The crypto market participants again feel cheated because of the Bitcoin-ETF cancellation and re-application. By doing this, CBOE gave the SEC another 240 days to make a final decision. And this seems to be intentional delays. Market participants blame big capital who do not want to open its wallet at current Bitcoin price levels, pressure from the American regulator, President Trump, shutdown, etc.

Surely in each of them, have some sense, but basically, the problem is in the very high initial expectations. Growth in 2017 for many was a kind of drug, the sensations from which you try to repeat all your life. However, the general theory of addiction sounds like “never as good as the first time.”

In 2017, the market felt the highest demand for the cryptocurrency, and this year we are witnessing demand for any kind of news. The bottom line is that we have stable transaction volumes on the Bitcoin network, many plans to launch crypto products, delays by regulators and investor confusion.

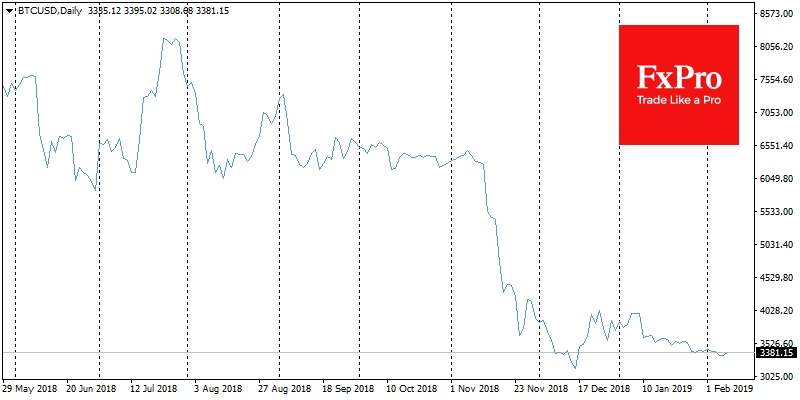

Last summer ofter called as Crypto Ice Age, but not chart of those times looks like a bumpy ride compared to recent days.

Vitaly Buterin at the recent conference in San Francisco said that the race for the number of transactions was a kind of meaningless game, which resulted in a “lot of bad crypto projects”. It should be noted that one of the Ethereum creators always spoke extremely negatively about the hype around the digital coins and overvalued prices, warning that at any time the value of these assets could drop to zero. It is worth to listen to such specialists in times of high uncertainty.

Big capital has enough patience and resources to stand aside until the crypto-industry from venture investment turns into a functioning business or squeeze out “whales” and the crypto exchanges from the market. The latter is unlikely to survive the pressure of regulators, the perennial fall of prices and trading volumes decline.

Alexander Kuptsikevich, the FxPro analyst