The Federal Reserve signalled at their March meeting that they are on hold for now. Being long treasuries seems obvious, right? Well, sometimes the most obvious trades are the ones to take. I will outline why treasuries are headed higher (yields lower) and why it may continue for some time.

Treasuries are in a win-win situation. That is, they should go higher, whether equities continue their march higher, or whether they tank. It's largely irrelvant. If we look at the Q4 2018 decline in equity markets, that was met, as one would assume, with a rally in treasuries. Yet, what has happened to equities in Q1 2019? They've rallied. Treasuries simply consolidated their gains and recently broke out when they got the go ahead from the FED. This reluctance by yields to move higher even as equities surged shows a structural shift in the direction of the treasury market.

We can assume that if equities continue to move higher, then it's because of easy FED policy. Treasuries should continue higher. If equities start reversing their gains, the weaknening global growth narrative becomes much more real and treasuries should surge in this case on a flight to safety. This is the win-win situation.

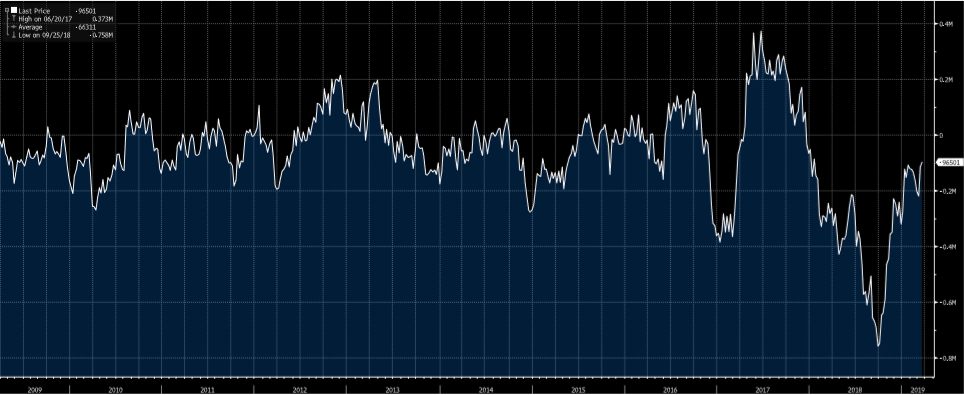

How is the market positioned? Looking at the CFTC net non-commercial combined positions (futures and options on the 10Y), investors are still short 96,501 contracts. The next data release will likely show some of this to have been covered, given the recent rise in treasuries. Still, this is not the sort of levels you see at tops.

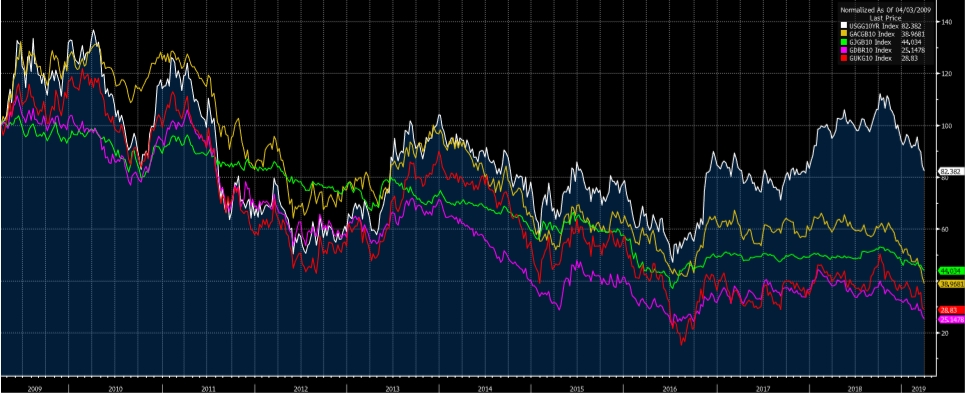

Additionally, if we look at 10-year sovereign yields around the world, the U.S. has a lot of catching up to do on the downside. Rarely do yields between countries diverge for so long. If we normalize yields from a starting point in 2009, this becomes visually clear.

Ultimately, the buck begins and ends with one thing - price action. The consolidation and then breakdown in yields, even as equities surged in Q1 was the confirmation signal and I see no signs of this trend change. We can expect to see pullbacks with heightened volatility in treasuries, but the long-term trend should remain higher.