Your daily roundup of commodity news and ING views

Energy

U.S. inventories: The API is set to release its weekly U.S. inventory report later today, with the market expecting that U.S. crude oil inventories fell by 500Mbbls over the last week. Expectations are for an 800Mbbls drawdown in gasoline inventories, and a 922Mbbls build in distillate fuel oil. The drawdown in gasoline comes despite the market expecting refinery run rates to have increased over the last week. The API release is delayed by a day due to a public holiday in the U.S. earlier this week. This will also see the more widely followed EIA release delayed until tomorrow afternoon.

Metals

Chile copper: Workers at Codelco’s Chuquicamata mine have been voting on whether to strike after labour unions rejected the final offer by management; the result of the vote is expected this evening. The current labour contract expires on 31 May, however the mine will still have a few more days of negotiations including the five day government-mediated talks before workers potentially start industrial action. Meanwhile, Chinese copper treatment charges continue to edge lower, standing at US$63.5/t currently, compared to US$66.5/t at the start of the month and US$91.5/t at the end of 2018, reflecting a continued tightening in the concentrate market.

Chinese iron ore: In an effort to rein in speculation, the Dalian Commodity Exchange has announced an increase in trading fees on iron ore futures active contracts from 0.006% to 0.01%. Aggregate open interest in DCE iron ore contracts has increased this year from 0.9m contracts at the start of 2019 to 2.1m contracts as of yesterday, reflecting increased speculative interest in iron ore after the dam disaster in Brazil. Meanwhile, Steelhome data showed that Chinese iron ore inventories at ports fell by another 3.9mt last week, taking total withdrawals to 21mt since early April, with current stocks falling to a two-year low of 127.8mt.

Agriculture

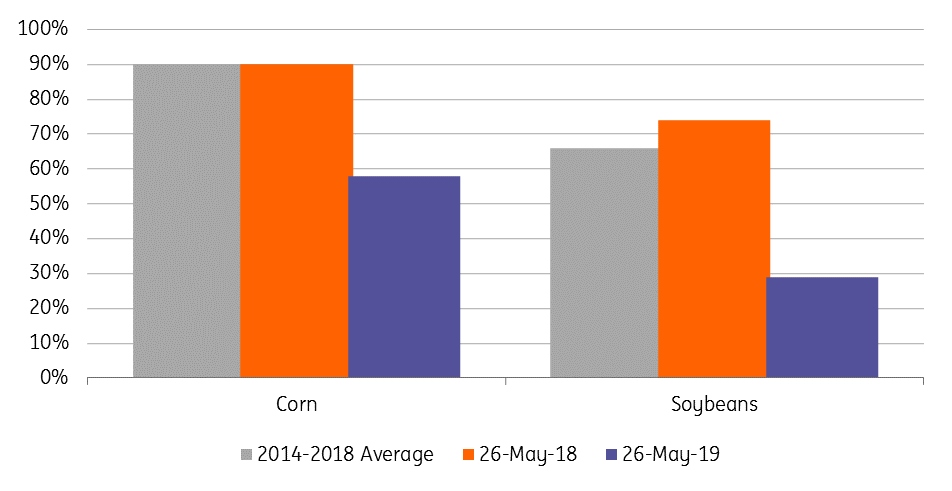

US corn plantings: Latest data from the USDA shows that US corn plantings continue to be delayed due to heavy rains across the US Midwest. As of the 26 May, 58% of area had been planted, which is up from 49% in the previous week, however this is still well below the 90% that was planted by the same stage last year. Plantings over the week were even lower than what most were expecting. Corn has made even further gains on the back of these poor plantings, and the implications this could have on corn yields, with CBOT corn now trading at US$4.35/bu, up almost 12% over the last week. Similarly for soybeans, plantings reached 29% as of 26 May, up from 19% in the previous week, but well below the 75% planted at the same stage last year.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more