Your daily roundup of commodity news and ING views

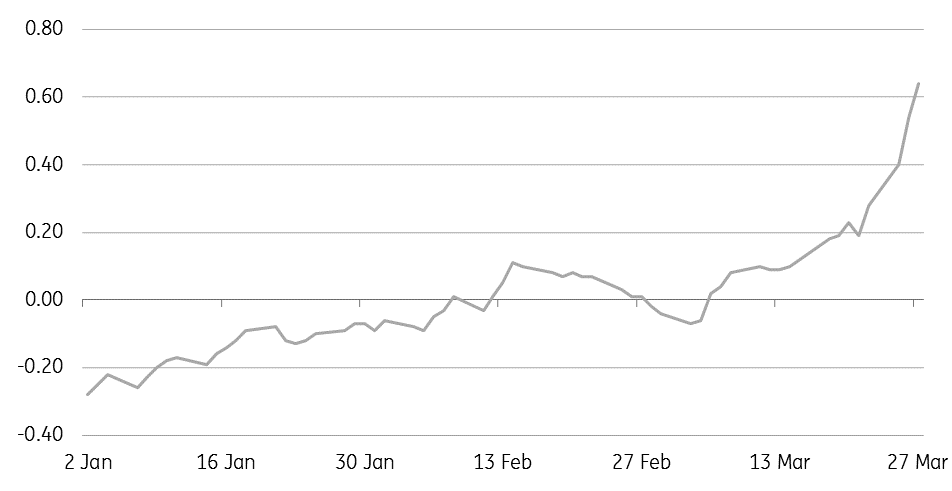

ICE (NYSE:ICE Brent May/June spread continues to strengthen (US$/bbl)

Energy

US crude oil inventories and Russia: Oil was well supported yesterday with WTI breaking above US$60/bbl at one stage. Russia’s energy minister reassured the market that the country would meet its targeted production as part of the broader OPEC+ output cut deal. Production in February was only 81Mbbls/d lower than the October reference level, as opposed to the agreed cut of around 230Mbbls/d.

However WTI failed to settle above US$60/bbl, with the API reporting towards the end of the day that US crude oil inventories increased by 1.93MMbbls over the last week, compared to expectations of a 2.5MMbbls draw. Although they did report significant draws on the product side, with gasoline inventories falling by 3.47MMbbls and distillate fuel oil inventories declining by 4.28MMbbls. The EIA is scheduled to release its more widely followed weekly report later today.

ICE Brent prompt spread: Spread action in ICE Brent continues to support the view of a tightening in the prompt market, with the May/Jun spread rallying to US$0.63/bbl premium this morning- this spread was trading at a discount at the start of March. We continue to believe that with Saudi Arabia showing that it is more than committed to the output cut deal, that spreads should remain well supported, as the physical market continues to tighten.

Metals

Vale iron ore output: Vale yesterday published its 4Q18 production update, which showed that the company’s iron ore output totalled 100.99mt over Q4 - an 8.2% increase YoY. Meanwhile full year 2018 output totalled 384.64mt, up 4.9% YoY. However as a result of the dam collapse at the end of January, which has led to both voluntary and involuntary capacity suspensions, 92.8mtpa of production has been affected, although the miner will try limit these losses, with increases elsewhere. Further details are expected from Vale today, with the company announcing its quarterly results today.

Australian disruptions end: The majority of miners and port operators have resumed operations after 4-6 days of disruption following cyclone activity. The Port of Hedland and Ashburton re-opened on Tuesday morning, while Dampier port restarted operations this morning. Iron ore mining activities have also resumed in the Pilbara region, while rail operations are scheduled to restart today. Suggestions from the Pilbara Ports Authority is that no major damage was sustained as a result of the cyclone.

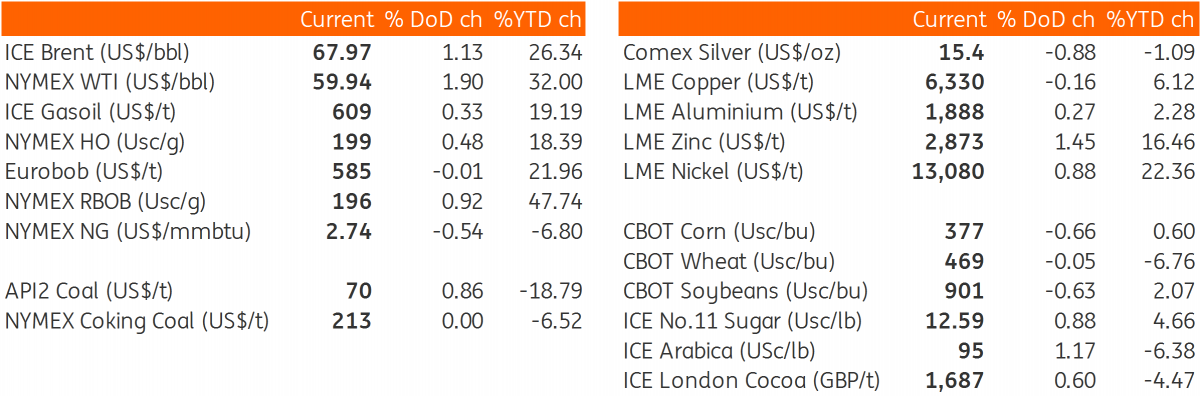

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.