The collapse of the government of Netherlands means that the European debt crisis is now increasingly impacting the more prosperous members of the eurozone. It also brings into sharp focus the following four risks:

- The unwillingness of the Netherlands to meet its deficit targets does not bode well for the odds of economically weaker countries being able to reach their targets;

- The increasing ability of parties on the far right and left of the political spectrum to counter the policies of the traditional governing political parties;

- The creation of yet another precedent for countries not willing to meet their fiscal targets;

- The growing isolation of the German position that the crisis should be overcome via strict austerity measures.

The governing coalition led by Prime Minster Mark Rutte of the Liberal party collapsed on April 21st following the failure of negotiations with one of its coalition partners, the far-right Freedom Party, over how to implement austerity measures worth 14-16 billion euros. Without these cuts, the government will not be able to reduce its deficit from its current 4.7% of GDP to an EU-mandated 3% by 2013. "The Freedom Party benches are unanimously against Brussels diktats and the attack on our elderly," Geert Wilders, the leader of the far-right Freedom Party said. The Freedom Party is opposed to the euro and wants to return the country to the guilder, the former Dutch Currency.

On this issue at least, public opinion is with The Freedom Party. A recent poll showed that 57% of respondents wanted budgets cuts that were smaller than those demanded by the EU Commission. One of the driving forces behind these poll numbers is the Netherland’s struggling economy, which feeds into the public mood that one should not be financing bailouts for the very indebted countries when the needs are so great at home. Indeed, polls taken over the last year or so have repeatedly shown that the majority of Dutch are against providing further bailout financing.

Economic Storm Clouds On The Horizons

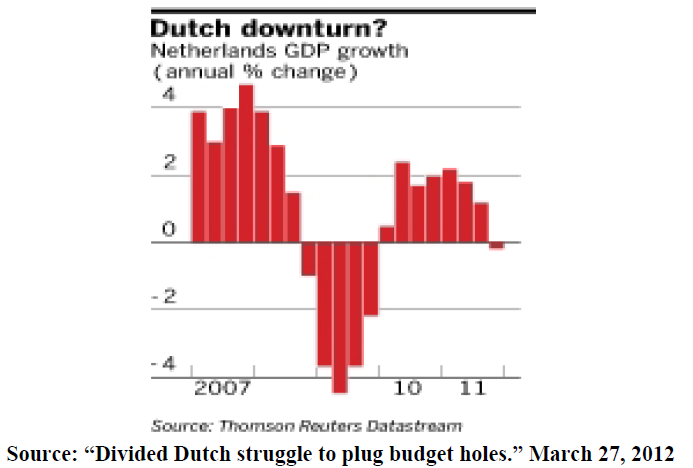

The Netherlands has entered its second recession in only 2 years. The economy shrank by 1.1% in the second half of 2011, and the EU predicts it will contract by another 0.9% in 2012. The Dutch worry that austerity measures would only deepen the downturn in the short-term.

The Achilles heel of the Netherlands’ economy is not public debt, which, at 65.2% of GDP, is lower than that of France, Germany and U.K. The real problem is household debt, which at 249% of GDP, is the highest in the eurozone. Real estate is the main reason behind this build-up in debt.

Unfortunately, the real estate sector is now struggling. Home prices have fallen 11% from their peak in August 2008, leaving up to 500,000 people with a negative equity position on their mortgages.The Netherlands’ economic challenges, combined with the inability to agree on budget cuts, threaten its triple A sovereign credit rating.

The Collapse Of The Government Has Created A Political Vacuum And Considerable Uncertainty

Economic challenges are further complicated by the fact elections are not scheduled to be held until early September, which means decisions on important matters will likely be delayed until after the election.

Moreover, if current polls hold, the political landscape will continue to be very fragmented in the aftermath of the election, which means putting together a coalition government will be no easy feat. Indeed, it took about four months for a governing coalition to be formed after the June 2010 elections. Recent polls also indicate that it would be very difficult to form a government without either the support of the far right Freedom Party or the far left Socialist Party. While both these parties have widely divergent views on many issues, they share an anti-eurozone bias, in particular with regard to their opposition to bailouts.

Implications For The Eurozone

The political and economic challenges facing the Netherlands have very ominous implications for the eurozone.

If a relatively prosperous country like the Netherlands cannot find the political will and popular support to meet its EU deficit targets, what does it say for the chances of countries like Greece, Portugal, Ireland and Spain being able to overcome their far more daunting economic challenges?

The collapse of the Dutch government is yet another example of how the growing influence of far left and right parties is complicating the political landscape in Europe.

If the Netherlands (or Spain for that matter) is unable or unwilling to meets its deficit targets, it will encourage other countries to follow suit.

The fall of the government means there is a strong chance that the Dutch will not be in a position to ratify the European fiscal pact on budget discipline for many months. Although only 12 of 17 euro members are needed to ratify the pact for it to become law, the inability of a rich country like the Netherlands to pass it into law would damage the pact’s credibility. The Dutch government has also not yet approved the second and permanent European bailout fund, the European Stability Mechanism, which is supposed to replace the temporary one currently in place by July.

The collapse of the Dutch government, and the potential defeat of Sarkozy in France, leaves Germany looking increasingly isolated in its quest to overcome the debt crisis through the enforcement of strict austerity measures

All of these trends point to increasing political divisions in the eurozone, which does not bode well for the ongoing efforts to overcome the debt crisis.

Below is a list of reports that NBF Geopolitical Research has written on the eurozone crisis to date:

The Geopolitics of the Euro Zone Debt Crisis: Are the Markets Underestimating the Risks? (February 2011)

The Euro Zone's Growing Geopolitical Impasse Worsens the Debt Crisis (March 2011)

Spain: The Euro Zone's Firewall or Next Domino? (May 2011)

The Geopolitical Obstacles To A Successful Resolution Of The Euro Zone Debt Crisis: An Update (September 2011)

The Geopolitical Obstacles to a Successful Resolution of the Euro Zone Debt Crisis: Prospects for 2012 (Jan 2012)

The Day After….Are the Markets and Politicians Underestimating the Impact of a Disorderly Greece Default and Euro

Zone Exit? (March 2012)

Why The Markets Should Pay Attention To The Upcoming French Elections And The Aftermath (April 2012)