Your daily roundup of commodity news and ING views

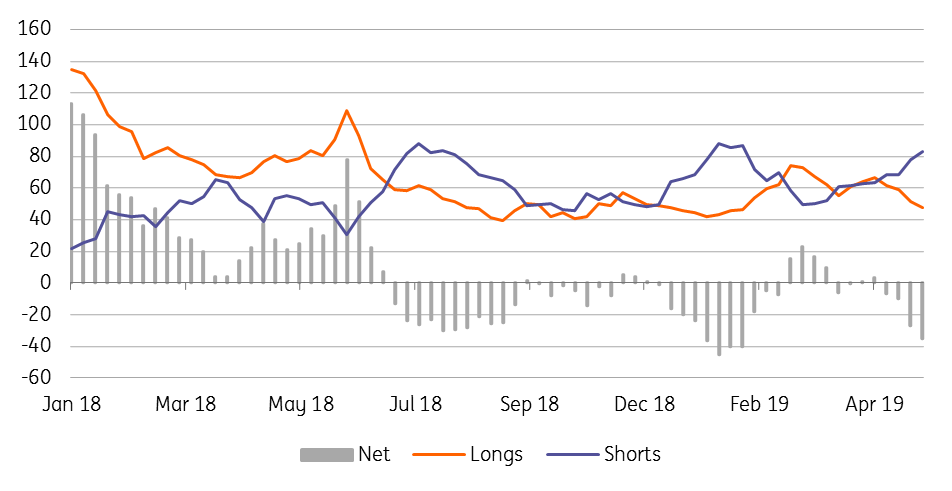

COMEX Copper managed money position (000 lots)

Energy

OPEC+ JMMC meeting: A handful of OPEC+ members met in Jeddah over the weekend for the Joint Ministerial Monitoring Committee meeting. OPEC+ reported that compliance with the production cut deal over the month of April hit 168%, while average compliance since January came in at 120%. The key for members was to keep monitoring inventory levels in the coming weeks and months. The Saudis seem keen to extend the production cut deal into the second half of this year, in order to “gently” draw down inventories. The Saudi energy minister also said that the Kingdom would keep output at 9.8MMbbls/d over May and June.

The key to the deal however is Russia, and whilst they would be supportive of continuing their cooperation with OPEC over the second half of the year, it will depend on the state of the oil market.

We are of the view that OPEC+ does not need to extend the production cut deal in its current form. Our balance sheet shows significant tightening as we move into the third quarter.

Metals

U.S. tariffs: President Trump announced that the U.S. will remove section 232 tariffs on Canadian and Mexican aluminium, whilst there will also be no quotas or restriction on metal flows as long as the countries are not being used as a transit to ship metals from other origins. Canada is a major aluminium supplier to the U.S., supplying nearly half of total U.S. aluminium imports in 2018; and the removal of the 10% import tariff may weigh on regional premiums which have been resilient so far despite the general softness in LME aluminium prices.

Speculative positioning: Money managers increased their net short position in COMEX copper by 8,451 lots last week, holding a net short of 35,257 lots as on 14 May. Speculators increased their gross short by 4,802 lots, while gross longs liquidated 3,649 lots over the week. Apprehension around copper demand as a result of escalating trade tensions appears to be keeping money managers entering the market from the long side. Meanwhile, net longs in COMEX gold surged by 46,201 lots over the last week as investors look to safe haven assets. The net long in gold stood at 65,922 lots as on 14 May.

Agriculture

Agri speculative positioning: Speculators remain clearly bearish agri markets, with money managers selling 8,282 lots in CBOT Soybeans over the last week to leave them with a record net short of 168,835 lots as of the 14 May. This shouldn’t come as too much of a surprise given the breakdown in trade talks between the US and China. Other agri commodities are not faring much better, with corn, wheat, sugar and Arabica coffee all seeing speculators holding sizeable net short positions.

However, corn and soybeans are quite vulnerable to a short covering rallying, particularly given that heavy rains in the US Midwest significantly delayed plantings.

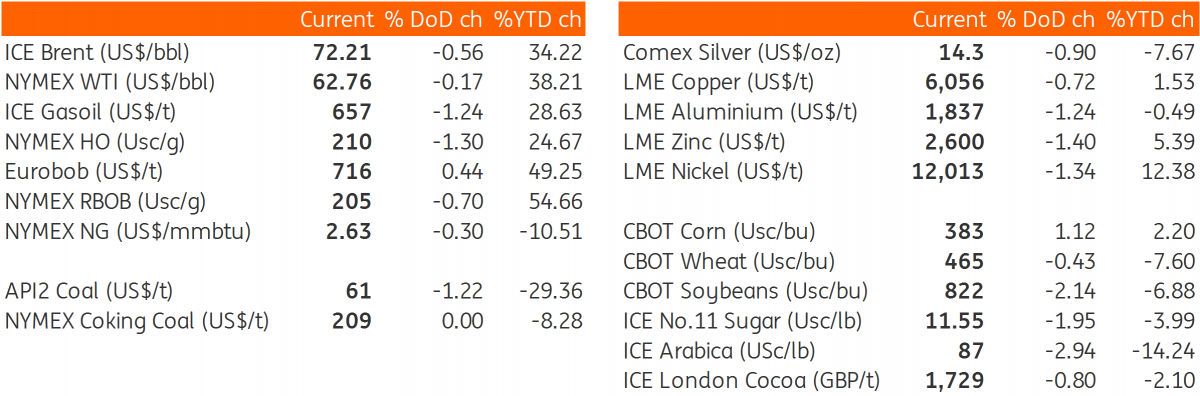

Daily price update

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.