The UK Chancellor, George Osborne, today delivered his Autumn Statement to the House of Commons. As expected, it wasn’t an easy affair. The chancellor was under pressure due to poor economic growth, rising unemployment and a deficit-reduction plan, which isn’t on track. The eurozone crisis is partly to blame but the austerity programme and household squeeze are also dragging down on economic growth, as we have pointed out on numerous occasions.

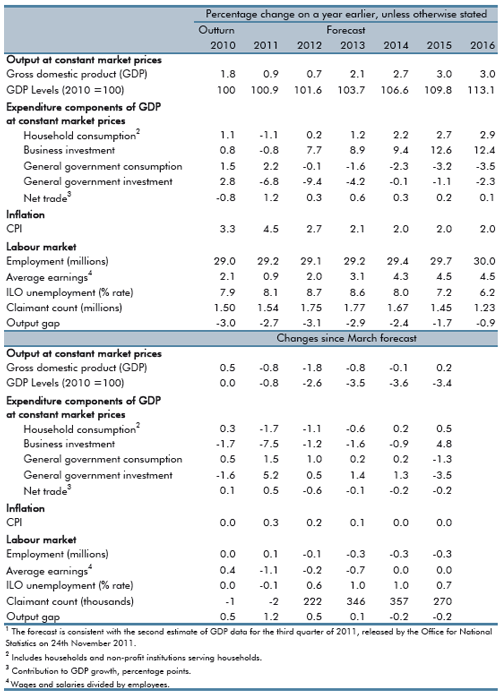

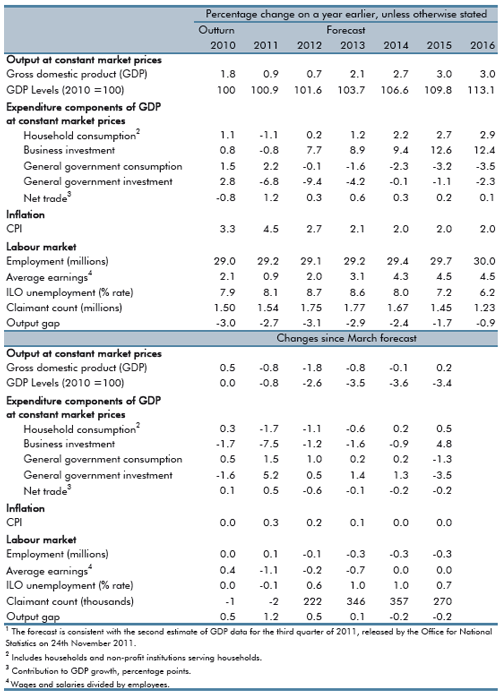

Firstly, Osborne said that the Office for Budget Responsibility (OBR) doesn’t expect the UK to end up in recession, in contrast to the OECD. The OBR sees economic growth at 0.9% in 2011 (down from 1.7% forecast in March) and 0.7% in 2012 (previously 2.5%). The OBR maintains its optimistic forecasts for 2013-15, where it expects solid growth of 2.1%, 2.7% and 3.0%, respectively. If a recession hits, it will, in our view, be a mild one but it is worrying as output remains some 4% below the 2007 peak and more than 10% below trend growth. We stick to our view that it will be very difficult to see growth rates above 2% when the public sector shrinks and we are sceptical of the OBR’s forecasts beyond 2012.

Secondly, Mr Osborne said, “Our debt challenge is even greater than before” and admitted that the UK will have to borrow more than previously anticipated. The Treasury will have to borrow an extra £56bn over the next three years – the equivalent of £2,160 per household. The UK will have a structural budget shortfall of 4.6% as a percentage of GDP this year and will post a surplus of 0.5 percent in five years’ time, the OBR projects. Government debt as a percentage of GDP will peak at 78% in 2014/2015 from this fiscal year’s estimate of 67% and is set to fall by the end of the current parliament, according to the OBR’s estimates. The OBR is, in our view, too optimistic with its debt projection and we see additional revisions coming in March and November next year.

Thirdly, the government will introduce a credit easing programme to support lending to small- and medium-sized companies. There will be a ceiling on the programme of 40 billion pounds and the government has agreed with Bank of England Governor, Mervyn King, to reduce part of the central bank’s Asset Purchase Facility used to buy company debt by 40 billion pounds. The chancellor also said the government was going “to reinvigorate the right to buy” to allow residents of social housing to purchase their homes.

