We have been saying for over a year now that there is a disconnect between the economic fundamentals around physical gold and the price we see in international markets. This is clear, as is pointed out below, when one looks at the phenomenal demand for physical gold in Asia (namely India and China) and the low gold price in the West.

Sprott and his team are in doubt that manipulation is in play when it comes to the Gold price. There are others who believe this is also the case, GATA being the main organisation campaigning against this. However, not everyone who supports gold as money or even as an investment believes that manipulation is going on, or at least they’re not yet convinced.

For example, at a talk with Marc Faber last night, someone asked Dr. Doom himself what he thought of the manipulation chatter. He said that whilst there was academic work showing that there was odd trading behaviour surrounding both Comex and the London gold fix he struggled to see the motives of the Western banks and central banks accused of carrying out these ‘attacks’. Faber believes that it would be in the interests of these banks to stop the Chinese from buying gold, but by driving the price down they are making it easier.

Whether you believe or not that manipulation is the reason for the low gold price this has been a good time to buy gold bullion and it looks like time might be running out for these low gold prices.

After a long and agonizing winter which was attributed to the so-called “Polar Vortex”, we thought it would be appropriate to highlight for precious metal investors the implications of what we call the “Chinese Gold Vortex”. Over the past year, we have been very vocal about what we consider an aberration: the complete disconnect between gold supply and demand fundamentals and the actual price of the metal.

We have shown in February Markets at a Glance (MAAG) that, for all of 2013, demand from emerging markets, particularly China, was extremely strong, outstripping world mine supply by a fair amount. But this extreme tightness in the physical market was not reflected in gold prices. We have since then discussed many signs of manipulation in both the paper and physical gold markets (ETF flows, Indian intervention, LBMA fixings, to name a few).

This month’s Markets at a Glance presents an update on the demand dynamics in China, discussion around new evidence of manipulation and concludes with an illustrative example of the opportunity in gold equities.

Supply and Demand

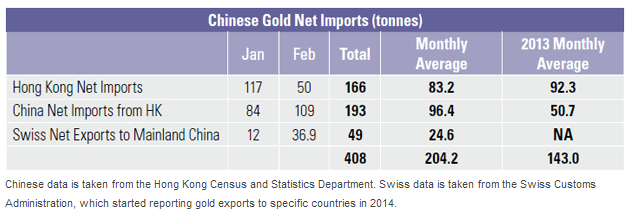

While the year is still young, we have been able to gather a few data points from China and they are truly impressive. The table below shows Chinese net imports of gold for the first two months of 2014. So on average, each month this year, China has imported about 204 tonnes of gold, up from about 143 tonnes last year.

To put these numbers in perspective, for the full year 2013, total mine supply excluding China and Russia averaged 192 tonnes per month (see the February 2014 MAAG for details on the methodology).3 Basically, China is currently vacuuming, on a monthly basis, all of the world’s mine production plus an additional 10 tonnes. But that is only China; anecdotal evidence from other countries suggests that demand remains strong in other Emerging Markets, where Central Banks keep adding to their gold reserves. Moreover, whereas last year’s ETFs contributed (unsustainably) to supply, this year has so far seen net inflows into gold bullion ETFs.

What immediately comes to mind is: where does all this gold come from? As we have long argued, gold to Emerging Markets has been supplied by Western Central Banks for many years.4 Recent data substantiates this claim. A closer look at Swiss import and export data shows that it imports most of its gold from the US and the UK and exports most of it to China and Hong Kong. For example, in the first two months of 2014, the UK has exported over 233 tonnes of gold to Switzerland; this is more than half of the Chinese net imports over the same period (remember the UK doesn’t produce any gold). Similarly, the US, which has a monthly gold production of about 19 tonnes, has exported, in the month of January alone 56 tonnes, most of which went either to Switzerland or to Hong Kong directly.5 So where does all this gold come from? It is supplied by Western Central Banks, which according to our analysis have very little gold left.

While it is still early, the Chinese Gold Vortex is firing on all cylinders and data so far this year suggests that demand will far outstrip supply.

Manipulation

The topic of gold price manipulation seems to be making its way into the mainstream. Regulators in Germany made the first foray into gold manipulation with their investigations of the London Bullion Market Association (LBMA) now infamous Gold Fixing.6 Now, we hear that the CME Group (which owns the COMEX, where paper gold trades) has been sued by three traders for allegedly selling order information to HFTs ahead of the broader market.7

Simultaneously, academic studies have found evidence of manipulation in the gold market and a consultancy (Fideres) even claims that “global gold prices may have been manipulated 50% of the time between January 2010 and December 2013”.8

We have long suspected manipulation, but it is now clear to us that both the physical and paper bullion markets have been tampered with for quite some time, to the advantage of those that are naturally short gold (i.e. the bullion banks and other gold dealers). With the increasing amount of scrutiny from the public, academia, regulators and now lawyers, manipulators should have a progressively more difficult time preventing gold from reaching fair value.

The Opportunity

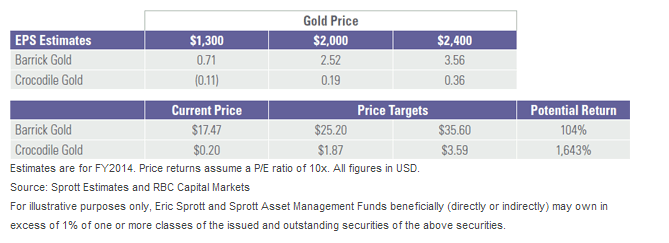

The stars are aligned in 2014 for a significant re-rating of the gold price. In our opinion, the best way to participate in a return of the gold price to fundamentals is to invest in junior gold miners. The tables below show EPS estimates under various gold price scenarios and the associated stock price targets, assuming a price-to-earnings ratio of 10x, for both a major (Barrick) and a junior (Crocodile) miner. From the table, it is obvious that junior gold miners have much more leverage to the price of gold.

In summary, the tailwinds are twofold for gold: the Chinese Gold Vortex is putting an undeniable pressure on the physical market, while focus on price manipulation makes it progressively harder for price manipulators to operate. The reversal of this anomalous, yet explicable market dysfunction could provide astute investors with multi-hundred per cent returns.