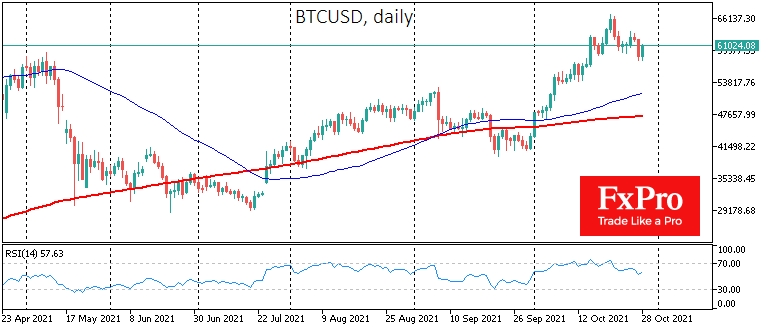

The cryptocurrency market moved into a correction phase after Bitcoin's dip. From the US session until the beginning of trading in Europe, Bitcoin steadily traded below $60,000 but jumped at the start of the European session. Nevertheless, for the week, the coin was down almost 10%. If we are seeing a local bottom now, the news is good enough.

Some believe this could be a balancing process before the push for new highs. Others think it's the beginning of a broader correction that will take Bitcoin to $45,000-$50,000. If Bitcoin falls to these lows, expect new buyers to step in.

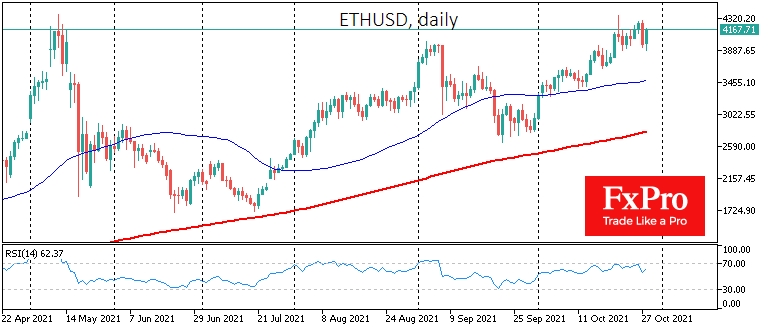

Ethereum

Meanwhile, Ethereum's blockchain has received another update, and although the final phases of the roadmap are still a long way off, it is seen positively by crypto market participants. Despite the retreat from the highs, the second cryptocurrency is holding above $4,000.

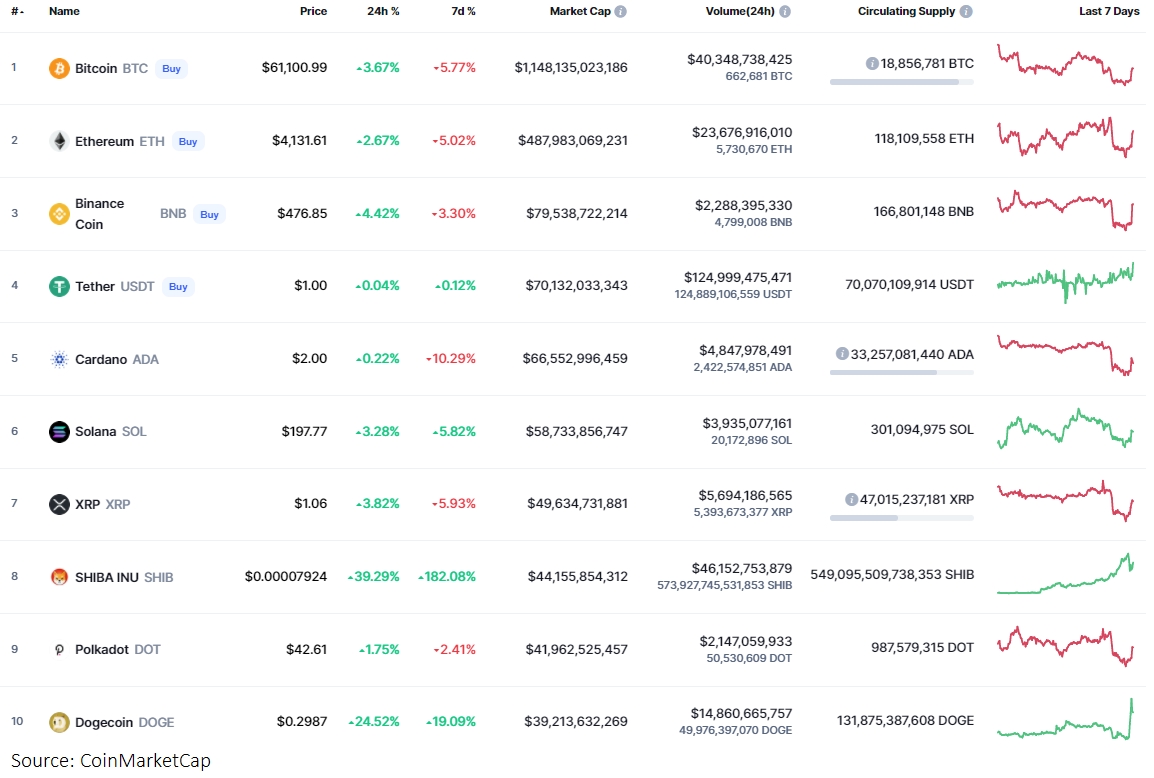

Total cryptocurrency capitalization is $2.5 trillion, near historic highs. Bitcoin's dominance index is at a comfortable value of about 44.5%, reflecting the broad demand across the crypto market.

The Crypto Fear & Greed Index has surrendered ground recently but remains firmly in "greed" mode. The RSI for Bitcoin on the daily chart is retreating from the overbought area. Both indicators point to a widening space for Bitcoin's growth.

SHIBA INU and Dogecoin Skyrocket

Several altcoins stood out firmly and have the limelight. We are talking about the two meme tokens, Dogecoin and SHIBA INU. At one point, SHIBA INU's capitalization exceeded $50 billion, pushing Ethereum out of 7th place on CoinMarketCap. Of course, such episodes of growth are followed by a correction.

Nevertheless, the situation is quite remarkable. The community considers SHIBA INU to be the "killer" of Dogecoin. But the crypto market space is quite enough for these two projects to coexist in harmony, with speculators switching from one to the other.

Another bright hero of the last few days was a 1inch token, which at some point jumped in price by 100% within a day. The coin got help from such fundamental factors as listing on the Upbit exchange and increased user activity.

Conclusion

As before, the crypto market continues to generate lightning-fast success stories attracting more investors to the sector, hoping to make quick and big money.

Crypto casinos continue to work and win. Before the end of the year, we may see a new episode of ups and downs in the sector, and it looks like a new Bitcoin price high will cause an explosive demand for digital assets.

The FxPro Analyst Team