Fourthly, the chancellor said the amount taken from financial institutions' balance sheets will increase from a projected 0.075% to 0.88% annually. The move will ensure HMRC will collect its targeted amount of £2.5bn-a-year from the banking industry through this tax, after a fall in revenues during the economic crisis. Perhaps it can also stave off calls from European nations to implement a Financial Transaction Tax or 'Tobin tax' on all financial transactions that the UK opposes.

Economic and fiscal outlook – more QE in the pipeline

The government focused on three areas in the Autumn Statement: 1) Protecting the economy, 2) building a stronger economy for the future and 3) fairness. Our first take is that none of these is as far-reaching as they probably should be in order to avoid recession. Most of the measures will not have an immediate effect and those that do are insufficient. In other words, we are not impressed with the new initiatives.

Without massive fiscal stimulus, we forecast that the Bank of England will continue to buy Gilts to stimulate economic growth. Yesterday, the OECD predicted that the Bank of England will pump another £125bn into the economy to try to salvage the recovery, meaning that total purchases will amount to £400bn by the end of 2012. That sounds like a lot and may be difficult without creating market distortions but most members of the Monetary Policy Committee seem open towards printing money to spur growth. Accordingly, we expect to see a strong underlying demand for UK Gilts next year. Isolated, this flow will be GBP negative.

Firstly, Osborne said that the Office for Budget Responsibility (OBR) doesn’t expect the UK to end up in recession, in contrast to the OECD. The OBR sees economic growth at 0.9% in 2011 (down from 1.7% forecast in March) and 0.7% in 2012 (previously 2.5%). The OBR maintains its optimistic forecasts for 2013-15, where it expects solid growth of 2.1%, 2.7% and 3.0%, respectively. If a recession hits, it will, in our view, be a mild one but it is worrying as output remains some 4% below the 2007 peak and more than 10% below trend growth. We stick to our view that it will be very difficult to see growth rates above 2% when the public sector shrinks and we are sceptical of the OBR’s forecasts beyond 2012.

Secondly, Mr Osborne said, “Our debt challenge is even greater than before” and admitted that the UK will have to borrow more than previously anticipated. The Treasury will have to borrow an extra £56bn over the next three years – the equivalent of £2,160 per household. The UK will have a structural budget shortfall of 4.6% as a percentage of GDP this year and will post a surplus of 0.5 percent in five years’ time, the OBR projects. Government debt as a percentage of GDP will peak at 78% in 2014/2015 from this fiscal year’s estimate of 67% and is set to fall by the end of the current parliament, according to the OBR’s estimates. The OBR is, in our view, too optimistic with its debt projection and we see additional revisions coming in March and November next year.

Thirdly, the government will introduce a credit easing programme to support lending to small- and medium-sized companies. There will be a ceiling on the programme of 40 billion pounds and the government has agreed with Bank of England Governor, Mervyn King, to reduce part of the central bank’s Asset Purchase Facility used to buy company debt by 40 billion pounds. The chancellor also said the government was going “to reinvigorate the right to buy” to allow residents of social housing to purchase their homes.

Fourthly, the chancellor said the amount taken from financial institutions' balance sheets will increase from a projected 0.075% to 0.88% annually. The move will ensure HMRC will collect its targeted amount of £2.5bn-a-year from the banking industry through this tax, after a fall in revenues during the economic crisis. Perhaps it can also stave off calls from European nations to implement a Financial Transaction Tax or 'Tobin tax' on all financial transactions that the UK opposes.

Economic and fiscal outlook – more QE in the pipeline

The government focused on three areas in the Autumn Statement: 1) Protecting the economy, 2) building a stronger economy for the future and 3) fairness. Our first take is that none of these is as far-reaching as they probably should be in order to avoid recession. Most of the measures will not have an immediate effect and those that do are insufficient. In other words, we are not impressed with the new initiatives.

Without massive fiscal stimulus, we forecast that the Bank of England will continue to buy Gilts to stimulate economic growth. Yesterday, the OECD predicted that the Bank of England will pump another £125bn into the economy to try to salvage the recovery, meaning that total purchases will amount to £400bn by the end of 2012. That sounds like a lot and may be difficult without creating market distortions but most members of the Monetary Policy Committee seem open towards printing money to spur growth. Accordingly, we expect to see a strong underlying demand for UK Gilts next year. Isolated, this flow will be GBP negative.