As the EUR enters a period of relief from the major bearish trend, Morgan Stanley (NYSE:MS) has turned tactically bullish on the single currency attempting to buy EUR/USD on dips for more than a week. In a note to clients today, MS outlines the case for this ongoing EUR rally projecting its potential target in the near-term along with its year-end target for the pair.

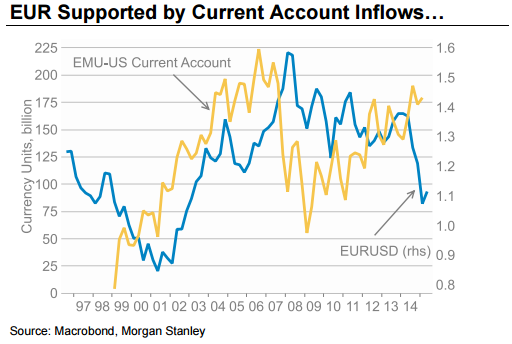

1- "Strong investment outflows from the eurozone since the beginning of the year, and the use of EUR as a global funding currency, not just for portfolio investment but also for longerterm business investment, were major contributing factors to the EUR’s steep decline earlier in the year. Without these investment and funding outflows the structural commercial inflows to the eurozone, resulting from the regions’ current account surplus, have the potential to push the EUR higher," MS argues.

2- "When a dovish Fed fails to spur markets to take on more risk, then it is time to take a cautious approach. Sharply falling commodity prices tell the same story, suggesting non-commodity currencies that either run current account surpluses or positive net foreign asset positions will rally. Hence, USD markets will likely stay split - USD benefiting from EM repatriation flows, while staying offered against surplus currencies. We expect the EUR and the SEK to benefit most from declining cross border investment flows and rising cross border liquidation flows," MS adds.

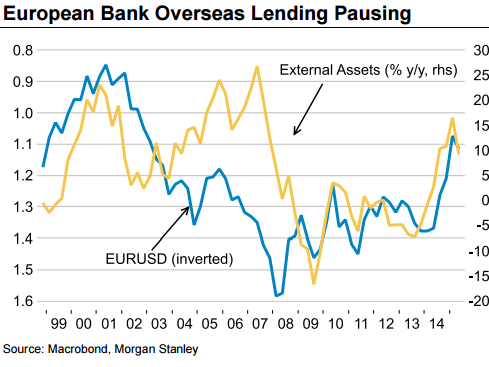

3- "European banks overseas lending data, another indicator of the use of the EUR for foreign funding, also showed a setback in the pace of gains in the second quarter of the year...While foreign investor portfolio inflows to European assets have been currency hedged, suggesting little in the way of direct currency impact from foreign inflows or outflows, the subsequent hedging activity is a significant EUR driver," MS notes.

4- "We believe there is scope for a EUR/USD rebound to 1.15, with the EUR also outperforming on many of the crosses, especially against EM and commodity-related currencies...However, we reiterate our longer term bearish EUR/USD view with 1.05 projected for year-end.