Key Points:

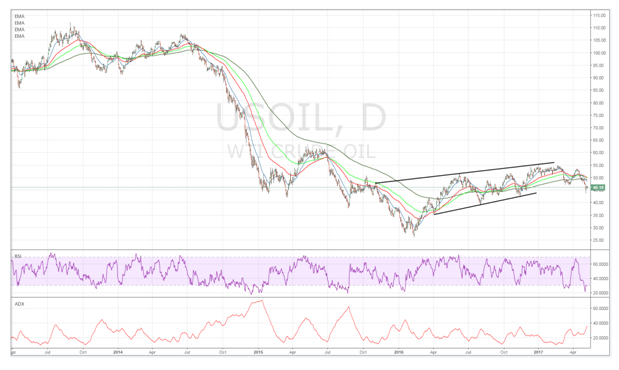

- WTI benchmark prices remain under pressure around $46.11 a barrel.

- Nigerian production likely to expand with refinery investment.

- OPEC needs to determine an effective strategy lest oil continues to decline.

Crude oil has had to travel a highly rocky path over the past few weeks as the commodity has been beset by ongoing concern over the growing glut of supply.Subsequently, WTI prices have slumped fairly convincingly over the past few weeks with the benchmark currently trading around the $46.11 a barrel mark. However, with both sides of the battle readying for action, things could be about to get a lot worse for crude prices.

A war between OPEC and U.S. shale producers has clearly been brewing for some time with the upstart shale plays attempting to eat into the cartel’s market share. At the time, OPEC’s primary strategy was to run out the clock on the shale industry by increasing supply and pushing prices below their marginal cost of extraction and thereby make much of the sector unprofitable. However, as proof that the law of unintended consequences reigns supreme, the U.S. oil industry responded by increasing R&D budgets and finding new, and cheaper, alternatives to extracting shale oil. Subsequently, OPEC now faces fighting a rear guard action as the Shale Industry continues to increase their rig count and productive output.

In addition, the latest market news seems to suggest that Nigeria, Africa’s largest oil producer, is now building new refineries to revitalise their industry and allow Lagos to increase their supply output. This poses an additional nail in OPEC’s strategy of cohesion and supply reduction and further complicates the cartels direction on cuts.

The reality is that with shale oil’s marginal extraction costs constantly falling the time is now for OPEC to pounce and drive some concerted action to rebalance the oil market. In fact, rather than cutting prices, which only seeks to shed market share to the U.S. and Canadian producers, the cartel needs to rapidly expand production and drive the price to historic lows. As difficult as such a move would be, it would cause havoc within the U.S. and Canadian sectors and force an urgent re-balancing of markets.

Obviously, any such move would be fraught with the danger of splintering amongst the various OPEC members, as well as adding to global deflationary pressures. Additionally, there is also plenty of political risk given that many of the Middle Eastern nations rely upon buoyant oil revenues to effectively balance their books. However, without some drastic action the cartel will only continue to diminish in power and it’s hard to see how they can effectively fight of the technologically superior shale and oil sand sector.

Ultimately, whichever way OPEC chooses to go will be a difficult battle but it’s clear that the war has started and won’t let up until either side fires their last shot. Regardless, depressed crude oil prices are likely here to stay for at least the medium term whilst the battle continues to rage.