The US dollar has been mired in a downturn since the beginning of the year. The move to the upside right after the November election was short lived. It has now lost the entire move higher and then some, off 12% from the top in December. But the US dollar is starting to show signs of strength. A possible impending boom to the upside.

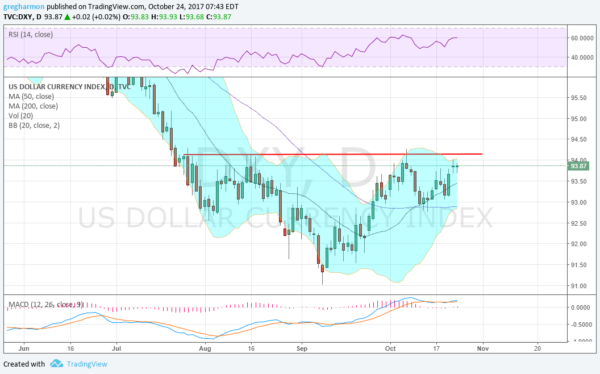

The chart below paints the picture. Since the end of July the US dollar has been working through a bottoming pattern. The move off of the September low tested the small August bounce and then a higher low in October has seen a reversal to the upside last week. This full pattern is near triggering an Inverse Head and Shoulders pattern.

A push over 94.15, the neckline, would be the trigger. This would give a price objective to the upside to at least 97.30. Momentum has been building for a reversal. The RSI is back over the mid line and holding near 60 while the MACD is crossing up after a leveling period. The Bollinger Band® squeezed in and are now opening to the upside. The boom may be coming soon.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.