 06:32 AM

The Curious Case Of The Indian Rupee

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.