The popularity of market cap-weighted indexing, where the size of a company directly influences its impact on the index, has been a preferred strategy among investors aiming to efficiently capture market beta.

This method is straightforward: as a company's share price climbs, so does its weight in the index, allowing the index to naturally benefit from the rise of successful companies without the need for complex rules or manual adjustments.

However, this approach comes with significant drawbacks, particularly in terms of concentration risk. If a specific sector or a group of stocks outperforms for an extended period, they can come to dominate the index.

The problem arises because the index, bound by its structure, cannot take profits or adjust its holdings; it must simply hold on, even as valuations peak and eventually revert to the norm. This situation can lead to heightened volatility and potential downturns when these overvalued stocks adjust.

The inherent risks in an average market cap-weighted index highlight why an equal-weighted ETF can be a valuable alternative for investors. By allocating investments equally across all index constituents, an equal-weighted ETF reduces concentration risk and provides a more balanced approach to market exposure.

The current state of the S&P 500

The current composition of the S&P 500, as reflected in the SPDR S&P 500 ETF (SPY (NYSE:SPY)), showcases a significant concentration in the technology sector.

Currently, technology stocks alone constitute around 30.58% of the ETF. This heavy weighting means that the performance of the SPY is heavily influenced by the tech industry's fortunes, which can amplify risks for investors due to the sector's volatility.

A downturn in technology stocks could disproportionately impact the entire index, which may not be in line with the diversification goals of some investors.

Furthermore, the ETF's top ten holdings command a substantial portion of its overall weight at around 32% as of April 22, 2024. This concentration suggests that the performance of SPY is less about the broad market and more about the movements of these few mega-cap companies.

If these top stocks experience a downturn, it could heavily influence the ETF's performance, potentially leading to greater-than-expected volatility for investors who might believe they are invested in a broad market index.

How RSP ETF sidesteps this

Established in 2003, the Invesco S&P 500 Equal Weight ETF (RSP+0.53%) has been offering investors an equally weighted alternative for over two decades.

In contrast to capitalization-weighted ETFs, RSP assigns the same weight to all components of the S&P 500, irrespective of their market size.

This means that a behemoth like Apple (NASDAQ:AAPL), with its multi-trillion-dollar market cap, holds the same proportion of the fund as a much smaller company such as Stanley Black & Decker.

The result is a portfolio where each constituent starts each quarter with an equal influence—approximately 0.20%—on the ETF's performance.

The fund's rebalancing process, which occurs quarterly, inherently embodies a "buy low, sell high" philosophy. Stocks that have decreased in value by the rebalancing date are bought, while those that have increased in value are sold, thus maintaining equal weighting.

This methodology not only avoids the concentration risk but also allows for the potential capture of the reversion to the mean within the market.

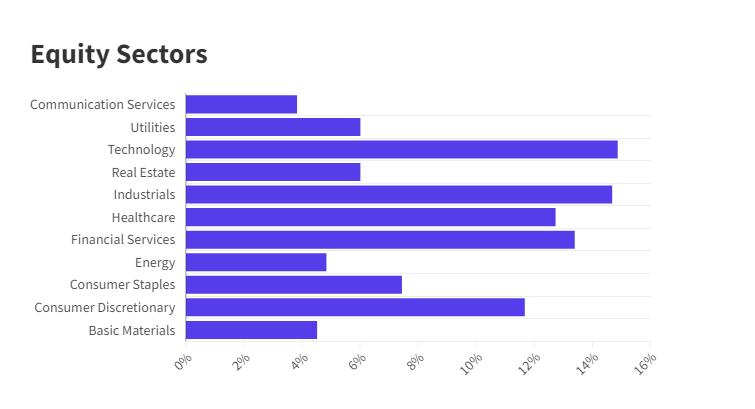

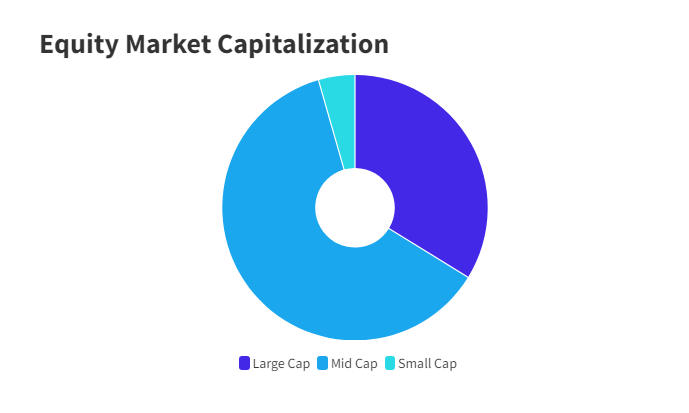

The outcome of this equal-weight strategy is a more balanced sector distribution and a more substantial inclusion of mid-cap stocks, which have historically been strong performers.

According to a 2015 study by S&P Dow Jones Indices, the S&P MidCap 400 has outperformed both the S&P 500 and the S&P SmallCap 600 over the majority of the preceding 20 years, suggesting the potential for RSP to benefit from the historically stronger performance of mid-sized companies.

RSP isn't an obscure fund either. Since its inception, the ETF has accumulated over $53 billion in assets under management. According to the ETF Central Screener, it is currently the largest equal-weight ETF on the market. Recently, it has been very popular as well, having received $2.75 billion in inflows over the preceding month as of April 22, 2024.

This content was originally published by our partners at ETF Central.