The automotive sector’s consumption of Platinum and Palladium has long been the main indicator of PGM demand, and the measure by which consumers and investor judge the health of the sector. But, a recent report from ETF Securities suggests there’s been a quiet revolution in recent years, with jewelry demand quietly taking up the slack left by weak automotive demand, particularly in Europe.

Platinum is heavily consumed in the manufacturing of auto catalysts for use in the diesel vehicles that dominate the European vehicle market. Tightening global emission standards have supported demand for these auto catalysts and for the platinum used in them, even as the car market in Europe collapsed following the financial crisis.

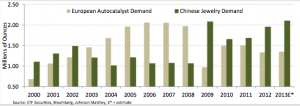

The US and Japan are also important sources of demand, but neither market favors diesels as strongly as Europe does. ETF advises that prior to the recession in Europe, European auto catalysts accounted for the single largest demand component for platinum. At the demand peaks in 2006 and 2007, European auto catalyst demand totaled just over 2 million ounces annually, although it has since fallen back to about 1.3 million ounces.

Yet platinum prices and demand have held up well of late. With such a sharp drop in demand, you may be excused for expecting the price to be at a discount to gold. Part of the reason is the fact that demand recovered very quickly post-recession and has continued to rise, as this graph from ETF Securities illustrates:

The slack left by automotive has been taken up by rising demand for jewelry from China. Jewelry demand now accounts for about 35% of total platinum demand, up from 26% in 2008, while Chinese demand for platinum jewelry now accounts for about 25% of all platinum demand, compared to the 16% from Europe’s auto catalyst sector.

Chinese platinum jewelry demand has doubled since 2008, on pace to account for nearly 80% of global platinum jewelry demand in 2013. In 2012, demand increased by 16% to just over 2 million ounces.

by Stuart Burns