Global stock markets were the boring markets for a change, as yesterday global bond markets took a potentially meaningful step back. In the U.S., 10-year yields rose 15bps (with no economic data to point to), reaching 2.28%. yesterday I noted that most of the last week’s rise in yields had come from an increase in inflation expectations; that trend corrected yesterday, as TIPS were also hammered. Ten-year TIPS yields rose 12bps, to -0.10%, implying that the 10-year breakeven rose a mere 3bps.

This was not just a U.S. story. The 10-year UK Gilt rose to the highest yield since December, +17bps yesterday. Germany was +13bps yesterday although still in the range; JGBs up to the highest level since December although that’s also only 9bps above the low yield from the last quarter since JGB yields have been effectively ‘pinned’ for a long time.

Although in the U.S. our selloff was largely in real yields yesterday, the underlying pressure here is from prices. I have previously illustrated the fact that core inflation globally has been rising for two years; this is starting slowly to be reflected in yields. The chart below is an eye-opening one of Japanese 5-year breakevens (there is no 10-year breakeven because Japan stopped issuing inflation-linked bonds a few years ago although they may soon resume). It has been rising almost non-stop since mid-2010, from -1.5% in five-year inflation expectations to…a positive number. That’s right, the poster child for deflation now has investors expecting prices to rise (albeit a small amount) over the next five years.

And with that small change, the yen has fallen 8 big figures against the dollar in about a month (see Chart, shown in terms of the number of yen per dollar). Higher inflation in Japan means the yen is finally losing real purchasing power too, and is no longer essentially a one-way bet versus the dollar.

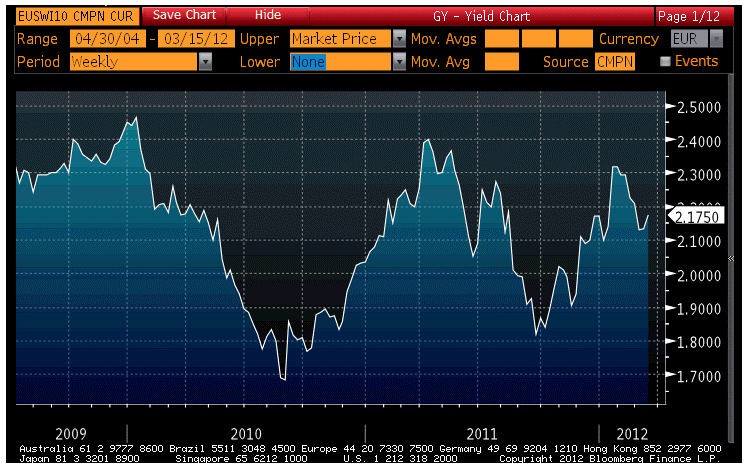

Euro 10-year inflation swap rates, despite the tremendous recent troubles, are closer to the highs than the lows of inflation expectations over the last several years:

Twenty basis points, or forty basis points, is nothing to get all in a lather about, yet. But I believe it is significant that global bond markets are all pricing in more inflation over the last few months, and nominal yields yesterday all rose. This is not a global growth story – it’s mostly a global inflation story.

In that context, it was especially odd to see precious metals get battered again yesterday (-3.3%), although the reasoning is easy enough to understand. Precious metals may hedge against a growth Armageddon, or they may hedge against inflation – but it is hard for them to hedge both outcomes at the same time.

Betting on Armageddon has never been a good bet, so far (since we’ve had zero Armageddons as of this writing), and being long precious metals in anticipation of that event is never a good idea. That said, there are other reasons to be long precious metals as part of a diversified commodity index, and I continue to be amused and confused by the fact that inflation indications are sprouting up all over, in many markets…but not yet in commodities, which historically produces the highest inflation “beta” in the early stages of an inflation episode. I think the adjustment will eventually come, and it may be swift when it does.

To repeat, a one-day or one-week selloff in bonds, even global in nature, is nothing to get panicky about. But higher inflation, higher interest rates, and higher gasoline prices each singly poses a challenge for increasingly-lofty equity valuations. Collectively, they pose a dangerous threat.

Right now, the stock market doesn’t seem to know what is good for it. It reminds me a bit of a rebellious teenager, like James Dean in “Rebel Without A Cause.” No good can come of the drag racing being done in equities right now. That being said, I covered some of my short (through equity options) on Tuesday before the Fed, because this feels like a pom-pom rally and everything is going to feel great until the morning.

So far, I can’t figure out how far away dawn is. The rapid movements in the dollar/yen, the abrupt drop in bonds, the rise in energy prices – these are all bad, but they’re still fairly insignificant moves. It will take more to derail stocks.

It won’t likely come today from the surveys (Empire Manufacturing, Consensus: 17.5 vs 19.53 last, and the Philly Fed Survey, Consensus: 12.0 vs 10.2 last) or Initial Claims (Consensus: 357k from 362k). But those are also not likely to be very bullish figures for bonds, either. I suspect the crack in stocks will come if investors notice that conditions in rates markets are getting less accommodative (or more attractive as a competing investment!). At 15bps per day, that may not take long but it’s probably not going to be today!

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Cool Kids Don’t Like Bonds Any More

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.