Well, yeah, this is more like it. Too bad this kind of market couldn’t persist for, oh, 100 days in a row. It’s such a nice change.

SPDR S&P 500 (NYSE:SPY)

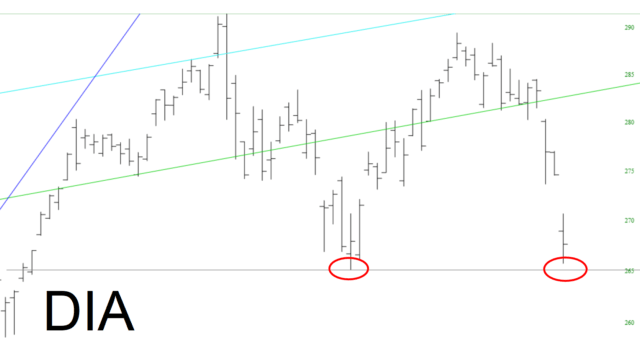

Of course, the darlings in D.C. are viewing this with a sweating brow, and their frantic buy-backs have probably already begun. We can see the diamonds rather near an important support level. Break this (on, say, Friday) and we get more fun.

SPDR® Dow Jones Industrial Average ETF Trust (NYSE:DIA)

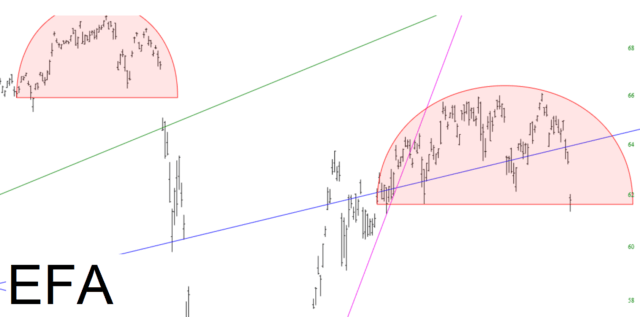

However, the nauseating optimism that had begun to peal forth has been beaten back down, and patterns I had felt were lost to the winds of time have been unexpectedly resurrected.

iShares MSCI EAFE ETF (NYSE:EFA)

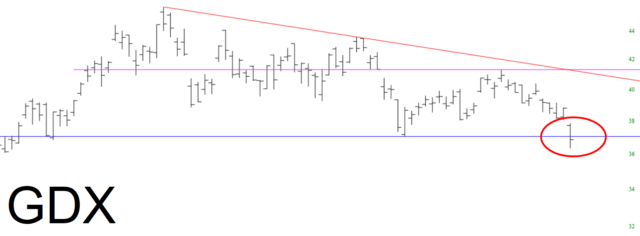

Miners have, as TNRevolution told us all, completely pooped the bed. This bearish pattern is quite complete now.

VanEck Vectors Gold Miners ETF (NYSE:GDX)

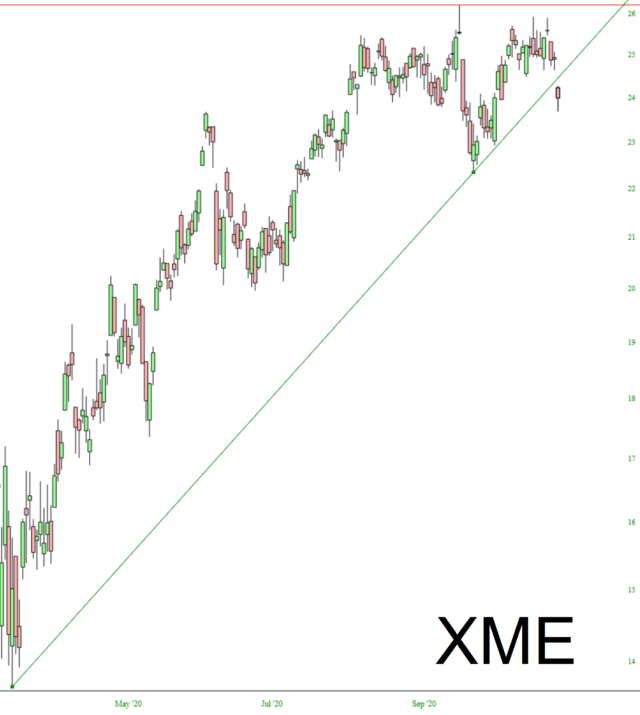

For me, the icing on the cake is SPDR® S&P Metals and Mining ETF (NYSE:XME), which has broken an important uptrend quite cleanly.

This week has been fantastic so far. The one dog was my TUP short, but the profits from my 64 other positions has made it unimportant.