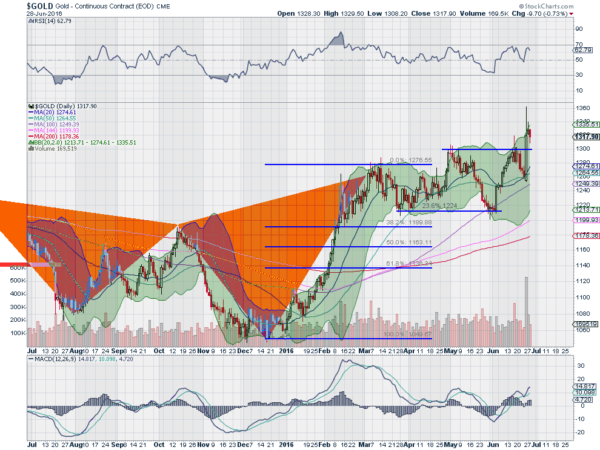

Yes I said it. Gold looks to be heading lower. True, the shiny rock has been moving higher since December. The pace of the move up slowed to a widening consolidation in March. Then it broke that range to the upside to start June. Mid month there was a pullback to a higher low before the Brexit move to the upside.

Many took that move as a signal of a return to more upside for gold. But it actually gave clues of a reversal that same Friday and is confirming it Tuesday.

The first clue is the long upper shadow in Friday’s candle. This is a sign of topping and if you look back to the June 16th top or the May 2nd top or March 14th top you see that same signal.

The second is the volume associated with that candle. It is extremely large, and smells like a blow off top.

These were followed Monday by another candle with an upper shadow but with a small body above the real body of Friday’s candle. Add in the red candle Tuesday and you have an Evening Star reversal confirmed.

None of these give a target, just confirm a direction. In fact the reversal could be over already. My best guess is that it retests 1300 though. Those big round numbers tend to be sticky. And it is not far from that now. That would be about a 61.8% retracement of the jump higher Friday.

From there, who knows? A bounce at 1300 could move higher continuing the trend of higher highs and higher lows. Follow through below it and then undercutting 1250 would bring out the bears.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.