A headline that says a recession is coming can never be wrong. There WILL be a recession in the future. The questions are: when, how big, and what are the causes. The USA and global economies are soft, and it will not take much of a newly formed negative dynamic to send the economy into contraction.

Follow up:

I do not believe opinion based forecasts, as recessions are never forecast (not to mention opinion is unreliable). Yes, every now and then someone will predict a recession and be correct - and this opinion will give the person his or hers 15 minutes of fame.

On the other hand, analytical forecasts use historical benchmarks to project economic growth - and the only way analytical forecasts could be 100% reliable is IF every possible permutation of economic dynamics were known and quantified - and that is currently impossible.

We face the reality that "this time is different" is possible due to our lack of complete data sets and imperfect economic models. What should concern EVERYONE is that the USA economy is still in the clutches of extraordinary and "untested" monetary measures thanks to the Federal Reserve. There is little understanding of the long term affects of extraordinary monetary measures (or the effects of unwinding extraordinary measures). For this reason, the confidence level in ANY economic outlook is reduced.

The closest thing the USA has to real time economic analysis is GDPNow produced by the Atlanta Fed. The latest forecast:

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2015 is 0.6 percent on January 15, down from 0.8 percent on January 8. The forecast for fourth quarter real consumer spending growth fell from 2.0 percent to 1.7 percent after this morning's retail sales report from the U.S. Census Bureau and the industrial production release from the Federal Reserve.

The economy is shown to be slowing in this model. The trend is downward and trends continue until they do not. So if I were a trend forecaster, I would say the USA economy is headed into the toilet. But trends are not the only element used in forecasting. There are relationships in forward looking data which have yet to signal a recession. Still, no relationship is particularly strong - and a few are of concern.

Next week, Econintersect will release its economic forecast for February. Preliminary data is showing a flattening of the decline in the economy.

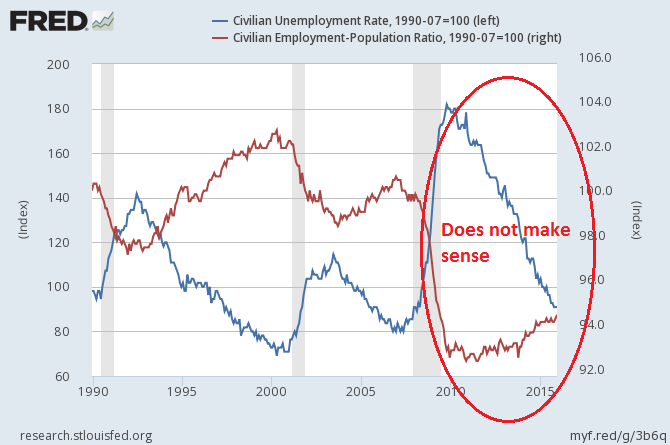

I believe the real weakness in the economy stems from employment. Employment is what makes the economy improve at Main Street level. The headline view of employment is blowing smoke up our rears - the USA has an unemployment rate of 5.0% which is normally seen during periods of relatively strong economic expansion.

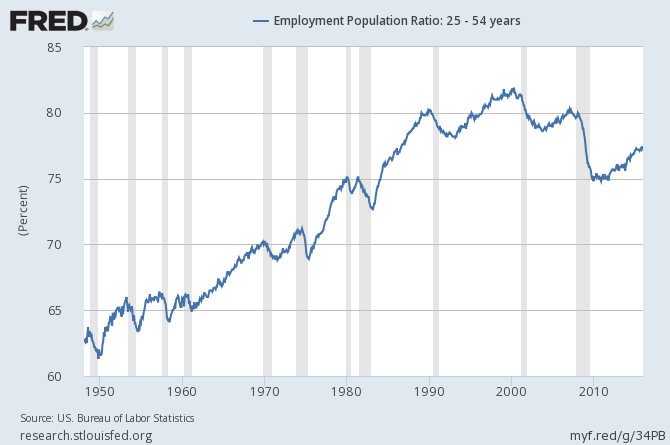

Historically, there is an inverse relationship between unemployment and the employment population ratio. In the Mediocre Recovery following the Great Recession, the movements of the unemployment rate and the employment population ratios did not follow historical relationships. In short, the headline unemployment methodology is UNDERSTATING the real unemployment levels.

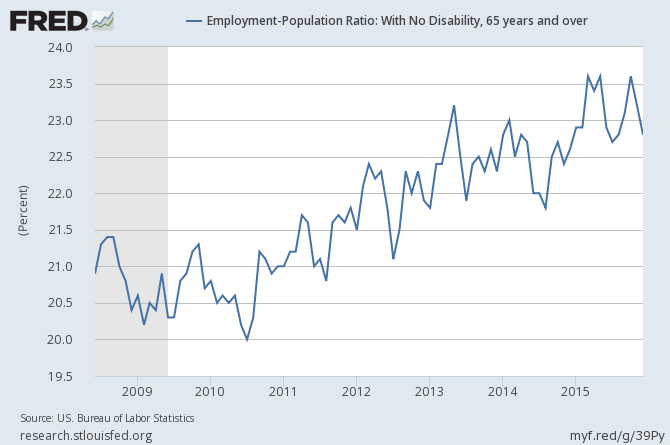

For those who believe that the employment-population ratio's new movements were caused by a demographic shift (aka boomers retiring) - think again. More old-timers (expressed as a percentage of the population) are working than ever before. This can only mean too many of the prime working age population is not working.

And the prime working age population is far from pre-recession levels.

Without higher employment levels - the economy will continue to be mediocre, bordering on recessionary. Being mislead by good headline employment numbers means low employment levels will be ignored, and the economy will continue to function at near stall speed.

Other Economic News this Week:

The Econintersect Economic Index for January 2016 declined - and is now at the lowest value since the end of the Great Recession. The tracked sectors of the economy which showed growth were mostly offset by the sectors in contraction.Our economic index remains in a long term decline since late 2014.

Current ECRI WLI Growth Index

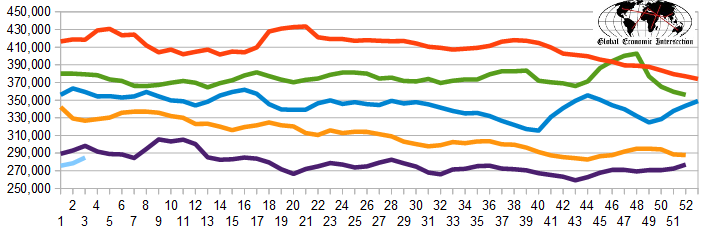

The market (from Bloomberg) was expecting the weekly initial unemployment claims at 267 K to 285 K (consensus 275,000) vs the 293,000 reported. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 278.500 (reported last week as 278.750) to 285,000. The rolling averages generally have been equal to or under 300,000 since August 2014.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line), 2015 (violet line)

Bankruptcies this Week: TriStar Wellness Solutions (chapter 7), Privately-held Timothy Place

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: