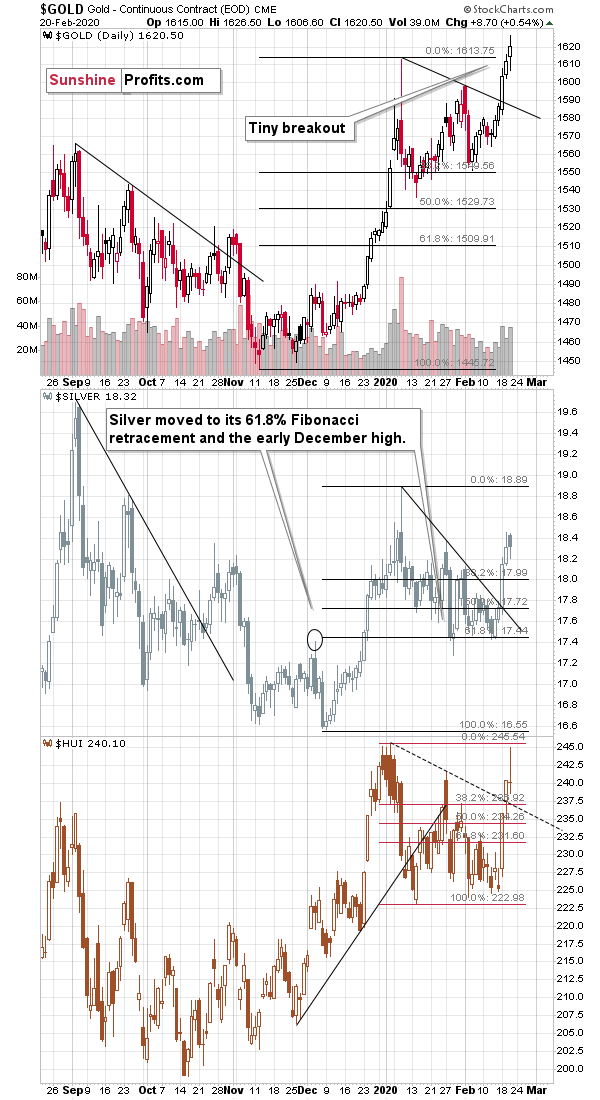

Some things that we outlined previously, happened yesterday or in today's pre-market session (gold moved to $1,630, and gold miners moved to their January high) and some things didn't take place (silver didn't move to its January high) - at least not yet. So, is the top in the PM sector in?

It might be already in as far as mining stocks are concerned, but it's unlikely to be in as far as silver is concerned. And in case of gold it's relatively unclear, but closer to being in than most people think.

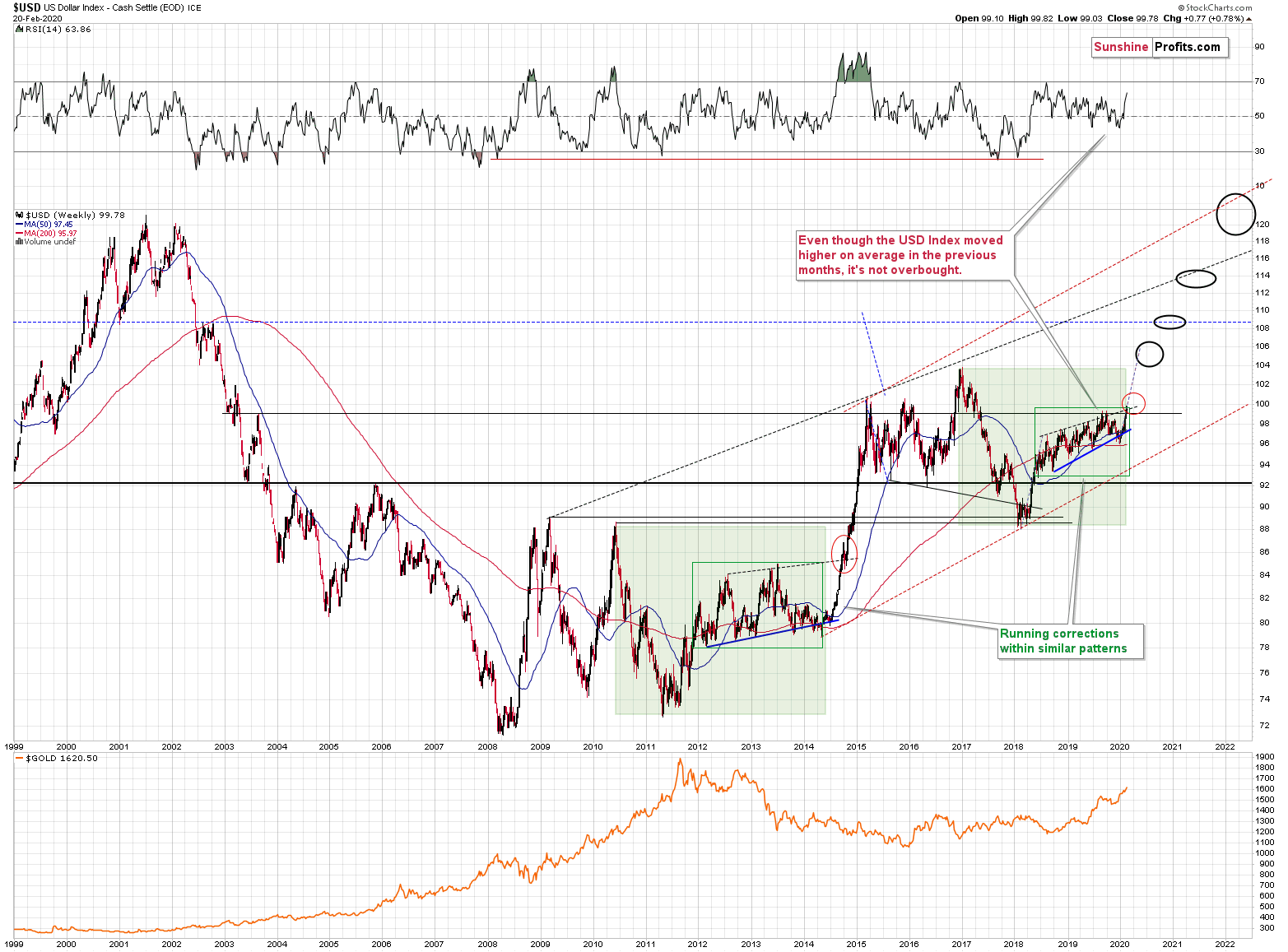

USD Status

First of all, the USD Index doesn't seem to have topped or corrected yet, but since it moved very close to 100 level (just 0.18 below it), it might have already topped. Whether this is the case or not (and it's not clear), it is clear that the USD Index has not yet bottomed. This means that the force that could push the PMs higher in the short run remains intact.

PMs Yesterday

Miners should be lagging gold before the top and silver should be outperforming gold. Miners have definitely underperformed gold yesterday by reversing despite a higher close in gold. Their reversal is also a topping sign on its own.

However, we should also see silver outperform gold at the very end of the move up and that didn't happen yesterday. Consequently, it seems that we will get another move higher - perhaps later today or early next week - when PMs would move higher and during this move silver would rise with more verve.

It would be a great bearish confirmation if miners showed weakness during the above-mentioned move higher - perhaps by once again testing the previous high, and once again failing to break above it on a closing-price basis.